Unveiling Three TSX Growth Companies With High Insider Ownership

As the first half of 2024 closes with notable strength in the Canadian market, particularly in sectors like technology and utilities, investors are witnessing a period marked by robust economic indicators and optimistic market trends. The TSX has shown resilience with solid gains, setting a positive tone for those looking at growth opportunities within this landscape. In this context, stocks with high insider ownership can be particularly appealing as they often suggest that company leaders have significant confidence in their business's future prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

Payfare (TSX:PAY) | 15% | 46.7% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 71.7% |

Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 12.6% | 64.7% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Underneath we present a selection of stocks filtered out by our screen.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

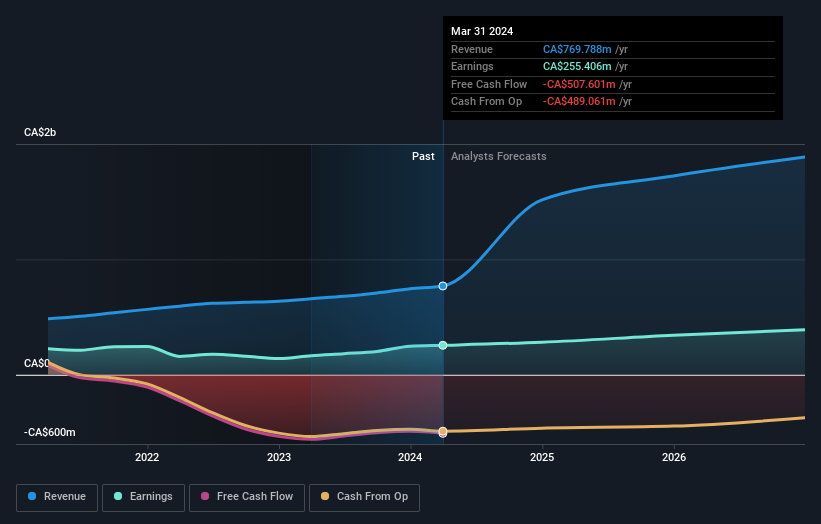

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.67 billion.

Operations: The company generates revenue primarily through its operations in the Americas (CA$2.53 billion), followed by Europe, the Middle East & Africa (CA$730.10 million), Asia Pacific (CA$616.58 million), and Investment Management services (CA$489.23 million).

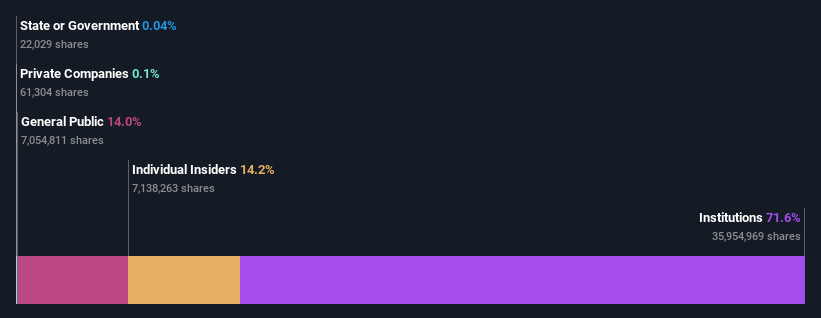

Insider Ownership: 14.2%

Colliers International Group has demonstrated robust growth with a forecasted revenue increase of 9.5% annually, outpacing the Canadian market average. Earnings have surged by nearly 120% over the past year, and are expected to grow at an impressive rate of 38.34% annually over the next three years. Despite some shareholder dilution last year, recent insider activity shows more buying than selling. However, debt levels are concerning as they are poorly covered by operating cash flow. Recent engagements like marketing a significant property in Mississippi highlight operational expansions but financial flexibility may be impacted by a recent $57.62 million shelf registration for employee stock ownership plans.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market capitalization of CA$3.31 billion.

Operations: The company generates revenue through leasing and lending services, with CA$153.99 million from easyhome and CA$1.17 billion from easyfinancial.

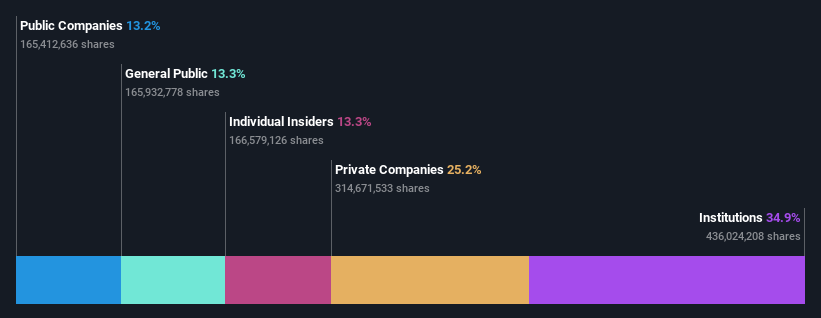

Insider Ownership: 21.5%

goeasy Ltd., a Canadian growth company with high insider ownership, has shown promising financial performance with a revenue increase to CA$357.11 million and net income rising to CA$58.94 million in Q1 2024. While the company's earnings are forecasted to grow at 15.8% annually, surpassing the Canadian market's average, it faces challenges with debt not well covered by operating cash flow and dividends that are not sufficiently supported by cash flows. Recent executive appointments aim to strengthen its consumer credit services, enhancing strategic direction and operational efficiency across its brands.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$23.25 billion.

Operations: The company primarily generates revenue through the mining, development, and exploration of minerals and precious metals in Africa.

Insider Ownership: 12.6%

Ivanhoe Mines, a Canadian growth company with significant insider ownership, is poised for substantial growth with its revenue and earnings forecasted to increase by 83% and 64.72% per year respectively. Despite recent insider selling, the firm's strategic advancements are evident as it completed the Phase 3 concentrator at Kamoa-Kakula ahead of schedule—boosting processing capacity and expected to significantly enhance copper production. However, it trades below its fair value estimate by 14.2%, presenting a potentially undervalued opportunity amidst operational successes.

Dive into the specifics of Ivanhoe Mines here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Ivanhoe Mines' share price might be too optimistic.

Make It Happen

Unlock more gems! Our Fast Growing TSX Companies With High Insider Ownership screener has unearthed 26 more companies for you to explore.Click here to unveil our expertly curated list of 29 Fast Growing TSX Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:CIGI TSX:GSY and TSX:IVN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance