UMB Financial (UMBF) Q1 Earnings Top Estimates, Stock Falls 6.5%

UMB Financial Corp.’s UMBF first-quarter 2024 operating earnings per share (EPS) of $2.47 beat the Zacks Consensus Estimate of $1.85. Also, the bottom line compared favorably with $1.91 earned in the year-ago quarter.

Results benefited from higher non-interest income, strong loan and deposit balances and lower provisions. Nonetheless, a decline in net interest income (NII), lower net interest margin (NIM) and increased expenses were undermining factors.

The company’s shares lost 6.5% following the release of its first-quarter 2024 results.

The results included the charge of $13 million related to the FDIC special assessment. After considering these charges, the net income for UMBF was $110.3 million for the specified quarter, up 19.3% year over year.

Quarterly Revenues Increase, Costs Rise

Quarterly revenues were $398.7 million, up 7.2% year over year. Also, the top line beat the Zacks Consensus Estimate of $369.8 million.

NII on an FTE basis was $246 million, which declined nearly 1% from the prior-year quarter. On an FTE basis, NIM was 2.48%, down 28 basis points.

Non-interest income was $159.2 million, up 22.3% year over year. The rise was primarily driven by an increase in trust and securities processing, insurance fees and commissions, bankcard fees and investment securities gain.

Non-interest expenses were $254.8 million, up 7.5% year over year. The rise was driven by higher regulatory fees, mainly from the FDIC special assessment. Also, a rise in processing fees and an uptick in bankcard expenses were some of the other major reasons behind the improvement. These were partially offset by a decline in operational losses and equipment costs. The operating non-interest expense was $241.2 million.

The efficiency ratio increased to 63.44%, up from the prior-year quarter’s 63.12%. An increase in efficiency ratio indicates a decrease in profitability.

As of Mar 31, 2024, average loans and leases were $23.4 billion, up 1.1% sequentially. Also, average deposits increased 2.6% to $33.5 billion.

Credit Quality Improves

The ratio of net charge-offs to average loans was 0.05% in the reported quarter, which decreased from 0.09% in the year-ago quarter.

Also, total non-accrual and restructured loans were $17.8 million, up 14.7% year over year.

The provision for credit losses was $10 million for the first quarter of 2024, down 57% from the prior-year quarter. This reduction was primarily due to the favorable changes in macroeconomic factors and credit metrics.

Capital Ratios Improve

As of Mar 31, 2024, the Tier 1 risk-based capital ratio was 11.09%, which rose from 10.57% as of Mar 31, 2023. The Tier 1 leverage ratio was 8.39%, which increased from 8.35% as of Mar 31, 2023. The total risk-based capital ratio was 13.03%, which grew from 12.49% in the year-ago quarter.

Profitability Ratios Improve

Return on average assets at the quarter’s end was 1.06%, which increased from the year-ago quarter’s 0.97%. Further, the operating return on average equity was 14.11%, up from 13.76% reported in the previous year’s quarter.

Capital Distribution Activities

In the first quarter of 2024, the board of directors approved a new share repurchase plan of up to one million shares of the company's common stock.

Our Take

UMB Financial is poised to benefit from elevated loan and deposit balances, as well as increased non-interest income and improved asset quality. Further, the bank has agreed to acquire Heartland Financial in an all-stock transaction valued at $2 billion. This will allow UMBF’s asset base to grow more than 40% and expand its geographical footprint. However, reduced NII and NIM, together with increased expenses, are near-term concerns.

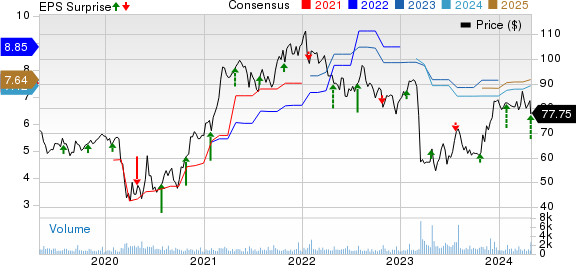

UMB Financial Corporation Price, Consensus and EPS Surprise

UMB Financial Corporation price-consensus-eps-surprise-chart | UMB Financial Corporation Quote

UMB Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Texas Capital Bancshares, Inc. TCBI reported first-quarter 2024 EPS of 62 cents (excluding non-recurring items), which beat the Zacks Consensus Estimate of 59 cents. However, earnings compared unfavorably with 70 cents reported in the year-ago quarter.

TCBI's results benefited from an increase in non-interest income and higher loan and deposit balances. Additionally, a strong capital position and lower provisions were other positives. However, a decline in NII and an increase in expenses were the undermining factors.

Citizens Financial Group CFG reported first-quarter 2024 EPS of 65 cents, missing the Zacks Consensus Estimate of 75 cents. The bottom line declined from $1 reported in the year-ago quarter.

Underlying EPS for the first quarter of 2024 was 79 cents, down from $1.10 reported in the year-ago quarter.

CFG’s results were adversely affected by lower NII and a rise in provisions and operating expenses. However, an increase in non-interest income and lower allowance for credit losses offered some support.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Capital Bancshares, Inc. (TCBI) : Free Stock Analysis Report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance