USD/CAD Daily Fundamental Forecast – March 8, 2018

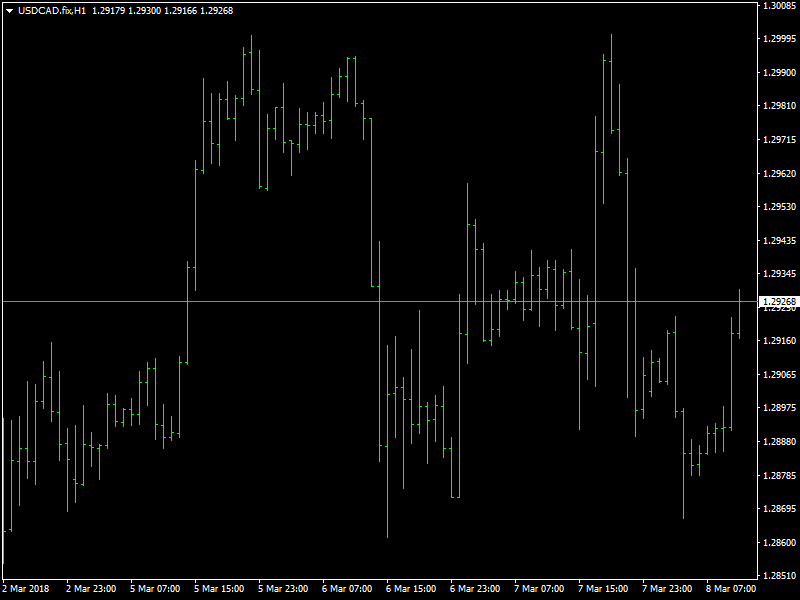

The USDCAD pair continues to trade near the highs of its range and this has been the case over the past couple of days. The pair has coiled itself into a tight phase of consolidation and ranging but we expect this to uncoil itself in the coming days as we are about to see the release of a lot of data in the coming days which should bring in a lot of volatility in the pair.

USDCAD Stays in Range

We saw the dollar weaken a bit across the board yesterday despite a stronger than expected ADP employment data. Normally, we would have seen a decent reaction from the dollar on this good data but the market seems to be more worried about the tariff plan that it chose not to react to the news of the better than expected data. The tariff plan from the US is expected to be signed by Trump anytime now and this also opens the possibility that the plan could be extended to other metals as well.

We also saw Trump say that it is likely that he views his neighbors favorably in this matter and hence there is still a bit of confusion and uncertainty on what the actual plan is. On the other hand, we saw the oil prices move lower during trading yesterday and this has adversely affected the CAD as Canada depends a lot on the oil prices. This weakened the CAD and that is why the pair continued to trade near the highs of its range.

There is not much by way of data from the US today but we are going to see the BOC Governor Poloz make a speech today. After the BOC chose to hold the rates for now, considering the fact that the data from Canada in recent times has been choppy at best, the market would want to see whether he has anything fresh to add.

This article was originally posted on FX Empire

More From FXEMPIRE:

Daily Market Forecast, March 8, 2017 – EUR/USD, Gold, Crude Oil, USD/JPY, GBP/USD

ECB Policy Meeting and Trump’s Trade War Announcement in Focus

European Share Markets: Investors Await ECB Press Conference

Natural Gas Price Fundamental Daily Forecast – Looking for Hedging Pressure Inside $2.774 to $2.823

Yahoo Finance

Yahoo Finance