Unveiling UK Growth Companies With At Least 13% Insider Ownership

As the United Kingdom's financial markets anticipate a potential stabilization with FTSE futures showing modest gains, investors remain keenly observant of broader economic signals and central bank decisions. In this context, growth companies with high insider ownership in the UK present an interesting focus, as such ownership can indicate confidence from those who know the company best, aligning their interests closely with other shareholders especially in uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Getech Group (AIM:GTC) | 17.3% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

B90 Holdings (AIM:B90) | 24.4% | 142.7% |

Afentra (AIM:AET) | 38.3% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Loungers

Simply Wall St Growth Rating: ★★★★☆☆

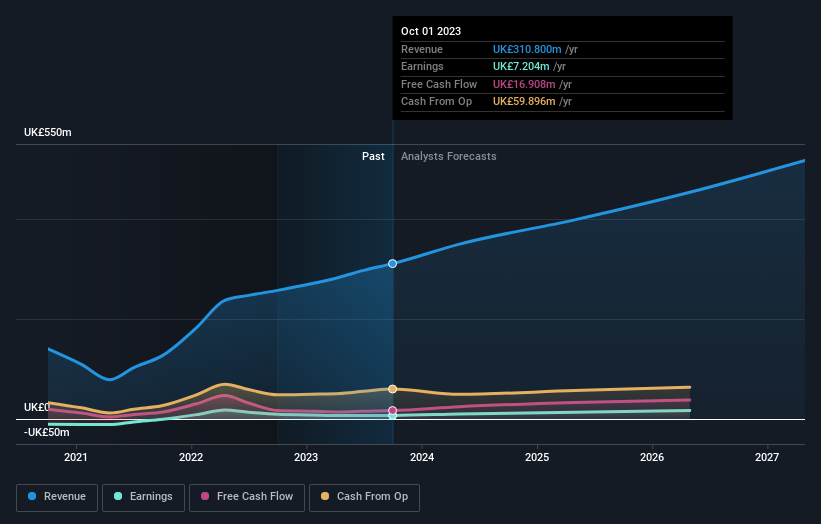

Overview: Loungers plc operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales, with a market capitalization of approximately £293.83 million.

Operations: The company generates its revenue primarily through the operation of café bars and restaurants, totaling £310.80 million.

Insider Ownership: 13.9%

Loungers plc, a UK-based growth company with significant insider ownership, reported a record revenue of £353.5 million for FY 2024, marking a substantial increase. Despite lower profit margins compared to the previous year, earnings are expected to surge by 31.4% annually over the next three years. Recent executive reshuffles aim to bolster this momentum, with the promotion of Justin Carter to Group MD and the appointment of Stephen Marshall as CFO enhancing strategic leadership as they target further expansion and operational efficiencies.

Navigate through the intricacies of Loungers with our comprehensive analyst estimates report here.

Upon reviewing our latest valuation report, Loungers' share price might be too pessimistic.

RWS Holdings

Simply Wall St Growth Rating: ★★★★☆☆

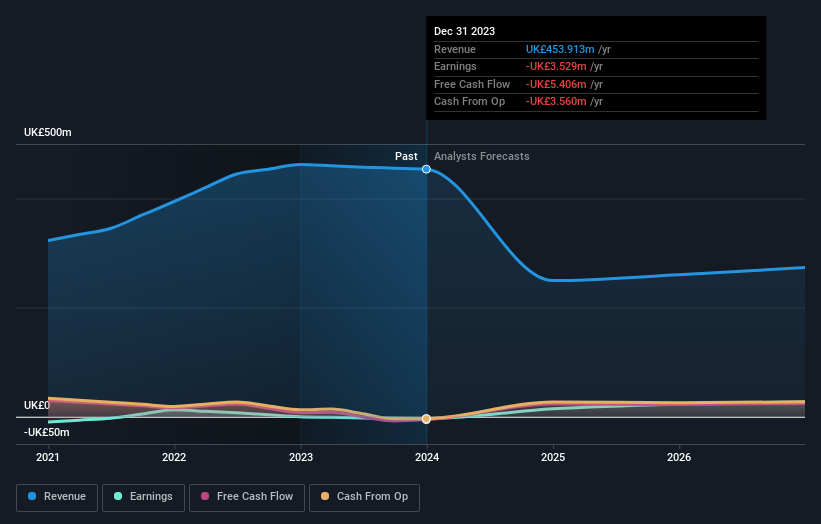

Overview: RWS Holdings plc specializes in technology-enabled language, content, and intellectual property services with a market capitalization of approximately £724.84 million.

Operations: The company specializes in technology-enabled services across language, content, and intellectual property sectors.

Insider Ownership: 24.6%

RWS Holdings, a UK-based growth company with significant insider ownership, recently launched HAI, an AI-driven translation platform aimed at enhancing global market access. Despite reporting a 4% revenue decline to £350.3 million in the first half of 2024 and a drop in net income to £11.1 million, the firm is optimistic about future prospects, evidenced by a modest dividend increase and ongoing executive transitions set to conclude in early 2025. These moves signal strategic realignment and innovation focus as RWS navigates current challenges while eyeing profitability improvements forecasted over the next three years.

M&C Saatchi

Simply Wall St Growth Rating: ★★★★☆☆

Overview: M&C Saatchi plc is a global advertising and marketing communications services provider operating across regions including the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas, with a market capitalization of approximately £238.40 million.

Operations: The company operates across various regions, generating revenue through advertising and marketing communications services.

Insider Ownership: 16.2%

M&C Saatchi, a UK-based growth company with substantial insider ownership, is navigating a challenging period with forecasted revenue declines of -13.4% annually over the next three years. Despite this, earnings are expected to grow significantly as the company aims for profitability. Recent strategic hires of new Global Chief Creative Officers and an approved dividend increase suggest a focus on revitalizing its creative output and shareholder returns amidst current financial setbacks.

Click here and access our complete growth analysis report to understand the dynamics of M&C Saatchi.

Turning Ideas Into Actions

Discover the full array of 64 Fast Growing UK Companies With High Insider Ownership right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:LGRSAIM:RWSAIM:SAA and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance