USD/CAD Daily Fundamental Forecast – October 9, 2017

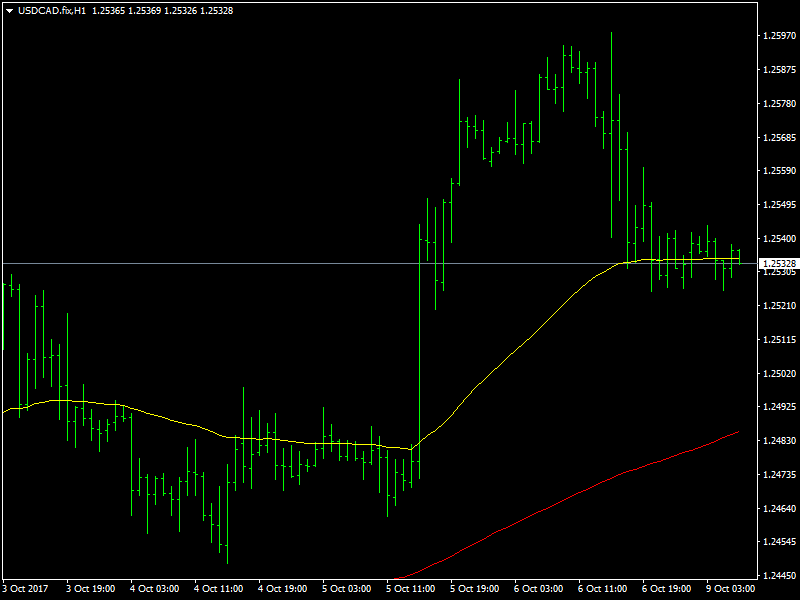

The USDCAD pair corrected lower on Friday on the back of weak US data and strong data from Canada and has since been consolidating as of this morning. We had mentioned in our forecast that though there had been a breakout in the pair on Thursday which pushed it towards the 1.26 region, we had advised caution and asked the traders to wait for the data and the news on Friday as it could easily lead to a reversal and the advice has been well served.

USDCAD Corrects as Dollar Weakens

The markets were looking forward to the NFP employment report and the wages report from the US all through the week. The NFP data from the US came much below expectations as it came in negative while the wages data from the US came in stronger than expected. The figures for the NFP data for the previous month were also revised higher and this led to a brief round of dollar buying. Then came in the realisation that the wages data could have been higher due to the hurricanes in the US and this led to some dollar selling.

A combination of these led to some choppy trading as far as the USDCAD was concerned. On the other hand, the employment data from Canada came in at a strong number and this led to further pressure on this pair and the pair fell by more than 60 pips and trades below 1.2550 as of this writing. The weakness is likely to continue in the short term as the dollar gets hit across the board on account of the bad data.

Looking ahead to the rest of the day, it is a holiday in the US and Canada as well and hence we can expect very little action in this pair. The USDCAD pair is likely to consolidate on either side of 1.2550 during the course of trading today.

This article was originally posted on FX Empire

More From FXEMPIRE:

US Unemployment at Lowest Level Since 200, US Dollar Remain Stable

Price of Gold Fundamental Daily Forecast – Prices Spike Higher on North Korean Concerns

Markets Remain High as Political Sagas Build, China Stocks Soar

EUR/USD, AUD/USD, GBP/USD and USD/JPY Daily Outlook – October 9, 2017

Possible New Bitcoin Rally Once the €4,000 Resistance is Shattered

Yahoo Finance

Yahoo Finance