Twitter (TWTR) to Report Q3 Earnings: What's in the Cards?

Twitter TWTR is set to report third-quarter 2021 results on Oct 26.

For the third quarter of 2021, the company expects total revenues between $1.22 billion and $1.3 billion. The Zacks Consensus Estimate for revenues stands at $1.29 billion, indicating growth of 37.5% from the year-ago quarter reported figure.

The consensus mark for third-quarter earnings has increased 6.3% to 17 cents per share over the past 30 days, indicating a decline of 10.5% from the year-ago quarter.

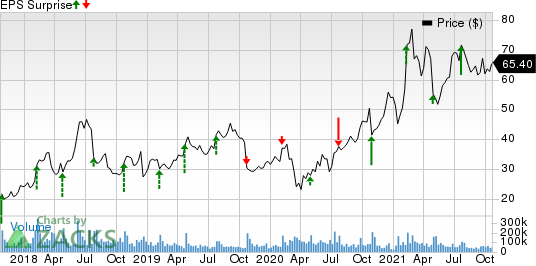

The company’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 110.8%.

Twitter, Inc. Price and EPS Surprise

Twitter, Inc. price-eps-surprise | Twitter, Inc. Quote

Factors to Consider

Twitter’s ad revenues are expected to have remained steady in the third quarter, driven by an upswing in advertiser sentiment for digital ads, following the coronavirus-induced sluggishness and improved demand for Twitter’s solutions, fueled by resumption of more events and product launches.

The Zacks Consensus Estimate for advertising revenues is pegged at $1.14 billion, indicating growth of 41.7% from the year-ago quarter’s reported figure.

Additionally, the company’s initiatives to add features and focus on tackling abuse issues are expected to have helped it expand monetized user base in the to-be-reported quarter.

On Sep 8, Twitter announced that it is testing a new feature called Communities, which would help groups of Twitter users to engage and encourage them to interact with other users. The company aims to create a more intimate space for conversation.

Moreover, the introduction of a tipping feature for hosts charging admission to their live audio chat rooms in its Spaces feature is expected to have attracted more content creators in the to-be-reported quarter. Twitter Spaces is currently available for iOS and Android apps besides mobile and desktop browsing.

Twitter users also started gaining first access to Super Follows in the to-be-reported quarter that let them sell exclusive content to paying subscribers, and Ticketed Spaces, in which they charge for entry into audio chat rooms they host on the platform.

In the second quarter of 2021, average monetizable DAU (mDAU) grew 11% year over year to 206 million, driven by global conversation around current events and ongoing product improvements.

Twitter’s improved ability to proactively identify and remove abusive content from the platform has been a notable development in this regard.

Further, steady demand for video ad products like Video Website Cards and in-stream pre-roll is likely to have contributed to the top line.

However, rising expenses due to increased investments are expected to have weighed on the profit margins.

What Our Model Says

According to the Zacks model, the combination of a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Twitter has an Earnings ESP of -39.60% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases:

Acadia Realty Trust AKR has an Earnings ESP of +1.50% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Campus Communities Inc ACC has an Earnings ESP of +2.73% and a Zacks Rank of 2, currently.

Aflac Incorporated AFL has an Earnings ESP of +1.44% and a Zacks Rank of 2, currently.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Acadia Realty Trust (AKR) : Free Stock Analysis Report

American Campus Communities Inc (ACC) : Free Stock Analysis Report

Twitter, Inc. (TWTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance