Transocean (RIG) Posts Narrower Q3 Loss, Shares Rise 16%

Transocean Ltd.’s RIG stock has gone up 16.1% since its third-quarter earnings announcement on Nov 2.

This rally could be attributed to the Switzerland-based offshore drilling contractor posting a third-quarter loss narrower than estimates and revenues outperforming the consensus mark.

Behind the Earnings Headlines

Transocean reported an adjusted net loss of 6 cents per share in the third quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of 15 cents. This outperformance reflects an increase in revenues due to growth in activity.

Moreover, RIG’s bottom line improved from the year-ago period’s loss of 19 cents.

The offshore drilling powerhouse’s total adjusted revenues of $730 million beat the Zacks Consensus Estimate of $679 million.

Adjusted revenues rose 16.6% from the year-earlier figure of $626 million. The outperformance was primarily due to a combination of more-than-anticipated operational days and early termination payment on Equinox and higher reimbursement.

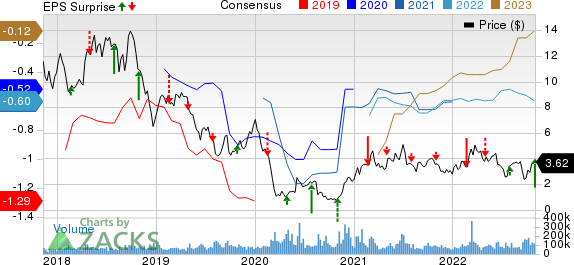

Transocean Ltd. Price, Consensus and EPS Surprise

Transocean Ltd. price-consensus-eps-surprise-chart | Transocean Ltd. Quote

Segmental Revenue Breakup

Transocean’s Ultra-deepwater floaters contributed to 62.7% of the total contract drilling revenues. Meanwhile, Harsh Environment floaters accounted for the remaining 37.3%.

In the third quarter of 2022, revenues from the Ultra-deepwater and Harsh Environment floaters totaled $433 million and $258 million, respectively, compared with the corresponding year-ago quarter’s reported figures of $428 million and $198 million.

Revenue efficiency for the reported quarter was 95%, lower than the 97.8% reported sequentially and the year-ago value of 98.1%.

Day Rates, Utilization & Backlog

Average day rates in the quarter declined to $343,400 from the year-ago level of $367,100. RIG witnessed a year-over-year decrease in average revenues per day from Harsh Environment floaters from $401,600 to $374,000 and the same from Ultra-deepwater floaters from $351,900 in the year-ago quarter to $326,600.

Overall, fleet utilization was 59.4% in the quarter, up from the prior-year period’s utilization rate of 52.8%.

Transocean’s backlog record of $7.3 billion for the quarter reflects a sequential increase from $6.2 billion in the last quarter.

Costs, Capex & Balance Sheet

Operating and maintenance costs decreased marginally to $411 million from $398 million a year ago. The company spent $87 million on capital investments in the third quarter. Cash provided by operating activities stood at $270 million at the end of the third quarter.

The company had cash and cash equivalents worth $954 million as of Sep 30, 2022. The long-term debt was $6.45 billion, with a debt-to-capitalization of 36.5% as of the same date.

Guidance

For the fourth quarter of 2022, RIG expects adjusted contract drilling revenues of approximately $600 million based on an average fleet revenue efficiency of 96.5%.

The firm anticipates its fourth-quarter operations and maintenance expenses to be approximately $440 million, higher than the prior quarter due to the timing of certain maintenance activities. Its general and administrative expenses for the fourth quarter are expected at around $54 million.

The net interest expense for the fourth quarter is forecast to be roughly $104 million. Capital expenditures and capital additions for the fourth quarter, including capitalized interests, are forecast to be approximately $575 million, including roughly $540 million for RIG’s newbuild drillships and $35 million of maintenance CapEx.

Finally, cash taxes for the fourth quarter are expected at roughly around $9 million.

Zacks Rank & Stocks to Consider

Transocean currently has a Zacks Rank #3 (Hold).

Investors interested in the energy space might look at some better-ranked stocks — Vista Oil & Gas VIST, NexTier Oilfield Solutions NEX and PBF Energy PBF — each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Vista’s 2022 earnings is pegged at $3.11 per share, which indicates an increase of 475.9% from the year-ago earnings of 54 cents.

The consensus mark for VIST’s 2022 earnings has been revised 29.6% upward over the past 60 days.

The Zacks Consensus Estimate for NexTier’s 2022 earnings stands at $1.41 per share, indicating an increase of about 427.9% from the year-ago loss of 43 cents.

NEX beat estimates for earnings in all the trailing four quarters, the average being around 271%.

The Zacks Consensus Estimate for PBF Energy’s 2022 earnings stands at $21.52 per share, indicating an increase of about 960.8% from the year-ago loss of $2.50.

PBF beat the consensus mark for earnings in all the trailing four quarters, the average being around 49%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Transocean Ltd. (RIG) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

Vista Oil & Gas, S.A.B. de C.V. Sponsored ADR (VIST) : Free Stock Analysis Report

NexTier Oilfield Solutions Inc. (NEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance