Unveiling ASX Growth Companies With High Insider Ownership In May 2024

The Australian market has shown robust growth, rising 1.5% in the last week and 7.3% over the past year, with earnings expected to increase by 13% annually. In this context, stocks with high insider ownership can be particularly compelling, as they often signal strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Liontown Resources (ASX:LTR) | 16.4% | 64.3% |

DUG Technology (ASX:DUG) | 28.3% | 43.3% |

SiteMinder (ASX:SDR) | 11.4% | 69.4% |

Let's explore several standout options from the results in the screener.

Bell Financial Group

Simply Wall St Growth Rating: ★★★★☆☆

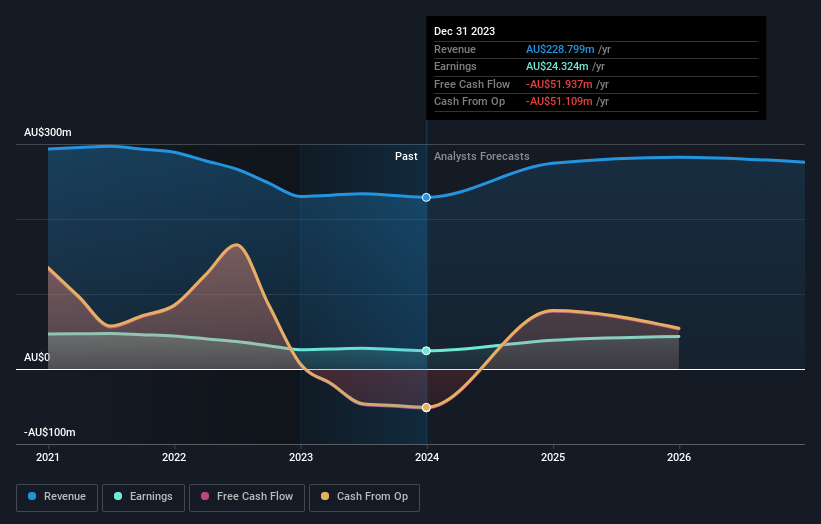

Overview: Bell Financial Group Limited, operating in Australia, offers broking, online broking, corporate finance, and financial advisory services with a market capitalization of approximately A$416.97 million.

Operations: Bell Financial Group generates revenue through four primary segments: retail broking (A$103.58 million), institutional broking (A$50.36 million), financial products and services (A$48.10 million), and technology and platform services (A$26.20 million).

Insider Ownership: 10.7%

Earnings Growth Forecast: 26.9% p.a.

Bell Financial Group, with high insider ownership, shows promising growth prospects in the Australian market. Despite a slight dip in net income and earnings per share in 2023, the company is expected to see its revenue grow by 5.6% annually, outpacing the broader market's 5% growth rate. Earnings are forecasted to surge by a significant 26.95% per year. However, its dividend sustainability is questionable as it's not well-covered by earnings or cash flows. The stock is currently trading at good value relative to peers.

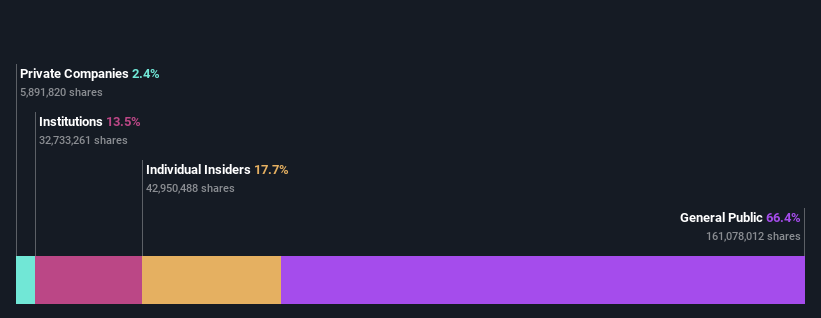

Develop Global

Simply Wall St Growth Rating: ★★★★★☆

Overview: Develop Global Limited, operating in Australia, focuses on exploring and developing mineral resource properties, with a market capitalization of approximately A$550.82 million.

Operations: The company generates revenue primarily from its mining services segment, totaling approximately A$109.75 million.

Insider Ownership: 17.7%

Earnings Growth Forecast: 126.8% p.a.

Develop Global, despite its recent addition to the S&P/ASX Small Ordinaries and 300 Indexes, faces challenges with a short cash runway. However, it has shown improvement with a significant reduction in net loss from A$6.4 million to A$3.81 million year-over-year and an increase in sales from A$23.83 million to A$65.8 million for the half year ended December 2023. The company's revenue is expected to grow by 54.2% annually, outstripping the Australian market forecast of 5% growth per year, and it is on track to become profitable within three years, showcasing potential above-average market growth despite past shareholder dilution.

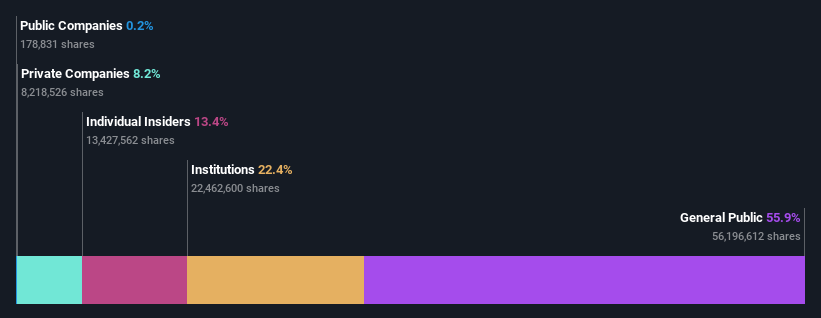

PWR Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PWR Holdings Limited specializes in designing, prototyping, producing, testing, validating, and selling cooling products and solutions across Australia, the US, the UK, Italy, Germany, and other international markets with a market capitalization of approximately A$1.16 billion.

Operations: The company's revenue is primarily generated through two segments: PWR C&R, which contributed A$37.35 million, and PWR Performance Products, contributing A$104.44 million.

Insider Ownership: 13.4%

Earnings Growth Forecast: 17% p.a.

PWR Holdings, a growth-oriented firm with high insider ownership, has seen positive financial trends and strategic board enhancements. Over the past year, earnings grew by 12.3%, with forecasts showing a 17% annual increase, outpacing the Australian market's 13.5%. Revenue is also expected to rise by 14.4% annually. Recent appointments like Jason Conroy as non-executive director strengthen governance, aligning with PWR’s growth trajectory despite not reaching very high growth rates in revenue or profit projections.

Dive into the specifics of PWR Holdings here with our thorough growth forecast report.

Our valuation report unveils the possibility PWR Holdings' shares may be trading at a premium.

Key Takeaways

Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 86 more companies for you to explore.Click here to unveil our expertly curated list of 89 Fast Growing ASX Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:BFG ASX:DVP and ASX:PWH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance