TSX Growth Leaders With High Insider Ownership June 2024

As of June 2024, the Canadian market continues to navigate through a landscape shaped by evolving economic trends and shifting market conditions, guided by insights from experts like Craig Fehr. In this environment, understanding the significance of insider ownership can be crucial for investors looking for growth companies on the TSX that demonstrate confidence from those who know them best.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Payfare (TSX:PAY) | 15% | 57.7% |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Vox Royalty (TSX:VOXR) | 12.4% | 77.3% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

Aritzia (TSX:ATZ) | 19% | 51.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 13.2% | 65.3% |

Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's take a closer look at a couple of our picks from the screened companies.

Green Thumb Industries

Simply Wall St Growth Rating: ★★★★☆☆

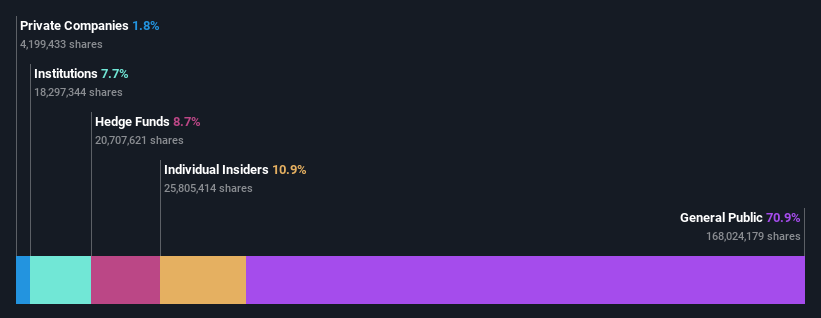

Overview: Green Thumb Industries Inc. operates in the United States, focusing on the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult-use markets, with a market capitalization of approximately CA$3.86 billion.

Operations: The company generates revenue primarily through its retail operations and consumer packaged goods, totaling approximately $806.38 million and $583.78 million respectively.

Insider Ownership: 10.9%

Revenue Growth Forecast: 10.3% p.a.

Green Thumb Industries, a Canadian-listed cannabis producer, has recently shown interest in merging with U.S.-based Boston Beer Company. This strategic move aims to enhance market presence and diversify product offerings, potentially increasing shareholder value. Despite slower revenue growth at 10.3% annually compared to the industry average, GTII's earnings are expected to grow significantly at 23.5% per year over the next three years. Insider transactions have not been substantial lately, reflecting a cautious stance from insiders amidst these developments.

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

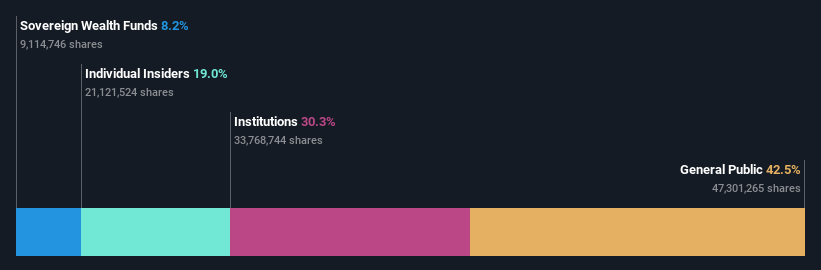

Overview: Aritzia Inc., a Canadian fashion retailer, designs, develops, and sells women's apparel and accessories primarily in the United States and Canada, with a market capitalization of approximately CA$4.14 billion.

Operations: The company generates its revenue primarily from the sale of women's apparel, totaling CA$2.33 billion.

Insider Ownership: 19%

Revenue Growth Forecast: 11% p.a.

Aritzia, a Canadian retailer, is experiencing notable growth with earnings forecasted to increase by 51.2% annually, outpacing the market's 14.6%. Despite trading at a significant discount to fair value and expecting revenue growth of 11% per year—higher than the market's 7.1%—its profit margins have declined from last year's 8.5% to this year's 3.4%. Recent financial results showed a dip in net income despite higher sales, but the company remains optimistic with projected revenue increases for fiscal 2025.

Dive into the specifics of Aritzia here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Aritzia's share price might be too pessimistic.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

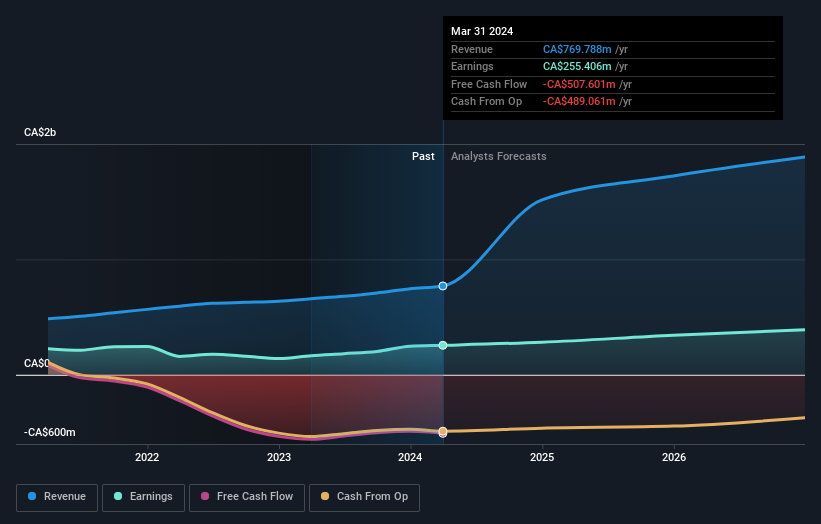

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market capitalization of approximately CA$3.12 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, totaling CA$153.99 million and CA$1.17 billion respectively.

Insider Ownership: 21.7%

Revenue Growth Forecast: 32.7% p.a.

goeasy Ltd., a Canadian company, recorded a robust revenue increase to CAD 357.11 million this quarter, up from CAD 287.3 million last year, with net income also rising to CAD 58.94 million. Despite its dividend sustainability concerns due to cash flow coverage issues, goeasy is expected to see earnings grow by 15.95% annually and revenue growth outpacing the market at 32.7% per year. The recent appointment of Patrick Ens as President of key brands could further enhance strategic direction and operational efficiency.

Navigate through the intricacies of goeasy with our comprehensive analyst estimates report here.

The valuation report we've compiled suggests that goeasy's current price could be quite moderate.

Seize The Opportunity

Discover the full array of 31 Fast Growing TSX Companies With High Insider Ownership right here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include CNSX:GTII TSX:ATZ and TSX:GSY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance