U.S. GDP Game Plan: EUR/USD Rebound Looks to Data for Fuel

DailyFX.com -

Talking Points

EUR/USD trading within ascending technical formation- ahead of U.S. GDP

Updated targets & invalidation levels

Compete to Win Cash Prizes with FXCM’s Forex Trading Contest

EURUSD 60min

Chart Created Using TradingView

Technical Outlook: EURUSD broke above the weekly opening-range high yesterday with the rally reversing just ahead of confluence resistance in early London trade. A newly identified median-line formation off the lows has continued to offer guidance with the exchange rate approaching a near-term support confluence at 1.1060. Heading into tomorrow’s U.S. 2Q GDP release, the pair remains constructive while above the lower parallel / 61.8% retracement at 1.1016 with the broader bullish invalidation level set to the weekly open at 1.0970.

Confluence resistance is eyed at 1.1106/10- a region defined by the monthly open, the 38.2% retracement & slope resistances. A breach above this zone is needed to validate the next leg higher for the euro with such a scenario eyeing subsequent topside objectives at 1.1123, the upper median-line parallel & the 50% retracement at 1.1170.

From a trading standpoint, heading into the GDP release I would be looking to fade USD strength (EURUSD weakness) into structural support. For the complete setup and to continue tracking this trade and more throughout the week- Subscribe to SB Trade Deskand take advantage of the DailyFX New Subscriber Discount.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

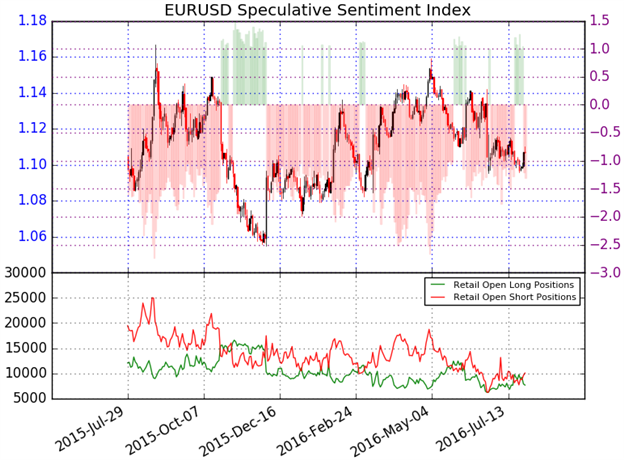

A summary of the DailyFX Speculative Sentiment Index (SSI)shows traders are net short EURUSD- the ratio stands at -1.34(43% of traders are long)-bullishreading

Yesterday the ratio was +1.02. Short positions are 15.1% higher than yesterday and 21.9% above levels seen last week.

Open interest is 0.5% lower than yesterday and 4.5% above its monthly average.

SSI flipped to net short yesterday as price defended the weekly open as support at 1.0970 with the subsequent breach of the weekly-range keeping the long-bias in play heading into tomorrow’s key U.S. event risk.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

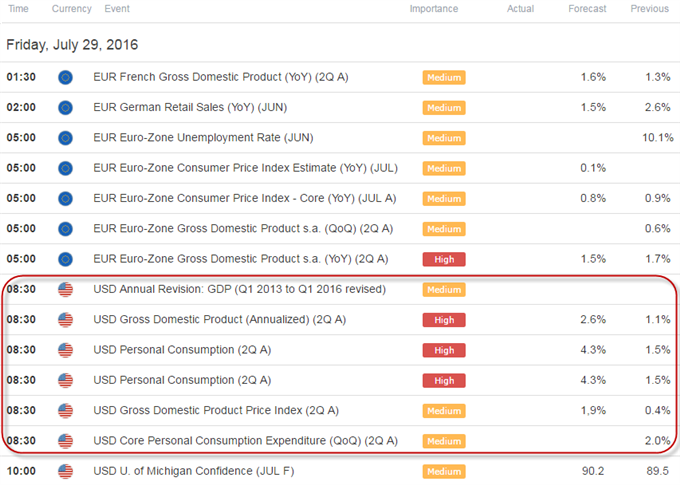

Relevant Data Releases This Week

Other Setups in Play:

AUD/NZD Correction Underway Ahead of RBA- Look to Buy the Dip

Post-Brexit NZDUSD Support Vulnerable to Weak NZ Trade Balance

Webinar: USDOLLAR within Striking Distance of 2016 Open Ahead of FOMC

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance