Top Ranked Value Stocks to Buy for November 4th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, November 4th:

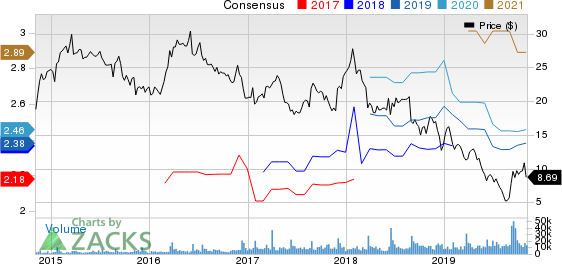

Navient (NAVI): This provider of education loan management and business processing services has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.9% over the last 60 days.

Navient Corporation Price and Consensus

Navient Corporation price-consensus-chart | Navient Corporation Quote

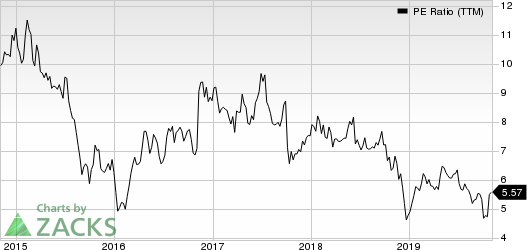

Navient has a price-to-earnings ratio (P/E) of 5.52 compared with 7.90 for the industry. The company possesses a Value Score of A.

Navient Corporation PE Ratio (TTM)

Navient Corporation pe-ratio-ttm | Navient Corporation Quote

Signet Jewelers Limited (SIG): This retailer of diamond jewelry has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 3.3% over the last 60 days.

Signet Jewelers Limited Price and Consensus

Signet Jewelers Limited price-consensus-chart | Signet Jewelers Limited Quote

Signet’s has a price-to-earnings ratio (P/E) of 5.25 compared with 14.50 for the industry. The company possesses a Value Score of A.

Signet Jewelers Limited PE Ratio (TTM)

Signet Jewelers Limited pe-ratio-ttm | Signet Jewelers Limited Quote

The Michaels Companies, Inc. (MIK): This specialty retailer of arts, crafts, framing, floral, wall décor, and seasonal merchandise has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.4% over the last 60 days.

The Michaels Companies, Inc. Price and Consensus

The Michaels Companies, Inc. price-consensus-chart | The Michaels Companies, Inc. Quote

Michaels Companies’ has a price-to-earnings ratio (P/E) of 3.65 compared with 9.60 for the industry. The company possesses a Value Score of A.

The Michaels Companies, Inc. PE Ratio (TTM)

The Michaels Companies, Inc. pe-ratio-ttm | The Michaels Companies, Inc. Quote

Pampa Energía S.A. (PAM): This company engaged in generation, transmission and distribution of electricity has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 32.8% over the last 60 days.

Pampa Energia S.A. Price and Consensus

Pampa Energia S.A. price-consensus-chart | Pampa Energia S.A. Quote

Pampa Energía has a price-to-earnings ratio (P/E) of 3.82 compared with 18.00 for the industry. The company possesses a Value Score of A.

Pampa Energia S.A. PE Ratio (TTM)

Pampa Energia S.A. pe-ratio-ttm | Pampa Energia S.A. Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

Pampa Energia S.A. (PAM) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

The Michaels Companies, Inc. (MIK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance