Universal Health's (UHS) Earnings Lag in Q3, Decline Y/Y

Universal Health Services Inc. UHS delivered third-quarter 2019 adjusted earnings of $1.99 per share, missing the Zacks Consensus Estimate by 12%.

Moreover, the bottom line declined 10.8% year over year due to higher expenses incurred in the quarter under review.

However, net revenues increased 6.6% year over year to $2.8 billion and also exceeded the Zacks Consensus Estimate by 2.4%, backed by higher admissions and patient days.

Total operating expenses of $2.6 billion at the end of the third quarter increased 10.1% year over year, mainly due to salaries, wages and benefits along with other operating expense plus supplies expenses.

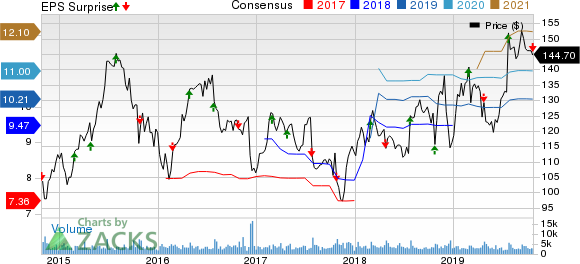

Universal Health Services, Inc. Price, Consensus and EPS Surprise

Universal Health Services, Inc. price-consensus-eps-surprise-chart | Universal Health Services, Inc. Quote

Segmental Update

Acute Care Hospitals:

Adjusted admissions and adjusted patient days rose 7.4% and 7%, respectively, from the prior-year quarter. Net revenues (on same-facility basis) climbed 9.3% in the third quarter, majorly aided by higher admissions and patient days.

Behavioral Hospitals:

On same-facility basis, adjusted admissions inched up 0.5% while adjusted patient days were up 0.4%, both on a year-over-year basis. Net revenues too were up 2.1% on same-facility basis.

Financial Update

As of Sep 30, 2019, the company had cash and cash equivalents of nearly $58.9 million, down 44% from the level at 2018 end.

Total assets were $11.6 billion as of Sep 30, 2019, up 2.9% from the 2018-end figure.

The company’s long-term debt came in at $3.8 billion, down 1.6% from the level at 2018 end.

For the first nine months of 2019, net cash provided by operating activities totaled $1.049 billion, up 10.5% year over year. This was on the back of improvement in net income plus/minus depreciation and amortization expense, stock-based compensation expense, provision for asset impairment and net gains on sale of assets and businesses, favorable change in accounts receivable and other combined net unfavorable changes.

Buyback Program

In the third quarter, the company bought back shares worth $79.5 million.

In July 2019, the company’s board of directors increased its share buyback plan by $1 billion.

Revised Guidance

Following third-quarter results, the company has revised its 2019 outlook.

Adjusted net income for 2019 is expected in the range of $9.60-$9.90 per share, lower than the earlier guidance of $9.70-$10.40. This includes unrealized loss of 11 cents per share recorded in the first nine months resulting from a decline in the market value of shares of some marketable securities held for investment and classified as available for sale.

Zacks Rank

Universal Health currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Releases From the Medical Sector

Among other players from the medical sector having reported third-quarter earnings so far, the bottom-line results of UnitedHealth Group Incorporated UNH, Anthem Inc. ANTM and Centene Corporation CNC topped the respective Zacks Consensus Estimate.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Centene Corporation (CNC) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance