Under Armour (UAA) Beats on Q1 Earnings, Raises '21 View

In spite of a challenging backdrop, Under Armour, Inc. UAA reported stellar first-quarter 2021 results that gained from strength in both North America and international regions as well as robust e-commerce sales. Markedly, both the top and the bottom lines not only surpassed the Zacks Consensus Estimate but also improved year over year. This Baltimore-based company's upbeat performance highlighted its improved operating model and investments that helped meet strong demand.

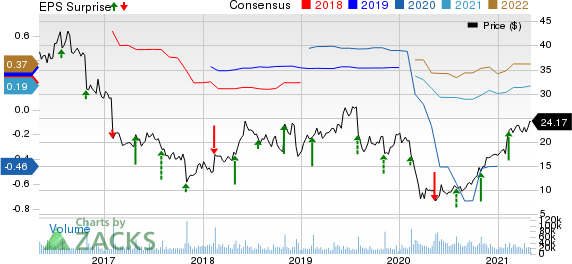

Under Armour reported adjusted earnings of 16 cents a share that fared far better than the Zacks Consensus Estimate of 4 cents. The bottom line also showcased a sharp improvement from a loss of 34 cents reported in the year-ago period.

Meanwhile, net revenues of $1,257.2 million comfortably outpaced the Zacks Consensus Estimate of $1,124 million, thus marking the fourth straight beat. The top line surged 35.1% on a year-over-year basis. While wholesale revenues rose 35% year over year to $800 million, direct-to-consumer revenues increased 54% to $437 million buoyed by 69% jump in e-commerce sales.

The stronger-than-anticipated results prompted management to raise full year view. We note that shares of this Zacks Rank #2 (Buy) company has increased 16.8% compared with the industry’s rally of 12.4% in the past three months.

Let’s Take an Insight

By product category, Apparel revenues jumped 35.4% year over year to $810 million, while Footwear revenues increased 47.4% to $309 million. Revenues from Accessories category surged 73.3% to $117.4 million. Meanwhile, Licensing revenues rose 8.6% to $21.7 million.

Net revenues from North America increased 32.3% to $805.7 million. Revenues from international business grew 57.8% (or up 50.2% on a currency neutral basis) to $452 million. Within international business, net revenues from Asia-Pacific and EMEA increased 119.7% and 40.6% to $210.2 million and $193.9 million, respectively. We note that revenues from Latin America region tumbled 9% to $48.3 million.

The company’s gross margin expanded 370 basis points to 50% owing to benefits from channel mix, supply chain initiatives and pricing.

Other Financial Details

Under Armour ended the quarter with cash and cash equivalents of $1,348.7 million, long-term debt (net of current maturities) of $1,009.9 million and total stockholders' equity of $1,770.2 million.

2021 View

Management now anticipates full-year 2021 revenues to increase at a high-teen percentage rate, up from the prior projection of high-single-digit percentage rate increase. This reflects a high-teen percentage growth rate in North America and low thirties percentage growth rate in the international business.

The company now envisions adjusted earnings in the band of 28-30 cents a share, up from previous expectation of 12-14 cents a share. The Zacks Consensus Estimate for the full year is pegged at 19 cents.

Under Armour anticipates full year gross margin to be up about 50 basis points when compared with the prior year adjusted gross margin of 48.6%. Management highlighted that benefits from pricing and supply chain efficiency will largely be offset by the impact of the divestment of the high gross margin business, MyFitnessPal. The company guided adjusted operating income between $230 million and $240 million compared to the previous expectation of $130-$150 million.

Here are 3 Key Stocks for You

Abercrombie & Fitch ANF has a long-term earnings growth rate of 18%. It presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Crocs, Inc. CROX has a trailing four-quarter earnings surprise of 219.6%, on average. Currently, the stock carries a Zacks Rank #1.

L Brands LB has a long-term earnings growth rate of 13%. It currently carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

L Brands, Inc. (LB) : Free Stock Analysis Report

Under Armour, Inc. (UAA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance