Top US Growth Companies With High Insider Ownership To Watch In May 2024

As U.S. markets exhibit resilience with stocks on the rise and the dollar weakening, investors are closely monitoring upcoming inflation data which could influence future monetary policy decisions. In this context, growth companies with high insider ownership stand out as potentially robust investment opportunities, given that high insider stakes often signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 102.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

Hall of Fame Resort & Entertainment (NasdaqCM:HOFV) | 30.2% | 71.1% |

Here we highlight a subset of our preferred stocks from the screener.

ARS Pharmaceuticals

Simply Wall St Growth Rating: ★★★★★☆

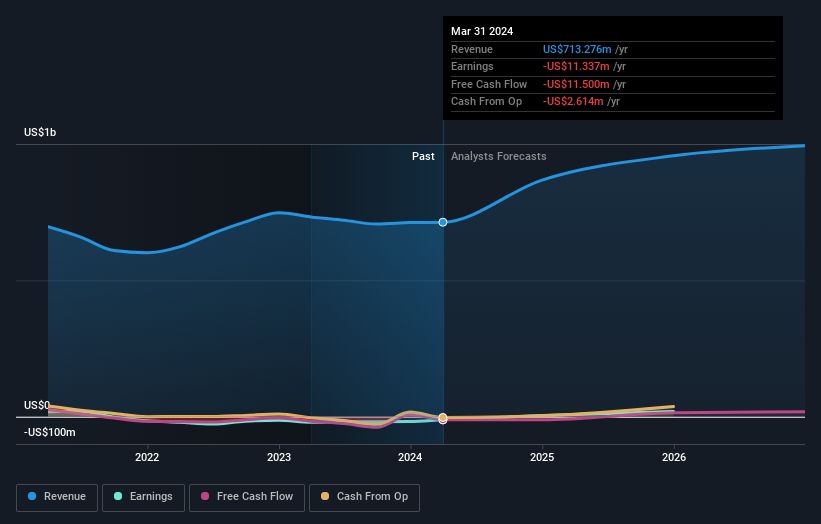

Overview: ARS Pharmaceuticals, Inc., a biopharmaceutical company, focuses on developing treatments for severe allergic reactions and has a market capitalization of approximately $870.12 million.

Operations: The company does not have reported revenue segments.

Insider Ownership: 25.7%

ARS Pharmaceuticals, despite its modest revenue of US$10K, is poised for significant growth with a forecasted revenue increase of 57.1% per year and earnings growth at 58.72% annually. The company recently reduced its net loss from US$14.96 million to US$10.29 million year-over-year and is progressing towards profitability within three years. Key developments include the advanced stages of regulatory approval in Europe for its neffy nasal spray and a strategic distribution deal in Australia and New Zealand, enhancing its market presence and future revenue streams.

Orion Group Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Orion Group Holdings, Inc. is a specialty construction company serving the building, industrial, and infrastructure sectors primarily in the United States, Alaska, Hawaii, Canada, and the Caribbean Basin with a market capitalization of approximately $288.47 million.

Operations: The company generates revenue through two main segments: Marine, which brought in $422.94 million, and Concrete, contributing $290.33 million.

Insider Ownership: 10.8%

Orion Group Holdings, despite a challenging financial landscape with recent losses and high share price volatility, maintains potential for growth with insider ownership dynamics showing more buying than selling over the past three months. The company reconfirmed its 2024 revenue guidance between US$860 million and US$950 million, reflecting an optimistic outlook. Recent shelf registration filings indicate preparations for potentially significant capital raising activities through common and preferred stock, alongside warrants and rights offerings.

P10

Simply Wall St Growth Rating: ★★★★☆☆

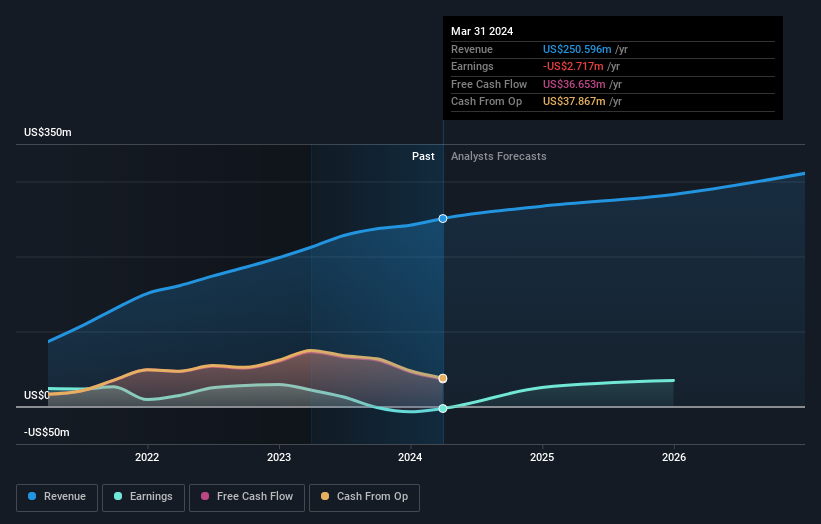

Overview: P10, Inc. operates as a multi-asset class private market solutions provider in the alternative asset management industry within the United States, with a market capitalization of approximately $0.93 billion.

Operations: The company generates revenue primarily through its asset management segment, totaling approximately $250.60 million.

Insider Ownership: 35%

P10, Inc. has demonstrated robust first-quarter growth with revenues rising to US$66.12 million and net income increasing significantly to US$5.02 million, signaling strong operational performance. Despite this, the company's revenue growth projections are slightly below the broader U.S. market expectation. High insider ownership continues with substantial insider purchases recently, enhancing stakeholder alignment but contrasted by a recent executive reshuffle as Robert Alpert steps down as Executive Chairman. The firm also increased its quarterly dividend by 8%, underscoring confidence in its financial health.

Seize The Opportunity

Reveal the 177 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:SPRY NYSE:ORN and NYSE:PX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance