Will UnitedHealth Group Do a Stock Split in 2018?

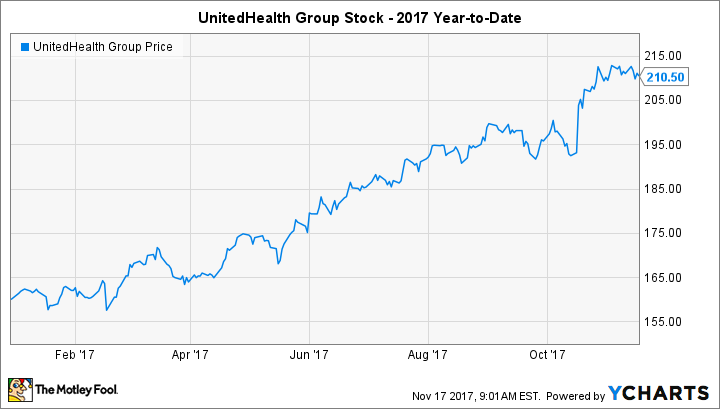

Healthcare remains in flux, with changing policies concerning the Affordable Care Act and health insurance more broadly having a huge impact on the industry. As a leader in the health insurance business, UnitedHealth Group (NYSE: UNH) has worked hard to overcome the challenges involved in planning for healthcare reform while still being as profitable as it can. 2017 has been a good year for UnitedHealth, and that has helped to send the company's share price above the $200 mark, earning it a place among the most influential stocks in the Dow Jones Industrial Average (DJINDICES: ^DJI).

UnitedHealth has responded to soaring share prices in the past by doing stock splits, and some investors believe that another split could come soon. Yet UnitedHealth hasn't made such a move in more than 12 years. Below, we'll take a closer look at UnitedHealth Group to see whether 2018 might finally bring the much-awaited split from the health insurer.

When has UnitedHealth done stock splits in the past?

Unlike some of its Dow peers, UnitedHealth made a regular habit of doing stock splits in the earlier part of the insurance giant's history. With average annual returns of well over 20% stretching back for 35 years, UnitedHealth's share price has climbed considerably over time, leading it to split its shares when the stock rose too high.

Split Date | Ratio | 100 Shares in 1990 |

|---|---|---|

Sept. 16, 1992 | 2-for-1 | 200 shares |

March 11, 1994 | 2-for-1 | 400 shares |

Dec. 26, 2000 | 2-for-1 | 800 shares |

June 19, 2003 | 2-for-1 | 1,600 shares |

May 31, 2005 | 2-for-1 | 3,200 shares |

Data source: UnitedHealth investor relations.

During its early history in the 1980s, UnitedHealth had nothing to worry about when it came to stock splits. The insurer's shares traded in single digits throughout much of that time. The tide, however, turned in the early 1990s following UnitedHealth's establishment of its pharmacy benefits management business. When the stock climbed nearly to $100 per share, UnitedHealth did its first 2-for-1 stock split in 1992.

Subsequently, UnitedHealth didn't follow a hard-and-fast rule in timing its splits. In the mid-1990s, UnitedHealth didn't let the stock price reach triple digits before doing a second 2-for-1 split. In 2000, the company waited until the stock was above $120 per share. The $100-per-share threshold, though, seemed to play a role in most of UnitedHealth's split decisions.

Will UnitedHealth pull the trigger on a split in 2018?

UnitedHealth's past practice on stock splits seems to have changed. The company hasn't talked about stock splits on conference calls, reflecting the general shift away from share price-induced splitting. With brokers allowing small investors to buy or sell even single shares of stock, the former need to keep share prices low to allow for round-lot trading in 100-share increments has all but disappeared.

The one catalyst that could support a stock split could come from UnitedHealth's being part of the Dow Jones Industrial Average. UnitedHealth current has a weighting within the Dow of more than 6%, approaching double what its influence would be if the Dow were equal-weighted. UnitedHealth's market capitalization of more than $200 billion justifies in part its heavy weight, but it still has a larger impact on the Dow than some other healthcare companies with higher market caps.

UnitedHealth is unlikely to take action unless its peers in the Dow do the same. Three other Dow stocks have higher share prices than the insurer right now, and nearly half would have higher share prices following a UnitedHealth 2-for-1 split. Unless coordinated action occurs, then the insurance company doesn't seem to have much incentive to voluntarily reduce its influence in the Dow.

Based on past practice, UnitedHealth would seem to be a logical candidate for a stock split in 2018. But times have changed, and the odds of a split are much lower than they would have been at this share price 10 or 20 years ago.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance