Top 3 ASX Stocks Estimated To Be Below Intrinsic Value In July 2024

Amidst a turbulent week where the ASX200 shed gains to close lower, investors face a challenging landscape marked by sector-wide declines and volatile commodity prices. In such an environment, identifying stocks that appear undervalued relative to their intrinsic value could offer potential opportunities for discerning investors looking to navigate these uncertain market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

Name | Current Price | Fair Value (Est) | Discount (Est) |

Fenix Resources (ASX:FEX) | A$0.39 | A$0.77 | 49.2% |

MaxiPARTS (ASX:MXI) | A$2.08 | A$3.99 | 47.9% |

GTN (ASX:GTN) | A$0.43 | A$0.85 | 49.4% |

Ansell (ASX:ANN) | A$26.72 | A$49.99 | 46.6% |

VEEM (ASX:VEE) | A$1.795 | A$3.55 | 49.4% |

IPH (ASX:IPH) | A$6.14 | A$11.83 | 48.1% |

hipages Group Holdings (ASX:HPG) | A$1.09 | A$2.06 | 47.1% |

Australian Clinical Labs (ASX:ACL) | A$2.48 | A$4.70 | 47.3% |

Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

MedAdvisor (ASX:MDR) | A$0.54 | A$1.07 | 49.6% |

Let's review some notable picks from our screened stocks.

Flight Centre Travel Group

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of approximately A$4.98 billion.

Operations: The company generates revenue primarily through two segments: the leisure sector, which brought in A$1.28 billion, and the corporate sector, with A$1.06 billion in earnings.

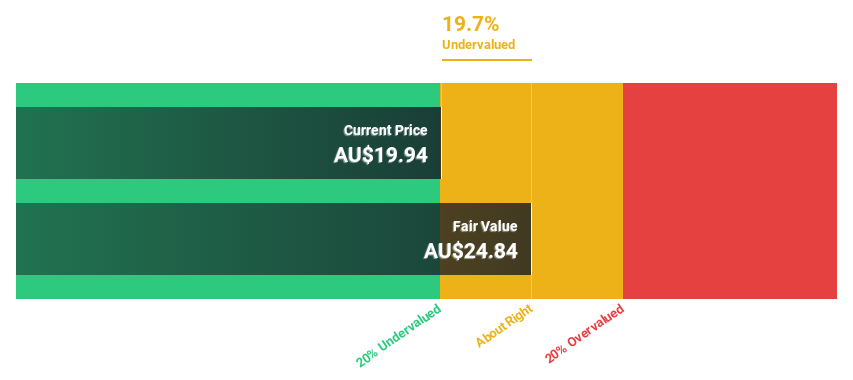

Estimated Discount To Fair Value: 26.6%

Flight Centre Travel Group, trading at A$22.66, is positioned below the estimated fair value of A$30.88, indicating a significant undervaluation based on discounted cash flows. Recently profitable, FLT's earnings are expected to grow by 19.1% annually, outpacing the Australian market forecast of 13.5%. While its revenue growth at 9.7% per year also exceeds the national average of 5.6%, it does not reach the high-growth benchmark of over 20%.

James Hardie Industries

Overview: James Hardie Industries plc specializes in manufacturing and selling fiber cement, fiber gypsum, and cement bonded building products for various building construction applications, primarily serving markets in the United States, Australia, Europe, New Zealand, and the Philippines with a market capitalization of A$23.18 billion.

Operations: The company's revenue is generated from three key segments: Europe Building Products at $482.10 million, Asia Pacific Fiber Cement at $562.80 million, and North America Fiber Cement at $2.89 billion.

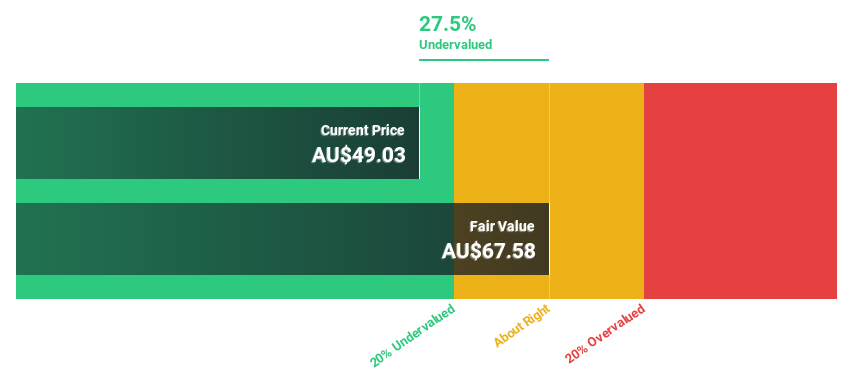

Estimated Discount To Fair Value: 22%

James Hardie Industries, priced at A$53.73, shows potential underpricing with a fair value estimate of A$68.87. Its earnings and revenue are set to outperform the Australian market with forecasts of 14% and 8% growth respectively. However, its growth rates don't exceed the high threshold of 20%. Despite this moderate growth forecast, it remains attractive due to a trading price that's 22% below estimated fair value and recent strategic moves like expanding its buyback plan by A$50 million and inclusion in the S&P/ASX 20 Index.

Webjet

Overview: Webjet Limited operates as an online travel booking service across Australia, New Zealand, the United Arab Emirates, the United Kingdom, and other international markets with a market capitalization of approximately A$3.51 billion.

Operations: The company generates revenue through its Business to Business Travel (B2B) and Business to Consumer Travel (B2C) segments, totaling A$327.90 million and A$142.80 million respectively.

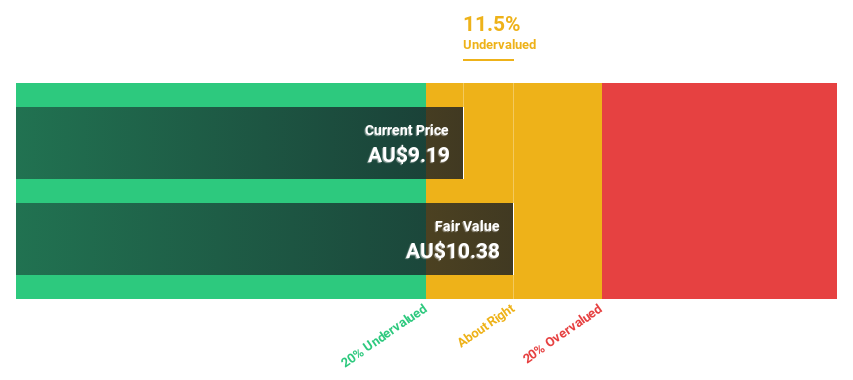

Estimated Discount To Fair Value: 13.1%

Webjet Limited, currently priced at A$8.97, is trading below the estimated fair value of A$10.32. With a revenue growth forecast of 10.6% per year and earnings expected to increase by 20.26% annually, it outpaces the Australian market's average growth rates in both metrics. Despite these positive indicators and a significant past earnings growth of 401.4%, Webjet's Return on Equity is projected to remain low at 15.9% in three years, suggesting potential concerns about future profitability efficiency amidst ongoing corporate restructuring, including a planned demerger aimed at enhancing operational focus and market positioning.

The analysis detailed in our Webjet growth report hints at robust future financial performance.

Navigate through the intricacies of Webjet with our comprehensive financial health report here.

Next Steps

Navigate through the entire inventory of 47 Undervalued ASX Stocks Based On Cash Flows here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:FLT ASX:JHX and ASX:WEB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance