United Natural (UNFI) Q4 Earnings Top Estimates, Sales Rise

United Natural Foods, Inc. UNFI reported fourth-quarter fiscal 2022 results, wherein the top and bottom line improved year over year and the latter came ahead of the Zacks Consensus Estimate.

The company remains optimistic as it enters the second year of its Fuel the Future strategy. It remains committed to making investments aimed at speeding up long-term growth, efficiency and value creation, alongside solidifying its balance sheet.

Quarter in Detail

United Natural’s adjusted earnings came in at $1.27 per share compared with the year-ago period figure as well as the Zacks Consensus Estimate of $1.25.

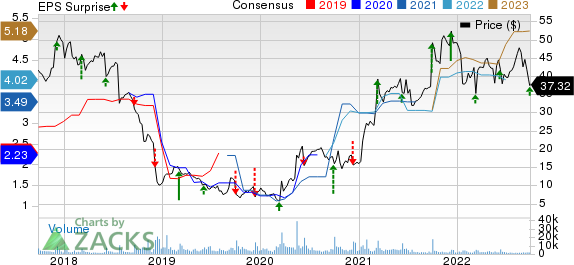

United Natural Foods, Inc. Price, Consensus and EPS Surprise

United Natural Foods, Inc. price-consensus-eps-surprise-chart | United Natural Foods, Inc. Quote

Net sales advanced 8% to $7,273 million but fell short of the Zacks Consensus Estimate of $7,347 million. The year-over-year upside was mainly backed by inflation and new business from current and new customers, including gains from cross-selling. This was somewhat countered by supply chain-related headwinds and lower unit sales growth.

Sales increased across all UNFI’s channels. Chains, Independent retailers, Supernatural and Retail channels witnessed sales growth of 3.7%, 12.4%, 13.5% and 1.3%, respectively. Other channel sales advanced 7.7%.

United Natural’s gross margin (excluding non-cash charges) of 15.2% improved from 15% in the year-ago quarter. The upside was mainly backed by the enhancement in the Wholesale segment’s margin rate, reflecting the effect of inflation and the company’s efficiency efforts. This was partially hurt by adverse changes in the customer mix.

The operating expense rate came in at 13.5% in the quarter under review, compared with adjusted operating expense rate of 13.2% in the year-ago period. The upside was a result of continued investments in servicing customers. This led to elevated transportation and distribution center labor costs and occupancy-related inflation, partly compensated by fixed-cost leverage and gains from United Natural’s efficiency efforts.

Adjusted EBITDA came in at $213 million, up from the $206 million reported in the year-ago quarter.

Other Updates

United Natural ended the quarter with total liquidity of nearly $1.7 billion, including cash of nearly $44 million and borrowing capacity of about $1.6 billion under the company’s asset-backed lending facility. Total outstanding debt (net of cash) was $2.12 billion. The company’s net debt to adjusted EBITDA leverage ratio was 2.6X as of the end of the fourth quarter compared with 2.9X as of the end of the third quarter.

During the fourth quarter, United Natural generated free cash flow of $269 million. This reflects net cash provided by operating activities of $362 million and capital expenditures of $93 million. The company expects capital expenditures of $350 million for fiscal 2023.

On Sep 21, 2022, management approved a new share buyback plan that authorizes the company to buy shares up to $200 million over four years. This replaces the company’s buyback plan announced on Oct 6, 2017.

Fiscal 2023 Guidance

United Natural issued its guidance for fiscal 2023, which is based on its fiscal 2022 results and expectations of sustained momentum.

For fiscal 2023, the Zacks Rank #2 (Buy) company anticipates net sales in the range of $29.8-$30.4 billion. At the midpoint, the metric suggests a 4% rise from the fiscal 2022 reported levels.

The company expects adjusted EBITDA in the range of $850-$880 million, indicating a 4% rise at the midpoint of the guidance. The company anticipates fiscal 2023 adjusted earnings in the range of $4.85-$5.15 per share. At the midpoint, the metric indicates a 4% rise from the fiscal 2022 reported levels.

Shares of the company have declined 6.1% in the past three months compared with the industry’s drop of 4.7%.

Other Stocks Worth Considering

Other well-ranked stocks from the sector are Lancaster Colony LANC, General Mills GIS and J. M. Smucker SJM.

Lancaster Colony, which manufactures and markets food products for the retail and foodservice markets, currently sports a Zacks Rank of 1 (Strong Buy). LANC delivered an earnings surprise of 170% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lancaster Colony’s current financial-year sales and EPS suggests growth of 9.6% and 38.3%, respectively, from the corresponding year-ago reported figures.

General Mills, a manufacturer and marketer of branded consumer foods, currently carries a Zacks Rank #2 (Buy). GIS has a trailing four-quarter earnings surprise of 6.1% on average.

The Zacks Consensus Estimate for General Mills’ current financial-year sales suggests growth of 2.5% from the year-ago reported number.

J. M. Smucker, which manufactures and markets branded food and beverage products, carries a Zacks Rank #2 at present. J. M. Smucker has a trailing four-quarter earnings surprise of 20.8% on average.

The Zacks Consensus Estimate for SJM’s current financial-year sales suggests growth of 4.4% from the year-ago period’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Lancaster Colony Corporation (LANC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance