TotalEnergies (TTE) Wins Two Contracts to Deliver LNG to Asia

TotalEnergies SE TTE announced that it entered in two contracts to supply liquefied natural gas (LNG) to two customers in Asia. Per the first contract, the company will supply 800,000 tons per year of LNG to Indian Oil Corporation in India from 2026. Per the second contract, TTE will supply 500,000 tons of LNG to Korea South-East Power in South Korea from 2027.

These two contracts further expand its LNG operation in the Asian markets, where it is particularly committed to supporting its customers with their decarbonization strategies. The Asian countries are expected to import more LNG over the long term to meet domestic demand for clean sources of fuel. TotalEnergies is expected to gain from the surge in demand for LNG in the Asian countries.

TotalEnergies’ Presence in Entire LNG Chain

TTE benefits from an integrated position across the LNG value chain, including production, transportation, access to more than 20 metric ton per year (Mt/y) of regasification capacity in Europe, trading and LNG bunkering.

TotalEnergies global LNG portfolio stands at 44 Mt/y in 2023 thanks to its interests in liquefaction plants in all geographies. The company continues to expand its LNG operation through acquisition, partnership and agreements. Its large fleet of LNG tankers and reserved capacity in several regasification terminals make it a perfect partner for the development of LNG projects globally.

Expanding LNG operation is in sync with its long-term ambition to increase the share of natural gas in its sales mix to close to 50% by 2030, to reduce carbon emissions and eliminate methane emissions associated with the gas value chain and also assist partners in their energy transition from coal to natural gas.

Demand for LNG to Rise Globally

Per International Energy Agency (IEA), LNG, the primary contributor to international gas trade, is likely to increase 21% between 2019 and 2025. Per IEA, emerging Asia markets remain the driving force behind the expansion of LNG imports, followed by the countries of Europe.

Rising demand for LNG will boost the prospects of the companies like Cheniere Energy LNG, Shell plc SHEL and Chevron Corporation CVX, as these companies play a vital role in the supply of LNG worldwide. These companies are committed to ensuring that the world has access to a reliable and affordable source of energy as it transitions to a cleaner future.

SHEL and CVX’s long-term (three-to-five years) earnings growth rate is pegged at 4.6% and 5%, respectively. LNG reported average earnings surprise of 58.9% in the last four quarters. The Zacks Consensus Estimate for LNG, SHEL and CVX’s 2024 earnings per share reflects an increase of 2.4%, 1.8% and 0.3%, respectively, in the past 30 days.

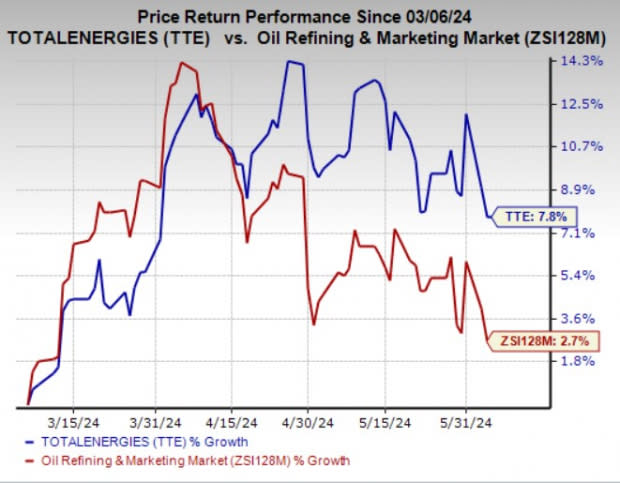

Price Performance

In the past three months, shares of TotalEnergies have gained 7.8% compared with the industry’s 2.7% growth.

Image Source: Zacks Investment Research

Zacks Rank

TotalEnergies currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance