Twilio (TWLO) Q3 Earnings Surpass Estimates, Guidance Upsets

Twilio Inc. TWLO reported third-quarter 2019 non-GAAP earnings of 3 cents per share, which topped the Zacks Consensus Estimate of a penny. However, the bottom line was lower than the year-ago figure of 7 cents.

Meanwhile, the company’s third-quarter revenues soared 75% year over year to $295.1 million and also surpassed the Zacks Consensus Estimate of $287 million, driven by increasing clientele and the Sendgrid buyout. Growing adoption of Twilio Flex is also a tailwind.

However, the company’s guidance for the full year as well as the fourth quarter was disappointing as it impacted shares to decline more than 10% in the extended trading session on Wednesday.

For 2019, Twilio now expects revenues in the range of $1.114-$1.117 billion compared with $1.113-$1.119 billion projected earlier. The Zacks Consensus Estimate is pegged at $1.2 billion.

For the fourth quarter of 2019, Twilio anticipates revenues between $311 million and $314 million. The Zacks Consensus Estimate is pegged at $321.2 million.

Moreover, the company forecasts non-GAAP earnings per share to be 1-2 cents. Thee Zacks Consensus Estimate for earnings stands at 7 cents.

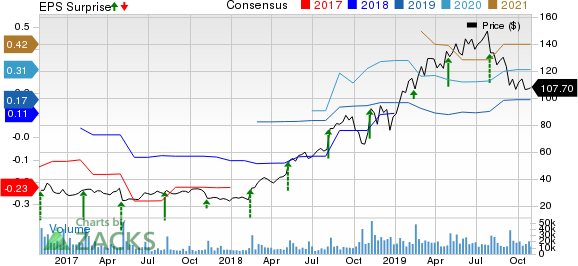

Twilio Inc. Price, Consensus and EPS Surprise

Twilio Inc. price-consensus-eps-surprise-chart | Twilio Inc. Quote

Quarterly Details

The company’s base revenues jumped 79% year over year to $275.5 million. However, the figure was lower than expected. Management mentioned errors in the company’s billing processes compelled the company to issue onetime credits of around $5 million to customers.

Organic base revenues of $227 million soared 47% year over year. While SendGrid revenues of $49 million grew 31% year over year.

Twilio’s top 10 active customer accounts contributed to 13% of its total revenues, down from 18% in the year-ago period. On a sequential basis, the figure was flat.

The company’s dollar-based net expansion rate was 132% in the reported quarter, down from 145% in the prior-year period.

The company’s active customer accounts increased to 172,092 as of Sep 30, 2019 from 61,153 on Sep 30, 2018. Alone in the third quarter, Twilio added 10,223 active customer accounts.

Operating Results

Non-GAAP gross profit skyrocketed approximately 84.3% year over year to $172.4 million. Further, gross margin expanded 300 basis points (bps) to 58%.

As a percentage of revenues, non-GAAP sales and marketing expenses plus research and development expenses escalated 200 bps to 26% and 500 bps to 23%, respectively, while general and administrative costs declined 100 bps to 10%.

The company reported non-GAAP operating loss of $3.6 million against operating income of $4.3 million in the prior-year quarter, primarily due to the company’s annual user and developer conference, SIGNAL, held in August.

Balance Sheet

The company exited the quarter under review with cash and cash equivalents plus short-term marketable securities of $1.88 billion, which came in flat sequentially.

During the first nine months ending Sep 30, 2019, the company generated $2.02 million of cash from operational activities compared with $12.8 million of cash generated in the year-ago period.

Outlook

For the full year, base revenues are estimated within $1.053-$1.055 billion, down from the previous prediction of $1.064-$1.068 billion.

The company projects non-GAAP earnings per share in the band of 16-17 cents compared with 17-18 cents envisioned earlier. The Zacks Consensus Estimate is pegged at 17 cents.

For the fourth quarter, base revenues are predicted within $300-$302 million.

Robust political traffic coupled with the ramp of a large international customer, which led to a 10% growth in the fourth quarter of 2018, is likely to induce a tough year-over-year comparison.

Zacks Rank and Stocks to Consider

Twilio currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Benefitfocus BNFT, Five9, Inc. FIVN and Square SQ, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Benefitfocus, Five9 and Square is currently estimated at 20%, 10% and 25%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Square, Inc. (SQ) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance