Unveiling 3 SGX Dividend Stocks With Yields Up To 7.4%

As the Singapore market embraces innovation, exemplified by Deutsche Bank joining the Monetary Authority of Singapore's Project Guardian to explore asset tokenization, investors are witnessing a dynamic shift in financial technologies and investment possibilities. In this evolving landscape, dividend stocks remain appealing for their potential to offer steady income streams, particularly when navigating through periods of technological transformation and market adaptation.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Singapore Exchange (SGX:S68) | 3.68% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.19% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.66% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.48% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.87% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.57% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.95% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Delfi (SGX:P34) | 6.68% | ★★★★☆☆ |

Sing Investments & Finance (SGX:S35) | 6.12% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results.

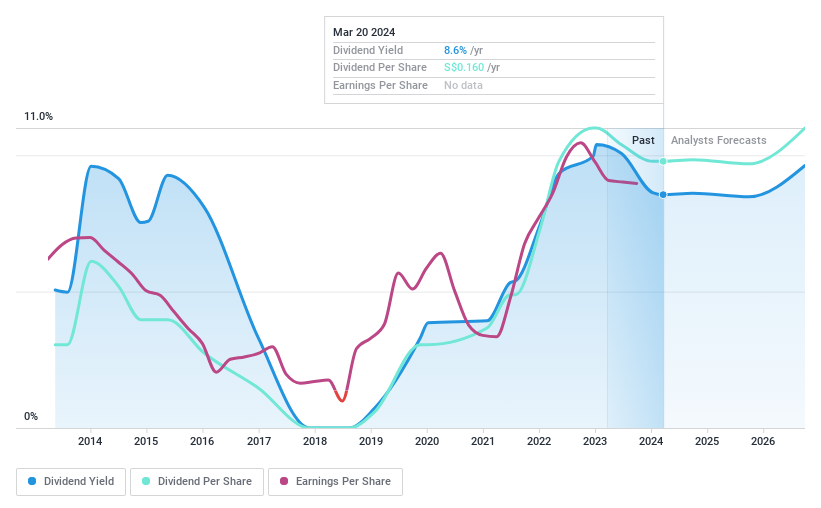

BRC Asia

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets including Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and internationally with a market capitalization of approximately SGD 587.11 million.

Operations: BRC Asia Limited generates revenue primarily through two segments: Trading, which contributed SGD 413.27 million, and Fabrication and Manufacturing, with SGD 1.21 billion in earnings.

Dividend Yield: 7.5%

BRC Asia, trading at S$0.55 below estimated fair value, offers a dividend yield higher than 75% of Singapore market payers. Despite its high debt levels, dividends are well-covered with a 38% earnings payout ratio and a 28.1% cash flow payout ratio. However, investors should note BRC's history of volatile dividends over the past decade, reflecting instability in payments despite recent improvements in coverage metrics.

Navigate through the intricacies of BRC Asia with our comprehensive dividend report here.

The valuation report we've compiled suggests that BRC Asia's current price could be quite moderate.

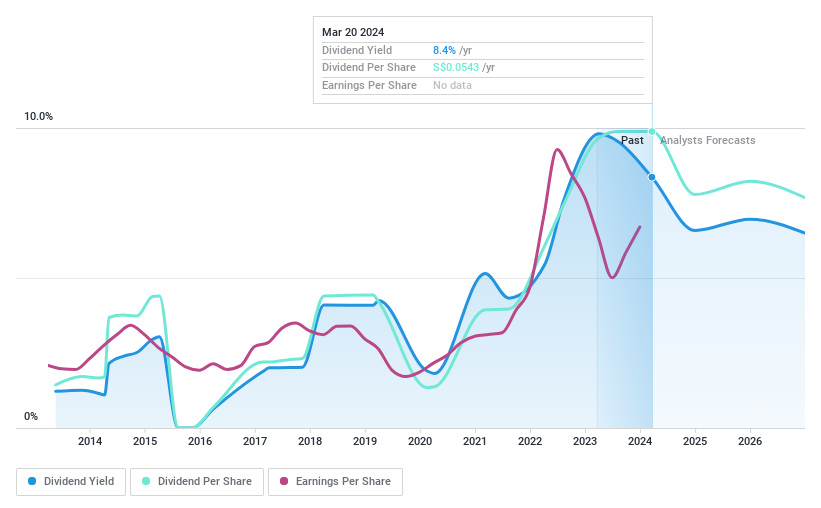

Bumitama Agri

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company focused on the production and trade of crude palm oil and palm kernel, primarily serving refineries in Indonesia, with a market capitalization of approximately SGD 1.19 billion.

Operations: Bumitama Agri Ltd. generates revenue primarily from its plantations and palm oil mills, totaling IDR 15.44 billion.

Dividend Yield: 7.0%

Bumitama Agri, with a dividend yield of 6.95%, ranks in the upper quartile of Singapore's dividend payers. The company's dividends are supported by a payout ratio of 40.4% and a cash payout ratio of 60.8%, indicating reasonable coverage by both earnings and cash flows. However, its dividend history over the past decade has been marked by volatility, and earnings are projected to decline annually by 5.5% over the next three years, which may challenge future dividend sustainability despite recent increases announced for April 2024 payouts.

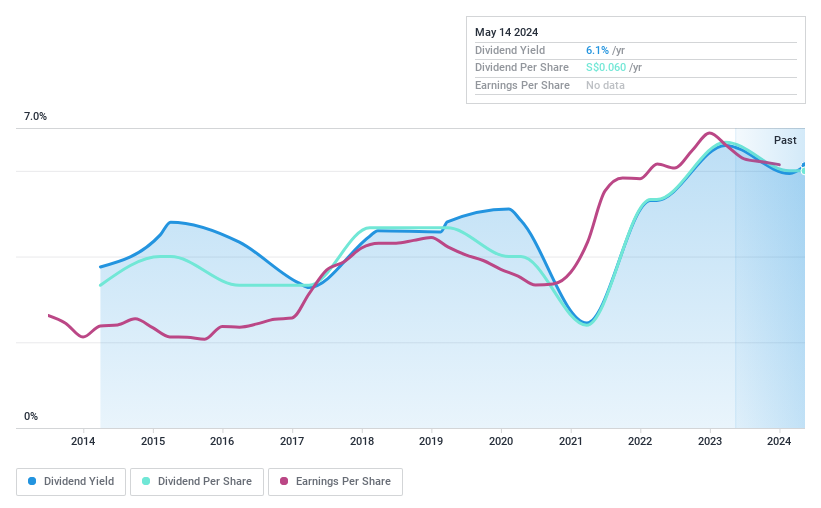

Sing Investments & Finance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sing Investments & Finance Limited offers financing solutions to both individuals and corporations within Singapore, with a market capitalization of approximately SGD 231.71 million.

Operations: Sing Investments & Finance Limited generates its revenue primarily through credit and lending services, amounting to SGD 68.26 million.

Dividend Yield: 6.1%

Sing Investments & Finance maintains a dividend yield of 6.12%, slightly below the top quartile in Singapore. Its dividends are well-supported by a payout ratio of 42.7% and an even stronger cash payout ratio of 9.6%. However, the company's dividend history reveals inconsistency, with payments showing volatility over the past decade. Recently, it proposed a dividend of S$0.06 per share for FY2023 at its upcoming AGM, reflecting a cautious approach amidst modest earnings growth reported for the year.

Key Takeaways

Investigate our full lineup of 20 Top SGX Dividend Stocks right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BEC SGX:P8Z and SGX:S35.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance