Trading Currencies Against the Crowd - Real Forex Strategies

Our proprietary forex sentiment and positioning data shows that the majority of traders often buy and sell at all of the wrong times. Here are some trading strategies we use to trade against the forex trading crowd.

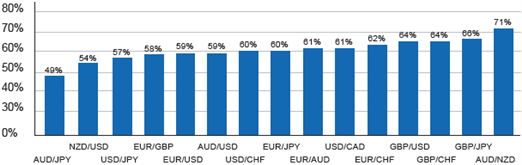

In our Traits of Successful Traders series, we studied the results of 12 million real forex trades placed by FXCM clients and the findings were significant. Our data showed that retail traders were profitable on 59 percent of all EURUSD trades placed, but further analysis showed an important statistic—most ultimately lost money trading the Euro/US Dollar.

Profitable Trades by Currency Pair

Source: The data is derived from Forex Capital Markets LLC accounts--excluding managed and Eligible Contract Participant accounts--from 10/01/2009 to 9/30/2010. All data is rounded to the nearest whole number.

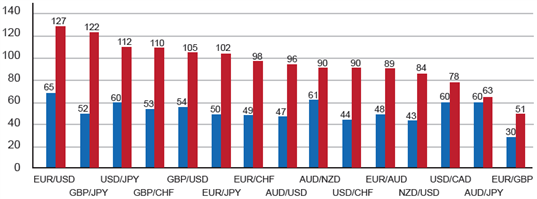

The winning percentage only tells part of the story. Traders lost money trading the Euro/US Dollar because their losses were nearly twice as large as their winners.

Average Trader Profit or Loss in Pips

Source: Ibid

We dedicated a Forex Education piece to why many traders lose money, and the takeaways are important. Just as significant, we want to know how we can use this information to our advantage in real trading. This is the major motivation behind our use of the FXCM Speculative Sentiment Index (SSI): our measure of retail trader FX positioning.

View a video on the Speculative Sentiment Index from the FXCM Trading Expo

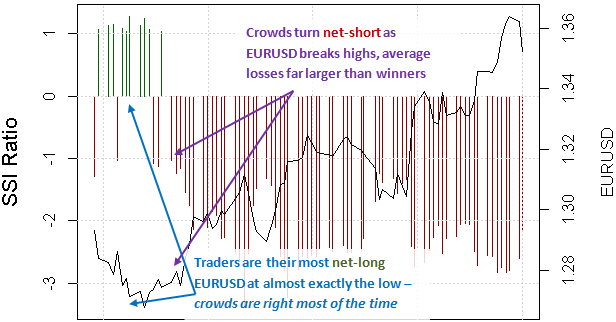

The SSI is simple: we look at how many traders hold open long positions versus those short and is expressed in a ratio. If the ratio is positive, it shows how many open orders are long for each one short. If it is negative, it shows the number of orders short for every one that is long.

For example: A EURUSD SSI ratio of 3.0 tells us that there are 3.0 open orders long for every 1 that is short. An AUDUSD SSI ratio of -2.0 tells us that there are 2.0 open orders short for every 1 long.

How Can We Trade Using Retail Forex Sentiment Data?

In order to understand our SSI-based trading strategies, it is important to recognize a key characteristic of crowd behavior: most will buy when a currency is falling and sell when it is rallying. As our data on real trade information suggests, the crowd is more often profitable as most trades are closed out at a gain. Yet when these trades don’t work, most traders expose themselves to outsized losses.

What does this mean? We most often go against what most traders are doing. If everyone is buying, we like to sell. If most are going short, we like to buy.

Forex Trading Crowds Buy Weakness, Sell Strength

Source: FXCM Speculative Sentiment Index

Our knowledge of crowd behavior and trade results underlines that this is a low-probability strategy: we will probably be wrong more often than right. But appropriate reward to risk on trades likewise suggests we may ultimately be successful.

There are many different ways to do that, and the below strategies use the Speculative Sentiment Index as the ‘heart’ of their trading logic.

Sentiment-Based Forex Trading Strategies Available on Tradestation Desktop:

Automate the Breakout2 trading system via the FXCM Apps store

Automate the Momentum2 trading system via the FXCM Apps Store

Automate the Momentum1 trading system via the FXCM Apps Store

Automate the Range2 trading system via the FXCM Apps Store

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up to David’s e-mail distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFXFacebook at http://www.Facebook.com/DRodriguezFX

New to forex? Sign up for our DailyFX Forex Education Series

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance