Top S&P 500 Stocks of 2024: SMCI, CEG, NVDA Ride AI Wave

Stocks have enjoyed a strong 2024 on the back of a resilient economy and overall positive earnings results, with the S&P 500 gaining 8% year-to-date. Large-cap technology has helped lead the surge, particularly the beloved ‘Mag 7’ group.

Concerning notable positivity, three stocks – Super Micro Computer SMCI, Constellation Energy CEG, and Nvidia NVDA – reflect a few of the top-performing S&P 500 members in 2024. Let’s take a closer look at what’s been driving the outsized share performance.

Super Micro Computer Raises Sales Outlook

SMCI shares have enjoyed a strong run thanks to the AI boom, with shares up nearly a staggering +200% year-to-date. The company is a total IT Solution Provider for AI, Cloud, Storage, and 5G/Edge, reflecting a unique investing angle to ride the frenzy.

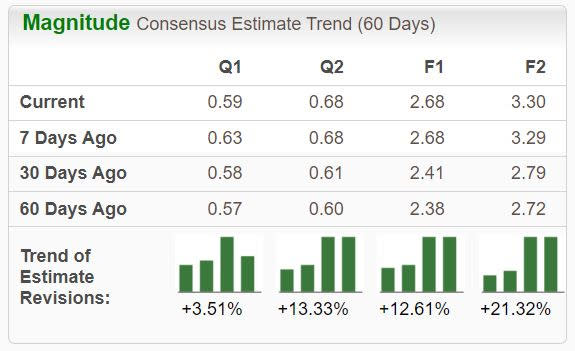

Analysts have been notably bullish, raising their earnings expectations across the board. Strong quarterly results have kept optimism afloat, with the current $23.51 Zacks Consensus EPS estimate for its current fiscal year suggesting 100% year-over-year growth.

Image Source: Zacks Investment Research

The company’s growth has been remarkable, posting triple-digit percentage year-over-year revenue growth rates in back-to-back periods. Super Micro Computer raised its current year sales outlook into a band of $14.7 - $15.1 billion ($14.3 - $14.7 billion previously) following its latest release thanks to strong demand for AI rack scale solutions.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

It’s worth noting that SMCI joined the S&P 500 back in March of this year.

Nvidia Data Center Results Remain Robust

Like SMCI, Nvidia shares have been red-hot thanks to the AI boom, with the company’s robust Data Center results consistently shocking investors. To little surprise, the stock remains a Zacks Rank #1 (Strong Buy), boasting a considerably bullish earnings outlook.

Image Source: Zacks Investment Research

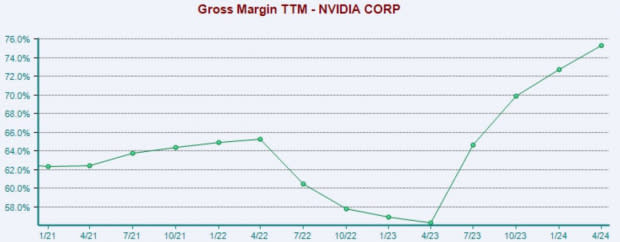

Concerning the latest quarterly release, earnings and revenue grew 460% and 260%, respectively, whereas Data Center sales melted 430% higher from the same period last year. The company’s profitability has shot higher amid margin expansion, as shown below.

Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Shares also recently underwent a 10-for-1 split, helping knock down barriers of entry to potential investors. While the split doesn’t reflect any fundamental changes within the company, it’s still a positive development and reflects an investor-friendly nature.

Constellation Energy Goes Nuclear for AI

CEG’s share performance has been driven by bullish outlooks regarding power consumption. In early May, the company stated that it’s in discussions to provide nuclear energy for data centers, with projects expected to begin in the coming years.

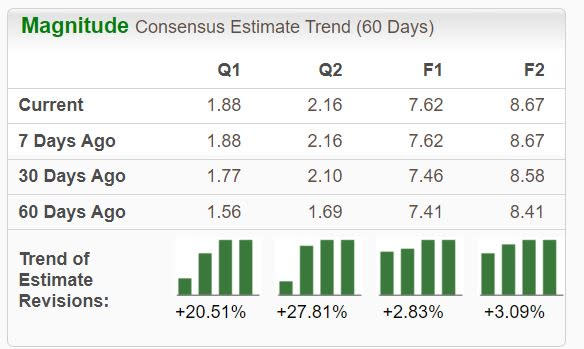

Analysts have taken note of its favorable stance, raising earnings expectations and pushing the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Joe Dominguez, CEO, on the company’s latest quarterly results, “We had another strong quarter as support grows for nuclear energy as a reliable, clean source to meet growing demand from electric vehicles, heavy industry and emerging technologies, such as AI and related digital infrastructure.”

Like those above, shares reflect an angle to ride the AI frenzy.

Bottom Line

It’s no secret that AI bullishness has pushed many stocks higher in 2024, a list that includes several S&P 500 members such as Super Micro Computer SMCI, Constellation Energy CEG, and Nvidia NVDA.

All three have seen their earnings outlooks move higher, further reflecting the positive sentiment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance