Top Dividend Paying Stocks

Dividend-paying companies such as B&G Foods and Meredith Corporation can diversify your portfolio cash flow by paying constant and large dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. As a long term investor with a short term temperament, I highly recommend these top dividend stocks.

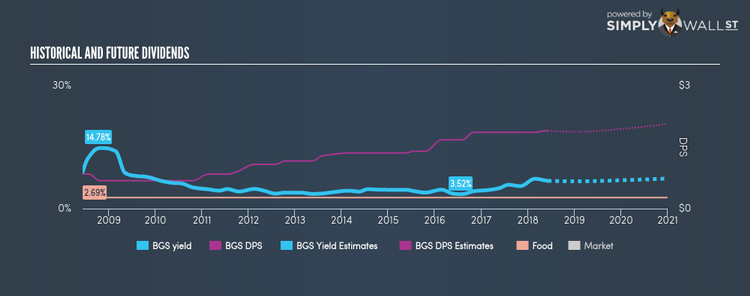

B&G Foods, Inc. (NYSE:BGS)

B&G Foods, Inc. manufactures, sells, and distributes a portfolio of shelf-stable and frozen foods in the United States, Canada, and Puerto Rico. Founded in 1996, and run by CEO Robert Cantwell, the company now has 2,584 employees and with the company’s market cap sitting at USD $1.90B, it falls under the small-cap group. BGS has an alluring dividend yield of 6.76% and pays 60.26% of its earnings as dividends , with analysts expecting a 89.07% payout in the next three years. Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. B&G Foods’s earnings per share growth of 88.30% outpaced the us food industry’s 7.41% average growth rate over the last year. More on B&G Foods here.

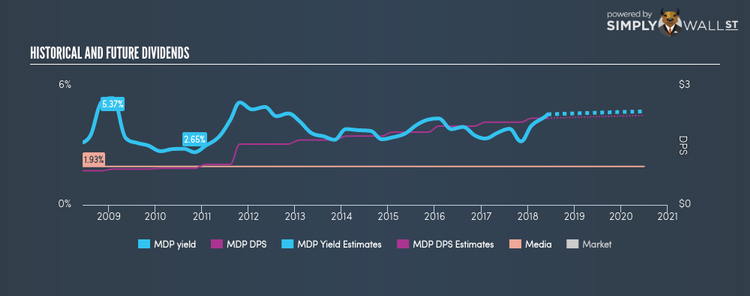

Meredith Corporation (NYSE:MDP)

Meredith Corporation operates as a diversified media company in the United States. Formed in 1902, and headed by CEO Thomas Harty, the company employs 3,560 people and with the stock’s market cap sitting at USD $2.18B, it comes under the mid-cap category. MDP has an appealing dividend yield of 4.56% and the company currently pays out 74.25% of its profits as dividends . In the case of MDP, they have increased their dividend per share from US$0.86 to US$2.18 so in the past 10 years. Much to the delight of shareholders, the company has not missed a payment during this time. Over the next year, analysts are estimating a double digit EPS growth of 72.52%. More on Meredith here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance