Unveiling 3 ASX Growth Companies With High Insider Ownership And A Minimum 22% Earnings Increase

Amidst a generally positive performance in the Australian market, with the ASX200 showing an uptick and significant gains in materials and energy sectors, investors are keenly observing trends and opportunities. In this context, growth companies with high insider ownership present an intriguing avenue for consideration, especially those demonstrating robust earnings growth in such vibrant market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

DUG Technology (ASX:DUG) | 28.3% | 43.3% |

SiteMinder (ASX:SDR) | 11.4% | 69.4% |

Let's review some notable picks from our screened stocks.

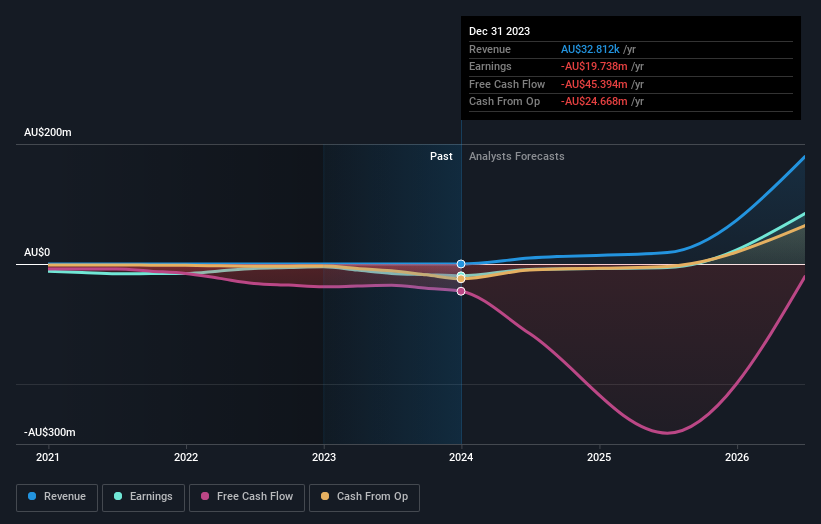

Alpha HPA

Simply Wall St Growth Rating: ★★★★★★

Overview: Alpha HPA Limited, a specialty metals and technology company, has a market capitalization of approximately A$933.80 million.

Operations: The company's revenue is primarily derived from its HPA First Project, generating A$0.03 million.

Insider Ownership: 28.3%

Earnings Growth Forecast: 95.9% p.a.

Alpha HPA, an Australian growth company with high insider ownership, exhibits promising financial forecasts despite its current small revenue base (A$33K). The company is expected to see a significant increase in earnings, with revenues projected to grow by 93% per year. Additionally, the return on equity is anticipated to be very high at 40.1% in three years. However, it faces challenges such as less than one year of cash runway and recent shareholder dilution.

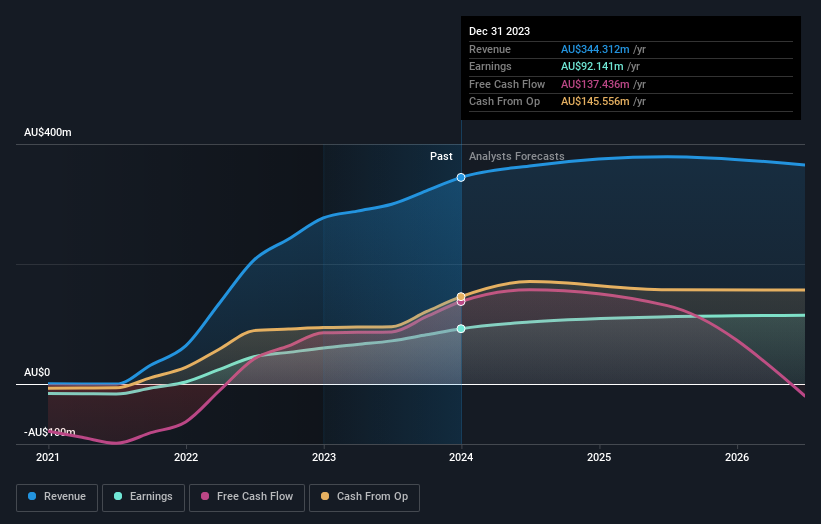

Emerald Resources

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.49 billion.

Operations: The primary revenue for the firm, totaling A$339.32 million, is generated from mine operations.

Insider Ownership: 18.5%

Earnings Growth Forecast: 22.8% p.a.

Emerald Resources, reflecting a blend of strengths and concerns within the Australian growth companies, is currently undervalued by 72.7% against its fair value. Despite a recent shareholder dilution, the company has experienced robust earnings growth of 53.4% over the past year with expectations for significant earnings expansion at an annual rate of 22.76% over the next three years. Additionally, its revenue growth forecast at 19.4% annually surpasses the broader Australian market's average.

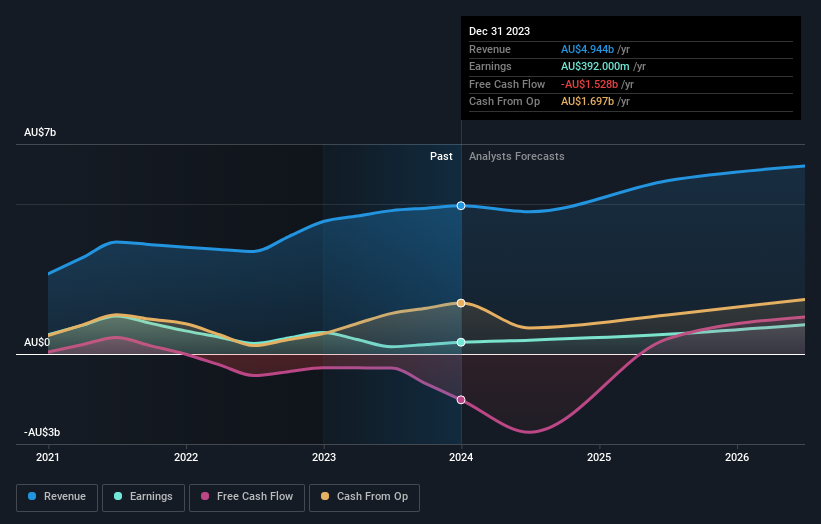

Mineral Resources

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited is a diversified mining services company operating in Australia, Asia, and internationally, with a market capitalization of approximately A$15.33 billion.

Operations: The company generates revenue from lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 29.2% p.a.

Mineral Resources, with a forecasted Return on Equity of 21.7% in three years, is poised for substantial growth, outpacing the Australian market's average earnings growth expectation. Despite trading at 28.7% below its estimated fair value and experiencing a decline in profit margins from 16.3% to 7.9%, the company has shown resilience with a significant year-over-year net income increase from A$388.6 million to A$537.3 million as of December 2023. However, its interest coverage remains weak, signaling potential financial stress.

Click to explore a detailed breakdown of our findings in Mineral Resources' earnings growth report.

Our valuation report unveils the possibility Mineral Resources' shares may be trading at a premium.

Taking Advantage

Explore the 89 names from our Fast Growing ASX Companies With High Insider Ownership screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:A4N ASX:EMR and ASX:MIN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance