U.S. Steel (X), Nippon Steel Clear Non-US Regulatory Hurdles

The United States Steel Corporation X and Nippon Steel Corporation announced the receipt of all necessary regulatory approvals outside of the United States for their proposed transaction. These approvals were granted by several regulatory bodies, including the Directorate-General for Competition of the European Commission (under the EU Merger Regulation and the Foreign Subsidies Regulation), the Mexican Federal Economic Competition Commission, the Serbian Competition Commission, the Ministry of Economy of Slovakia and the Turkish Competition Authority.

The United Kingdom Competition and Markets Authority confirmed that it has no further inquiries regarding the proposed transaction following the submission of a voluntary briefing paper.

U.S. Steel expressed satisfaction with the regulatory approvals, viewing them as evidence that the transaction with Nippon Steel is pro-competitive and strategically beneficial for foreign investment. The company emphasized that the partnership would position U.S. Steel and Nippon Steel as leading global steelmakers with enhanced technologies and resources, strengthening the steel industry and promoting competition. X asserted that the deal is advantageous for American steel and American jobs and it strengthens the U.S. alliance with Japan against China.

Nippon Steel acknowledged the importance of securing the necessary regulatory approvals from non-U.S. authorities, reiterating its consistent goal of protecting and growing U.S. Steel. The company expressed confidence that the transaction would benefit all stakeholders, including customers, employees, suppliers and communities. It affirmed that both companies are committed to fully cooperating with relevant authorities to complete the transaction.

U.S. Steel held a Special Meeting of Stockholders on Apr 12, 2024, where 71% of outstanding shares of U.S. Steel common stock voted in favor of the proposed transaction, with an overwhelming 99% approval among shares represented at the meeting.

The transaction is expected to be completed in the second half of 2024, contingent upon the fulfillment of remaining customary closing conditions, including the receipt of required U.S. regulatory approvals.

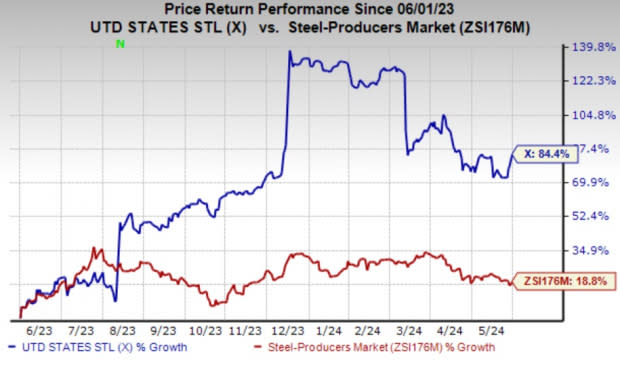

The stock has rallied 84.4% in the past year compared with the industry’s 18.8% rise.

Image Source: Zacks Investment Research

U.S. Steel anticipates a stronger second quarter, with adjusted EBITDA projected in the range of $425-$475 million, driven by improved performance in the Flat-Rolled unit. The Mini Mill segment is expected to face challenges due to lower average selling prices. The U.S. Steel Europe segment will likely continue to encounter commercial headwinds. Results in the Tubular segment are expected to be moderate due to declining selling prices.

United States Steel Corporation Price and Consensus

United States Steel Corporation price-consensus-chart | United States Steel Corporation Quote

Zacks Rank & Key Picks

U.S. Steel currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, sporting a Zacks Rank #1 (Strong Buy), and ATI Inc. ATI and Ecolab Inc. ECL, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 140% in the past year.

ATI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the earnings surprise being 8.34%, on average. The stock has surged 69% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a year-over-year rise of 26.5%. The Zacks Consensus Estimate for ECL’s current-year earnings has moved up in the past 30 days. ECL beat the consensus estimate in each of the last four quarters, with the earnings surprise being 1.3%, on average. The stock has rallied nearly 37.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance