UMB Financial (UMBF) Rides on Loan Growth Amid Rising Costs

UMB Financial Corporation UMBF benefits from balance-sheet strength on the back of increasing loan and deposit balances. Given the decent liquidity position, the company’s capital distribution activities seem sustainable. However, intense competition and significant exposure to commercial loans, along with elevated expenses, are major headwinds.

UMB Financial has a strong balance sheet position. This is evident by impressive net loan growth in the last three years (2020-2023), with a compounded annual growth rate (CAGR) of 13%. Also, deposits saw a CAGR of 9.8% during the same time period. The strong deposit pipeline and growing loan balances are likely to support the company’s financials. Management expects continued loan growth in various verticals across its footprint.

UMBF benefits from high interest rates. The company’s net interest income (NII) witnessed a CAGR of 8.2% over the last four years (ended 2023). Expectations of higher rates in the near term, coupled with decent loan demand, may support NII’s growth in the future. However, an increase in funding and deposit costs might weigh on it.

As of Dec 31, 2023, UMB Financial had a debt of $2.18 billion, which declined from $2.68 billion in the prior quarter. Cash and due from banks, as well as interest-bearing due from banks, were $5.61 billion as of the same date. The company seems to be well-placed in terms of its liquidity profile and is expected to continue meeting its debt obligations even if the economic situation worsens.

UMB Financial has been raising dividends annually on a regular basis since 2002, with the latest hike of 2.6% announced in October 2023. During third-quarter 2023, it approved the repurchase of up to one million shares of its common stock. UMBF's solid liquidity position will support its capital distribution activities in the long run.

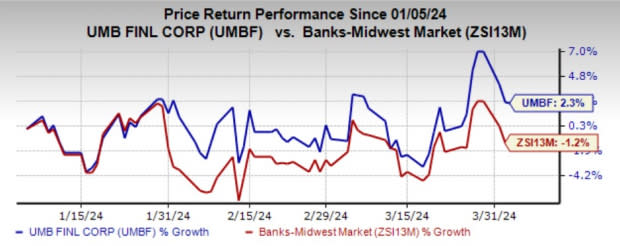

The bank currently carries a Zacks Rank #3 (Hold). Over the past three months, shares of UMBF have gained 2.3% against the industry's decline of 1.2%.

Image Source: Zacks Investment Research

Despite the above-mentioned tailwinds, cost escalation is the key concern for UMB Financial. The non-interest expenses flared up, seeing a CAGR of 6.4% over the last four years (2019-2023). Though the company is focusing on improving its operating leverage, a rise in expense base is likely to impede bottom-line growth in the upcoming period.

As of Dec 31, 2023, UMB Financial’s total commercial loans (commercial and industrial as well as commercial real estate) comprises 81% of total average loans. The current rapidly changing macroeconomic backdrop is likely to put some strain on commercial lending. Thus, the lack of loan portfolio diversification is likely to hurt its financials in case the economic situation worsens.

Additionally, UMBF faces intense competition from FinTech companies and online service providers, which threatens traditional banks’ market shares.

Stocks to Consider

Some better-ranked bank stocks worth mentioning are Commerce Bancshares, Inc. CBSH and First Business Financial Services, Inc. FBIZ.

Commerce Bancshares’s earnings estimates for the current year have been revised marginally upward in the past 60 days. The company’s shares have gained 15.3% over the past six months. At present, CBSH carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

First Business Financial Services’s 2024 earnings estimates have moved slightly upward in the past 30 days. The stock has gained 15.8% over the past six months. Currently, FBIZ carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Business Financial Services, Inc. (FBIZ) : Free Stock Analysis Report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance