US Growth Companies With High Insider Ownership To Watch

As the U.S. stock market experiences subtle gains with significant movements in tech giants like Amazon, investors are keenly watching the landscape for opportunities. In this environment, growth companies with high insider ownership may offer unique advantages, as aligned interests between management and shareholders can signal strong confidence in a company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.8% | 84.4% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's uncover some gems from our specialized screener.

ARS Pharmaceuticals

Simply Wall St Growth Rating: ★★★★★☆

Overview: ARS Pharmaceuticals, Inc., a biopharmaceutical company, focuses on developing treatments for severe allergic reactions and has a market capitalization of approximately $798.42 million.

Operations: The revenue segments for this entity are not specified in the provided details.

Insider Ownership: 20.1%

Earnings Growth Forecast: 58.7% p.a.

ARS Pharmaceuticals, despite a net loss of US$10.29 million in Q1 2024, shows promising developments with its neffy nasal spray for anaphylaxis. Recent submissions to both the EMA and FDA highlight progress, alongside strategic partnerships for distribution in Australasia. Although facing shareholder dilution over the past year, ARS is on track with fast-paced revenue growth projected at 57.1% annually and potential profitability within three years. However, current revenues are minimal at US$10K.

Amazon.com

Simply Wall St Growth Rating: ★★★★☆☆

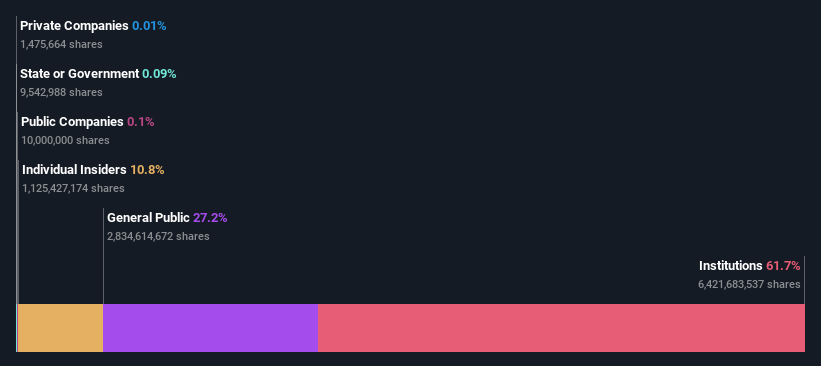

Overview: Amazon.com, Inc. operates as a global online retailer and provides advertising and subscription services, with additional physical store presence, boasting a market capitalization of approximately $1.93 trillion.

Operations: The company's revenue is derived from three primary segments: North America ($362.29 billion), International ($134.01 billion), and Amazon Web Services (AWS) ($94.44 billion).

Insider Ownership: 10.8%

Earnings Growth Forecast: 21.4% p.a.

Amazon.com, despite not being a top example of high insider ownership among growth companies, continues to innovate and expand its market reach. Recent collaborations with Keys Soulcare and the launch of new business technologies underscore its commitment to diversifying offerings and enhancing user engagement. These strategic moves may bolster Amazon's position in competitive sectors, although it's essential to consider the broader implications of such expansions on long-term growth and market dynamics.

Atlassian

Simply Wall St Growth Rating: ★★★★★☆

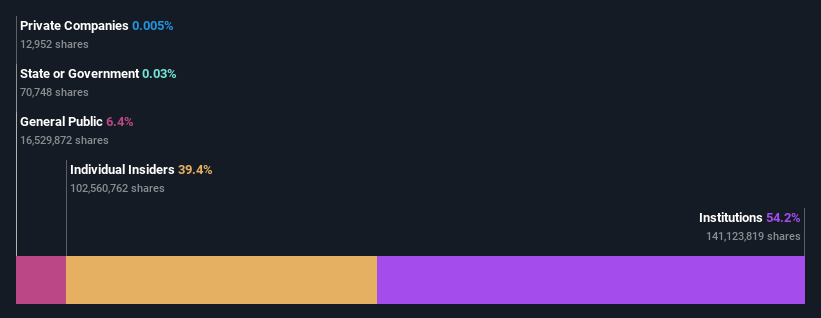

Overview: Atlassian Corporation operates globally, focusing on the design, development, licensing, and maintenance of software products with a market capitalization of approximately $42.88 billion.

Operations: The company generates its revenue primarily from software and programming, totaling approximately $4.17 billion.

Insider Ownership: 39.2%

Earnings Growth Forecast: 48.2% p.a.

Atlassian, a company known for its robust software solutions, recently reported a significant rebound with third-quarter revenue reaching US$1.19 billion, up from US$915.45 million year-over-year, and shifted from a net loss to a net income of US$12.75 million. Despite substantial insider selling over the past three months, Atlassian's forecasted annual earnings growth is impressively high at 48.17% per year. Recent debt issuances totaling nearly US$1 billion may raise concerns about leverage but also reflect strategic capital structuring for future growth initiatives.

Next Steps

Navigate through the entire inventory of 184 Fast Growing US Companies With High Insider Ownership here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:SPRY NasdaqGS:AMZN and NasdaqGS:TEAM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance