USD/CAD Daily Fundamental Forecast – October 20, 2017

The pair continues to chop around over the past 24 hours as a range of developments have been supportive of the dollar and also of the CAD and this has led to a kind of stalemate in the pair. We believe that this might be broken during the course of the day today as there is a slew of data that would be released later in the day from Canada.

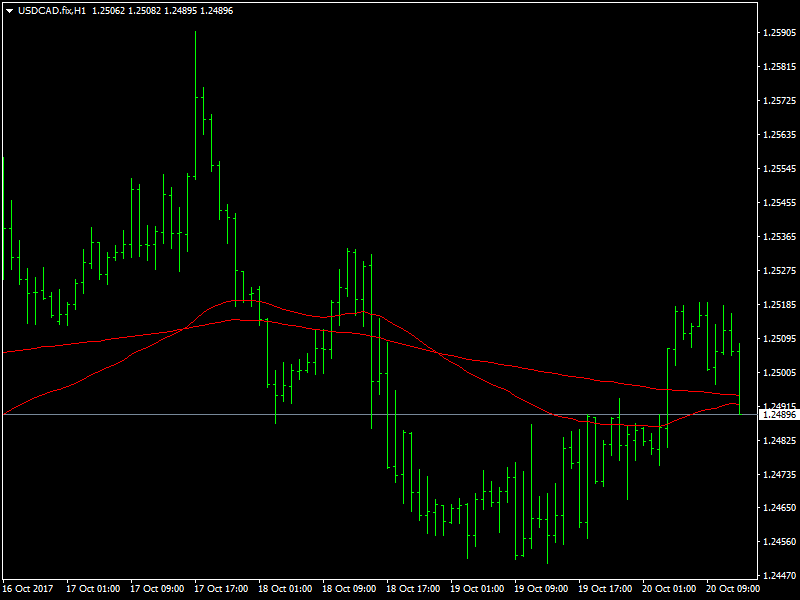

USDCAD Turning Choppy Ahead of Data

The pair rose during the first half of the day yesterday on the back of some weakness in the oil prices, which drove the CAD lower. The dollar was holding steady and this helped the pair move higher. This was then followed by a period of weakness in the dollar which once again pushed the pair below the 1.25 region as the market awaited further developments from the US.

Those developments came in the form of the tax reform bill which finally found the light of day as it was passed in the US. This was a huge boost for Trump and his team who have been struggling to get their bills pushed through due to the lack of support from within their own party. Now they would hope that this is the first of many important bills that they would be able to get passed. This led to a round of dollar buying which has since pushed the pair higher once again.

Looking ahead to the rest of the day, we have the retail sales and CPI data from Canada close to the beginning of the US session and this is likely to bring in a lot of volatility in the pair. These data would be important from the point of view of the next rate hike from the BOC and the CAD bulls would hope that the data would come in stronger to make the rate hike decision easier in the short and medium term.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance