Unpacking Q1 Earnings: Anheuser-Busch (NYSE:BUD) In The Context Of Other Beverages and Alcohol Stocks

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Anheuser-Busch (NYSE:BUD) and the rest of the beverages and alcohol stocks fared in Q1.

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 13 beverages and alcohol stocks we track reported a decent Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was 15.8% below consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and while some of the beverages and alcohol stocks have fared somewhat better than others, they collectively declined, with share prices falling 3.4% on average since the previous earnings results.

Anheuser-Busch (NYSE:BUD)

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE:BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

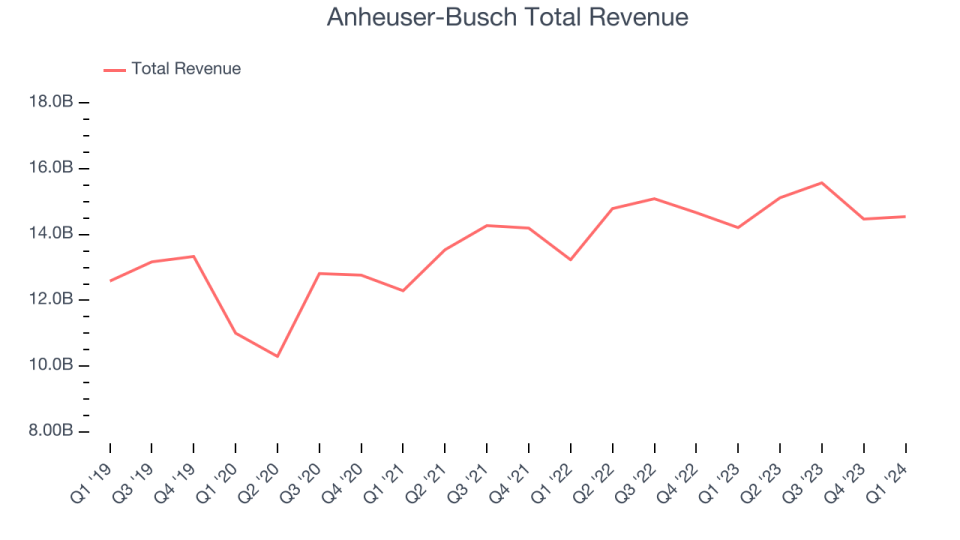

Anheuser-Busch reported revenues of $14.55 billion, up 2.3% year on year, topping analysts' expectations by 1.3%. It was a decent quarter for the company, with a decent beat of analysts' adusted EBITDA and earnings estimates.

We are encouraged by our results to start the year, and the consistent execution by our teams and partners reinforces our confidence in delivering on our 2024 growth ambitions.” – Michel Doukeris, CEO, AB InBev

The stock is up 1.2% since the results and currently trades at $61.27.

Best Q1: Boston Beer (NYSE:SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Boston Beer reported revenues of $426.1 million, up 3.9% year on year, outperforming analysts' expectations by 3.3%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 1.6% since the results and currently trades at $291.8.

Is now the time to buy Boston Beer? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Zevia PBC (NYSE:ZVIA)

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE:ZVIA) is a better-for-you beverage company.

Zevia PBC reported revenues of $38.8 million, down 10.4% year on year, falling short of analysts' expectations by 1.6%. It was a weak quarter for the company, with revenue guidance for next quarter missing analysts' expectations and a miss of analysts' operating margin estimates.

Zevia PBC had the weakest full-year guidance update in the group. The stock is down 11.4% since the results and currently trades at $0.93.

Read our full analysis of Zevia PBC's results here.

Molson Coors (NYSE:TAP)

Sporting an impressive roster of iconic beer brands, Molson Coors (NYSE:TAP) is a global brewing giant with a rich history dating back more than two centuries.

Molson Coors reported revenues of $2.60 billion, up 10.7% year on year, surpassing analysts' expectations by 3.7%. It was a very strong quarter for the company, with a solid beat of analysts' earnings estimates.

Molson Coors delivered the biggest analyst estimates beat among its peers. The stock is down 17.6% since the results and currently trades at $52.33.

Read our full, actionable report on Molson Coors here, it's free.

Vita Coco (NASDAQ:COCO)

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ:COCO) offers coconut water products that are a natural way to quench thirst.

Vita Coco reported revenues of $111.7 million, up 1.8% year on year, in line with analysts' expectations. It was a very strong quarter for the company: Vita Coco beat revenue, gross margin, and EPS expectations. It's also nice to see that full year guidance for revenue and adjusted EBITDA both came in slightly above Wall Street analysts' estimates.

Vita Coco achieved the highest full-year guidance raise among its peers. The stock is up 14% since the results and currently trades at $27.65.

Read our full, actionable report on Vita Coco here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance