What Type Of Returns Would Oil Search's(ASX:OSH) Shareholders Have Earned If They Purchased Their SharesFive Years Ago?

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

While it may not be enough for some shareholders, we think it is good to see the Oil Search Limited (ASX:OSH) share price up 15% in a single quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 55% in the period. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

Check out our latest analysis for Oil Search

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

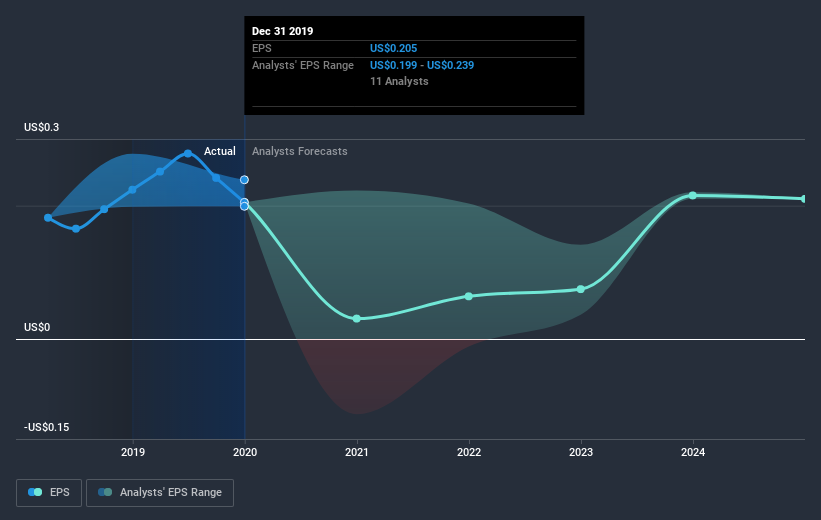

During the five years over which the share price declined, Oil Search's earnings per share (EPS) dropped by 3.0% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 15% per year, over the period. This implies that the market is more cautious about the business these days. The low P/E ratio of 10.74 further reflects this reticence.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Oil Search, it has a TSR of -50% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that Oil Search shareholders are down 50% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 6.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8.5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Oil Search has 3 warning signs we think you should be aware of.

Oil Search is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance