Uranium Energy (UEC) Falls Short of Q3 Earnings Estimates

Uranium Energy UEC reported third-quarter fiscal 2024 adjusted loss per share of 5 cents, which missed the Zacks Consensus Estimate of earnings of 1 cent per share. The company had reported a loss of 2 cents per share in the year-ago quarter.

Uranium Energy did not generate any revenues as there was no sale of purchased uranium inventory during the period. Revenues from toll processing services were also nil. The Zacks Consensus Estimate for revenues was $20 million. The variance mainly reflected the absence of the sale of purchased uranium inventory, which had been factored in the consensus estimate.

In the third quarter of fiscal 2023, the company had reported total revenues of $20.2 million, which included $20.1 million generated from sales of purchased uranium inventory while revenues from toll processing services were $0.1 million.

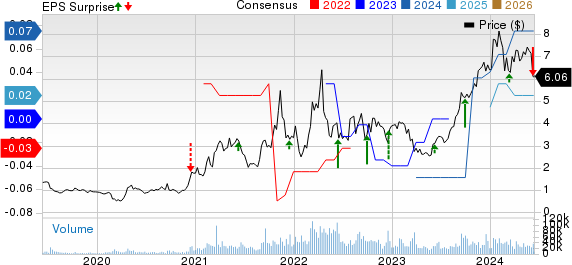

Uranium Energy Corp. Price, Consensus and EPS Surprise

Uranium Energy Corp. price-consensus-eps-surprise-chart | Uranium Energy Corp. Quote

The total cost of sales and services was nil compared with $14 million in the third quarter of fiscal 2023. The company, thereby, did not generate any gross profit in the fiscal third quarter. Gross profit was $6 million in the year-ago quarter.

Mineral property expenditures were around $9.1 million compared with $5.5 million in the third quarter of fiscal 2023. General and administrative expenses were $4.2 million, up 12.7% year over year. Total operating expenses rose 43% year over year to $13.8 million.

Uranium Energy reported an operating loss of $13.8 million compared with an operating loss of $3.5 million in the year-ago quarter.

As of Apr 30, UEC had 1,166, 000 pounds of purchased uranium concentrate inventory. As of the same date, the company had no uranium supply or off-take agreements in place. Uranium Energy stated that future sales of uranium are expected to take place through the uranium spot market.

Cash Position

Cash from operating activities in the nine months ended Apr 30, 2024, was an outflow of $93.9 million against an inflow of $43.8 million in the comparable period in the prior fiscal.

The company had $95 million of cash and cash equivalents, including restricted cash, as of Apr 30, higher than $45.6 million as of Jul 31, 2023.

Other Updates

The company has established the existence of mineralized materials for certain uranium projects, including the Palangana Mine, Christensen Ranch Mine (collectively the ISR Mines), Roughrider and Christie Lake Project.

On Jan 16, 2024, Uranium Energy announced that it had restarted uranium extraction at its fully permitted and past-producing Christensen Ranch Mine ISR operation. The first extraction is expected in August 2024 and will be funded with the company’s cash reserves.

Uranium recovered from the project will be processed at the company’s Irigaray central processing plant (“CPP”). Uranium Energy had submitted an application to increase the licensed capacity of the Irigaray CPP from 2.5 million pounds of uranium per year to 4.0 million pounds to the Wyoming Department of Environmental Quality in November 2023. An approval is expected later in 2024.

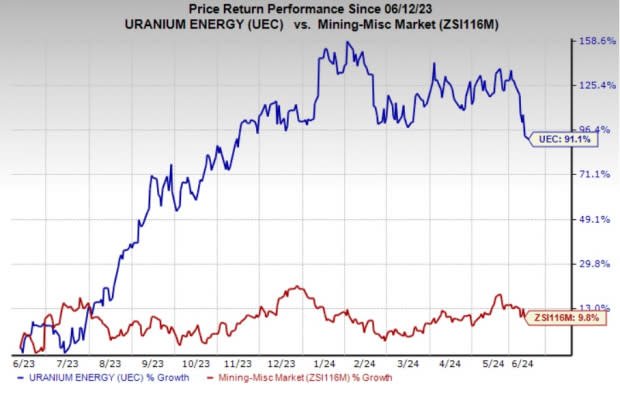

Price Performance

Shares of Uranium Energy have gained 91.1% in a year compared with the industry’s 9.8% growth.

Image Source: Zacks Investment Research

Few Peer Performances

Cameco CCJ reported revenues of $470 million in the first quarter (ended Mar 31, 2024), which were down 8% year over year. Adjusted earnings per share plunged 52% to 10 cents, which missed the Zacks Consensus Estimate of 33 cents.

In the uranium segment, Cameco produced 5.8 million pounds (its share), a 29% increase from the 4.5 million pounds (the company’s share) in the year-ago quarter. Sales volumes were down 25% year over year to 7.3 million pounds. The average realized uranium price rose 27% to $57.57 per pound.

Energy Fuels UUUU reported first-quarter earnings of 2 cents per share, which were in line with the Zacks Consensus Estimate. UUUU had reported a loss per share of 1 cent in the year-ago quarter.

Revenues were $25.43 million, which fell short of the consensus estimate of $26 million. This compares with year-ago revenues of $19.61 million. Energy Fuels sold 300,000 pounds of uranium concentrates at a weighted average price of $84.38 per pound for $25.31 million, which resulted in a gross profit of $14.26 million and an average gross margin of 56%.

Zacks Rank & a Stock to Consider

UEC currently carries a Zacks Rank #3 (Hold).

A better-ranked stock from the basic materials space is Carpenter Technology Corporation CRS, which currently sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.31 per share. The consensus estimate for earnings has moved 3% north in the past 30 days. It has an average trailing four-quarter earnings surprise of 15.1%. CRS shares have gained 102% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Energy Fuels Inc (UUUU) : Free Stock Analysis Report

Uranium Energy Corp. (UEC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance