USD/CAD Daily Fundamental Forecast – December 5, 2017

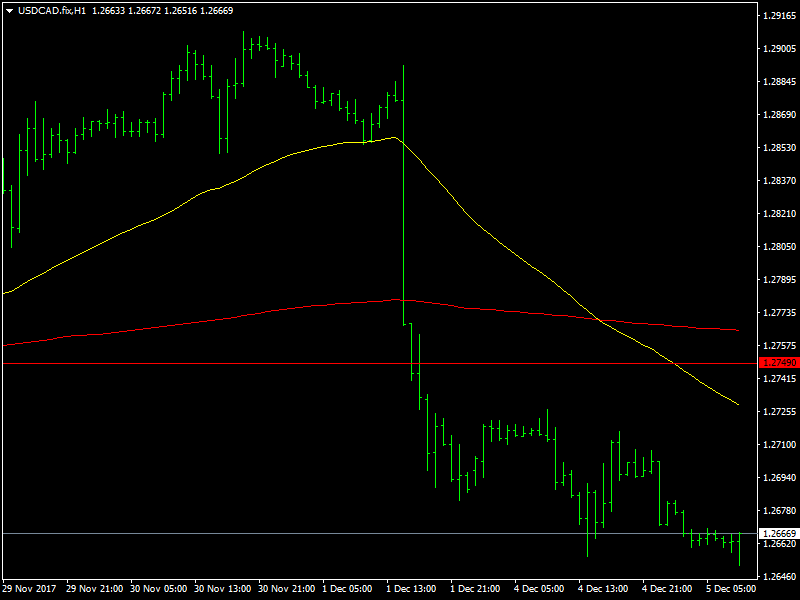

The USDCAD pair continues to trade near the lows of its range as it has been caught in a 200 pip range between the 1.26 and 1.28 region over the last few weeks. There have been many attempts to break through either side but so far, they have been largely unsuccessful and the pair continues to consolidate looking for some direction from somewhere.

USDCAD In Bottom of Range

For now, the pair seems to be forming a base for its next move towards the highs of its range and with us in the last month of the year, we believe that the liquidity would dry up as we get closer to the middle of the month as more and more traders begin to go on a holiday. This would reduce the market into a slumber mode for the next few weeks and this is probably the last piece of action that we are likely to see in the markets. This week, we have a range of news which is likely to bring in some volatility.

Yesterday, the dollar was on the backfoot due to the tax reform bill getting delayed and also due to the fact that the issue over Flynn and his revelations continue to dominate the headlines. This is set to continue for the short term. Later in the week, we have a slew of data from the US that includes the employment data and this should help to support the dollar later in the week.

Looking ahead to the rest of the day, we do not have any major news from Canada as all the focus continues to rest on the dollar. We will have the non-manufacturing PMI data from the US but that is likely to have little impact on the markets. We will have to wait and see how the situation pans out in the political domain and how it is likely to impact the dollar in the short term.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance