USD/CAD Daily Fundamental Forecast – December 8, 2017

The USDCAD pair continued to trade higher over the last 24 hours as the dollar stayed strong during the course of the day yesterday. There has been increasing anticipation of the tax reform bill being passed and this along with the rate hike that is expected from the Fed has only helped to feed the dollar strength.

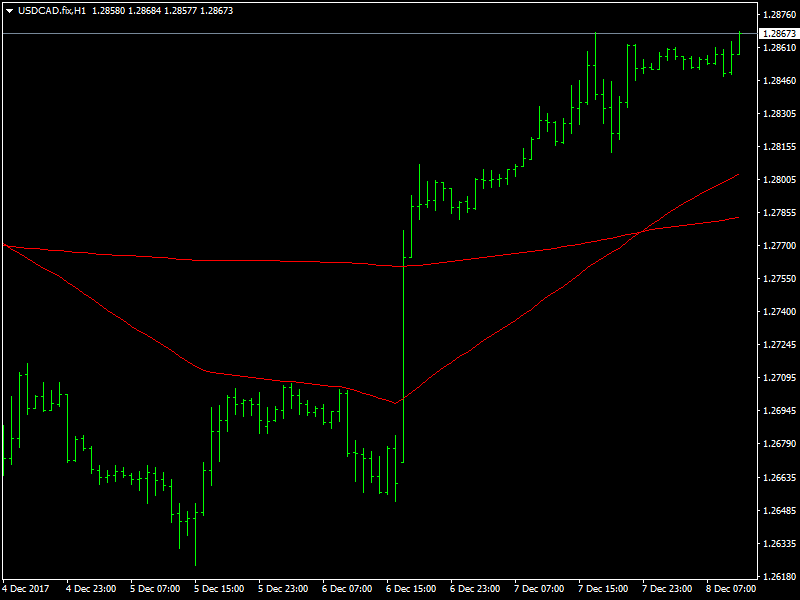

USDCAD Moves Higher

The CAD has clearly been on the backfoot ever since the BOC rate announcement came in a few days back. The market had clearly expected the BOC to be hawkish, as it usually is, and also expected it to give a kind of timeline on when the next rate hike could be expected. But the BOC painted a grim picture of the Canadian economy and said that a lot has to improve before it could think of a rate hike. This meant that the rate hike is still several months away and this disappointed the markets.

The traders have been selling off the CAD since then and this has helped the pair to move higher during this period. It only needs spark in the form of something fundamental or in the form of some strong economic data from the US to push the pair through the range and help it to aim for 1.30 in the short term. It remains to be seen whether this can happen when we are actually moving towards the end of the year.

The spark could come today in the form of a strong employment report from the US which is to be released later in the day today. A strong data point would mean quicker rate hikes in the year 2018 and this could be very supportive of the dollar in the short and medium term as well. This could help the pair move towards the 1.30 as is expected by the bulls.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance