Top Ranked Growth Stocks to Buy for October 1st

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, October 1st:

BJ's Restaurants, Inc. (BJRI): This restaurant chain, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.5% over the last 60 days.

BJ's Restaurants, Inc. Price and Consensus

BJ's Restaurants, Inc. price-consensus-chart | BJ's Restaurants, Inc. Quote

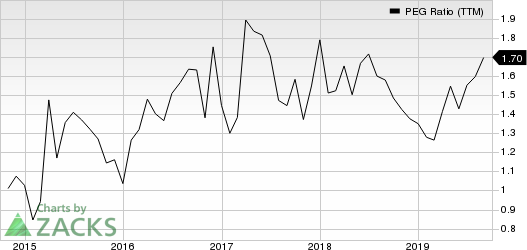

BJ's Restaurants has a PEG ratio of 1.39 compared with 2.62 for the industry. The company possesses a Growth Score of A.

BJ's Restaurants, Inc. PEG Ratio (TTM)

BJ's Restaurants, Inc. peg-ratio-ttm | BJ's Restaurants, Inc. Quote

Booking Holdings Inc. (BKNG):This engineering company, which carries a Zacks Rank #2, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.8% over the last 60 days.

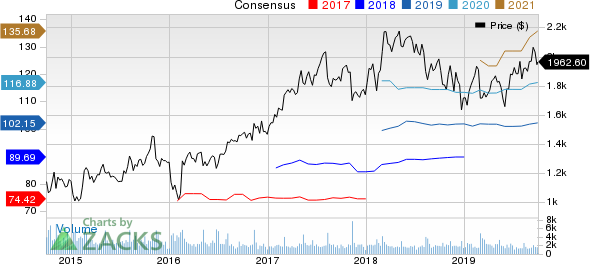

Booking Holdings Inc. Price and Consensus

Booking Holdings Inc. price-consensus-chart | Booking Holdings Inc. Quote

Booking Holdings has a PEG ratio of 1.46, compared with 3.83 for the industry. The company possesses a Growth Score of A.

Booking Holdings Inc. PEG Ratio (TTM)

Booking Holdings Inc. peg-ratio-ttm | Booking Holdings Inc. Quote

BrightView Holdings, Inc. (BV): This landscaping services company, which carries a Zacks Rank #2, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.6% over the last 60 days.

BrightView Holdings, Inc. Price and Consensus

BrightView Holdings, Inc. price-consensus-chart | BrightView Holdings, Inc. Quote

BrightView has a PEG ratio of 0.79, compared with 14.06 for the industry. The company possesses a Growth Score of A.

BrightView Holdings, Inc. PEG Ratio (TTM)

BrightView Holdings, Inc. peg-ratio-ttm | BrightView Holdings, Inc. Quote

Burlington Stores, Inc. (BURL): This department store company, which carries a Zacks Rank #2, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3% over the last 60 days.

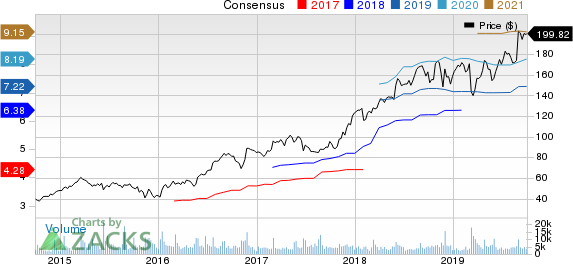

Burlington Stores, Inc. Price and Consensus

Burlington Stores, Inc. price-consensus-chart | Burlington Stores, Inc. Quote

Burlington Stores has a PEG ratio of 1.76, compared with 2.04 for the industry. The company possesses a Growth Score of A.

Burlington Stores, Inc. PEG Ratio (TTM)

Burlington Stores, Inc. peg-ratio-ttm | Burlington Stores, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BrightView Holdings, Inc. (BV) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance