Should TT Electronics (LON:TTG) Be Disappointed With Their 29% Profit?

TT Electronics plc (LON:TTG) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But the silver lining is the stock is up over five years. Unfortunately its return of 29% is below the market return of 37%.

See our latest analysis for TT Electronics

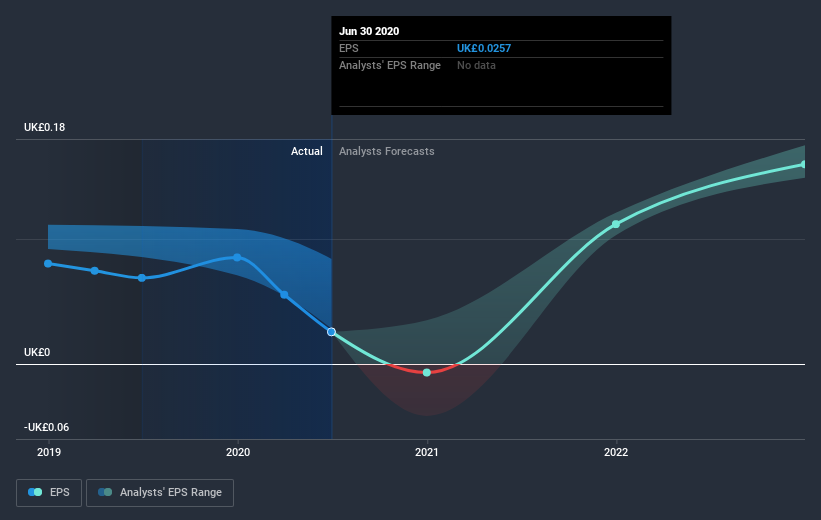

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, TT Electronics became profitable. That would generally be considered a positive, so we'd expect the share price to be up.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on TT Electronics' earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between TT Electronics' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that TT Electronics' TSR of 46% over the last 5 years is better than the share price return.

A Different Perspective

We regret to report that TT Electronics shareholders are down 17% for the year. Unfortunately, that's worse than the broader market decline of 8.7%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 8%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand TT Electronics better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with TT Electronics (including 1 which is makes us a bit uncomfortable) .

Of course TT Electronics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance