TSX Growth Companies With At Least 13% Insider Ownership

As the broader market continues to embrace the potential of artificial intelligence, with expectations of sustained growth across various sectors, Canadian markets are similarly poised to benefit from these technological advancements and productivity gains. In this environment, growth companies with high insider ownership in Canada represent an intriguing segment for investors seeking alignment with company leadership and a shared vision for long-term value creation.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Payfare (TSX:PAY) | 15% | 57.7% |

Aritzia (TSX:ATZ) | 19.1% | 51.6% |

Allied Gold (TSX:AAUC) | 22.4% | 68.1% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Magna Mining (TSXV:NICU) | 10.5% | 95.1% |

Artemis Gold (TSXV:ARTG) | 31.8% | 45.6% |

Ivanhoe Mines (TSX:IVN) | 12.4% | 37.8% |

UGE International (TSXV:UGE) | 35.4% | 63.5% |

Let's review some notable picks from our screened stocks.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market capitalization of approximately CA$2.98 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Insider Ownership: 21.7%

goeasy Ltd., a Canadian growth company with significant insider ownership, has demonstrated robust financial performance with earnings increasing by 54.3% over the past year. Analysts expect its earnings to grow by 15.9% annually, outpacing the Canadian market forecast of 13.6%. Revenue projections are similarly strong, anticipated to rise at 32.7% per year—far exceeding the market average of 6.9%. However, its dividend coverage is weak as cash flows do not adequately cover a dividend yield of 2.63%. Recent leadership changes, including Patrick Ens's appointment as President of easyfinancial and easyhome brands, aim to further bolster strategic direction and operational efficiency.

Take a closer look at goeasy's potential here in our earnings growth report.

The valuation report we've compiled suggests that goeasy's current price could be quite moderate.

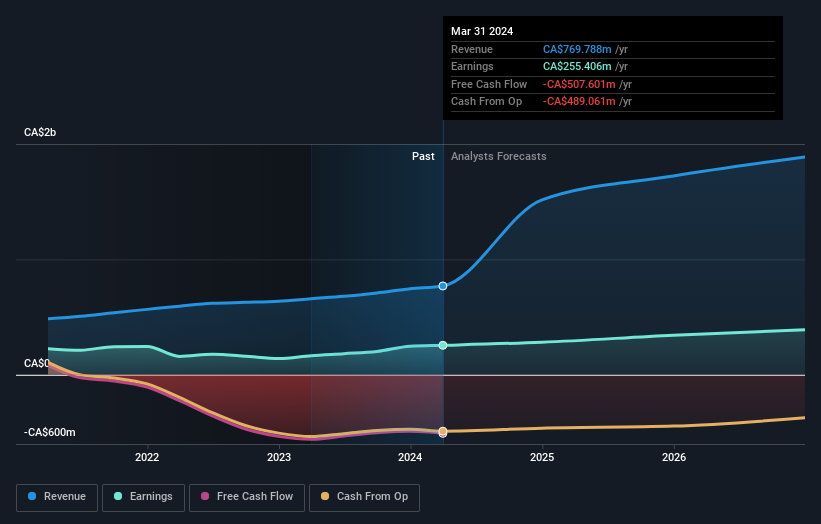

Artemis Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in identifying, acquiring, and developing gold properties, with a market capitalization of approximately CA$2.16 billion.

Operations: The company focuses on the identification, acquisition, and development of gold properties.

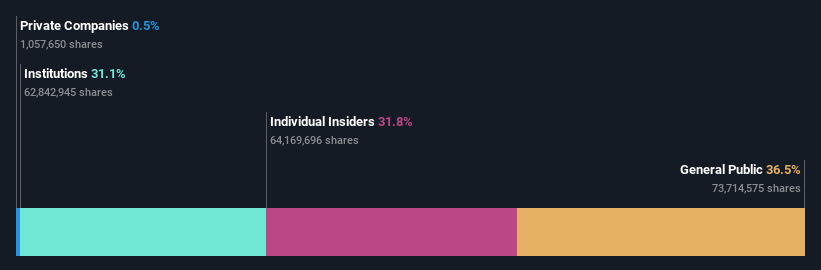

Insider Ownership: 31.8%

Artemis Gold, a Canadian growth company with high insider ownership, is navigating financial challenges while advancing its Blackwater Mine project. Despite reporting a net loss of CA$6.65 million in Q1 2024, the company's construction at Blackwater is on track with significant capital already committed. Insider activity has shown more buying than selling recently, although not in large volumes. Analysts forecast Artemis's revenue to grow substantially at 50.8% annually, outperforming the broader Canadian market significantly.

VersaBank

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VersaBank, operating in Canada and the United States, offers a range of banking products and services with a market capitalization of CA$347.92 million.

Operations: VersaBank generates revenue primarily through its digital banking segment, which brought in CA$102.91 million, and its cybersecurity services and financial technology development segment, which contributed CA$10.37 million.

Insider Ownership: 13.3%

VersaBank, a Canadian growth company with high insider ownership, reported a substantial year-over-year earnings increase in Q1 2024, with net income rising to CA$12.7 million from CA$9.42 million. The bank's revenue growth is forecasted at 18.8% per year, slightly below the high-growth benchmark but still outpacing the broader Canadian market significantly. Recent insider activities show more purchases than sales, indicating confidence among executives and directors despite not being large-scale transactions.

Get an in-depth perspective on VersaBank's performance by reading our analyst estimates report here.

Seize The Opportunity

Click here to access our complete index of 34 Fast Growing TSX Companies With High Insider Ownership.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:GSY TSXV:ARTG and TSX:VBNK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance