Triumph Group (TGI) Beats on Q3 Earnings, Tweaks EPS View

Triumph Group Inc.’s TGI adjusted earnings in third-quarter fiscal 2020 (ended Dec 31, 2019) were 69 cents per share, which surpassed the Zacks Consensus Estimate of 66 cents by 4.5%. The bottom line also improved 64.3% from 42 cents recorded in the prior-year quarter.

Including one-time adjustments, the company incurred GAAP loss of 27 cents per share in the fiscal third quarter compared with loss of 62 cents incurred in the year-ago quarter.

Improved operating income generated by the Aerospace Structures segment primarily contributed to the year-over-year improvement in the bottom- line figure.

Total Sales

Net sales in the quarter under review came in at $704.7 million, outpacing the Zacks Consensus Estimate of $675 million by 4.4%. However, the top line declined 12.8% on a year-over-year basis.

After taking divestitures into account, organic sales in the quarter went up 8% year over year driven by increased volumes on Airbus commercial programs, military rotorcraft components, aftermarket accessory services and legacy structures programs.

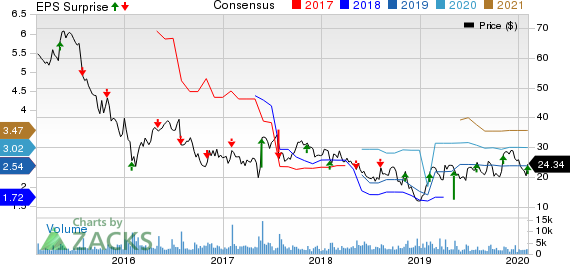

Triumph Group, Inc. Price, Consensus and EPS Surprise

Triumph Group, Inc. price-consensus-eps-surprise-chart | Triumph Group, Inc. Quote

Operational Highlights

In third-quarter fiscal 2020, the company generated adjusted operating income of $64 million, which improved 70.3% from the year-ago quarter’s figure. Adjusted operating margin of 9.1% increased 450 basis points from 4.5% in the third-quarter of fiscal 2019.

Interest expenses and other amounted to $33.2 million, up 13.2% from $29.3 million in the prior-year quarter.

Backlog came in at $3.34 billion, down year over year and on a sequential basis due to divestitures, sunsetting programs and production rate reductions.

Segmental Performance

Aerospace Structures: Segment sales totaled $369 million, down 24.8% from $490.3 million in the year-ago quarter. Operating income was $18.3 million, reflecting a significant improvement from operating loss of $49.8 million incurred in the year-ago period.

Integrated Systems: Segment sales rose 9% year over year to $275.2 million. Operating income was $47.9 million, up 19.9% from the year-ago level of $39.9 million.

Product Support: Segment sales declined 10.5% year over year to $64 million in the reported quarter. Operating income amounted to $9.5 million, down 16.5% from the year-ago figure of $11.5 million.

Financial Position

As of Dec 31, 2019, Triumph Group’s cash and cash equivalents totaled $53.6 million, compared with $92.8 million as of Mar 31, 2019.

Its long-term debt (excluding current portion) amounted to $1.40 billion as of Dec 31, 2019, compared with $1.48 billion as on Mar 31, 2019.

Net cash generated from operating activities in the first nine months of fiscal 2020 was $39.3 million, compared with net cash used worth $193.1 million a year ago.

The company’s capital expenditures were $27.3 million in the first nine months of fiscal 2020 compared with $34.8 million in the prior-year quarter.

Guidance

Triumph Group partially reduced its fiscal 2020 guidance.

It reduced the upper end of its adjusted earnings per share projection from $2.35-$2.95 to $2.35-$2.55. The Zacks Consensus Estimate for the metric, pegged at $2.54, lies above the mid-point of the company’s newly guided range.

Based on anticipated aircraft production rates and including the timing of pending program transfers, the company continues to expect revenues in the $2.8-$2.9 billion range. The Zacks Consensus Estimate for the same is pegged at $2.88 billion, which lies above the mid-point of the company’s projection.

Zacks Rank

Triumph Group currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

TransDigm Group Incorporated TDG reported first-quarter fiscal 2020 adjusted earnings of $4.93 per share, which surpassed the Zacks Consensus Estimate of $4.56 by 8.1%.

Lockheed Martin LMT reported fourth-quarter 2019 earnings of $5.29 per share, which surpassed the Zacks Consensus Estimate of $4.99 by 6%. The bottom line also improved 20.5% from $4.39 in the year-ago quarter.

General Dynamics’ GD fourth-quarter earnings from continuing operations of $3.51 per share beat the Zacks Consensus Estimate of $3.46 by 1.45%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Triumph Group, Inc. (TGI) : Free Stock Analysis Report

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance