TJX Companies (TJX) Beats on Q3 Earnings & Sales, Raises View

The TJX Companies, Inc. TJX has posted third-quarter fiscal 2020 results, wherein earnings and sales improved year over year and surpassed the Zacks Consensus Estimate. Further, comps increased on continued improvement in customer traffic. The company is impressed with the quarterly performance and began the fiscal fourth quarter on a strong note. These factors encouraged management to raise the bottom-line view for fiscal 2020.

Quarterly Details

The company’s earnings were 68 cents per share, which grew 8% year over year. Further, the bottom line surpassed the Zacks Consensus Estimate of 66 cents as well as management’s guidance.

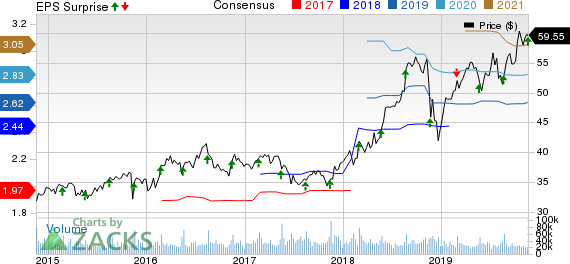

The TJX Companies, Inc. Price, Consensus and EPS Surprise

The TJX Companies, Inc. price-consensus-eps-surprise-chart | The TJX Companies, Inc. Quote

Net sales advanced about 6% year over year to $10,451.3 million and beat the Zacks Consensus Estimate of $10,318 million. Net sales growth included a 1% adverse impact from currency movements.

Sales were backed by solid comparable store sales (comps), which gained from robust customer traffic across all segments. TJX Companies' consolidated comps grew 4% year over year.

Comps rose 2%, 6%, 4% and 1% in TJX Canada, TJX International, Marmaxx and HomeGoods segments, respectively. Markedly, TJX International’s results were backed by solid performance in Europe.

Gross margin fell 0.1 percentage point (pp) to 28.8%. Selling, general and administrative costs as a percentage of sales rose 0.1 pp year over year to 18%.

Other Financial Updates

The company ended the quarter with cash and cash equivalents of $2,060.2 million, long-term debt of $2,235.9 million and total shareholders’ equity of $5,542.5 million. Cash provided by operating activities for 39 weeks ended Nov 2, 2019, was $1,873.6 million.

Consolidated inventories on a per-store basis (including distribution centers, and excluding e-commerce, inventory in transit and Sierra stores) increased 9% (also on a constant-currency basis) year over year. Given its impressive inventory position, the company is well-poised to take advantage of solid opportunities in the holiday season.

During the reported quarter, TJX Companies returned $778 million to its stockholders in forms of dividend payouts and share buybacks. In the fiscal third quarter, the company repurchased 9 million shares for $500 million and paid out dividends worth $278 million. In the first three quarters of fiscal 2020, management paid out dividends worth $795 million and repurchased 21.3 million shares for $1.15 billion. TJX Companies intends to buy back shares worth $1.5-$1.75 billion in fiscal 2020.

The company opened 107 stores in the fiscal third quarter, taking the total count to 4,519.

Further, on Nov 18, TJX Companies concluded an investment for a 25% stake in Familia — major off-price apparel and home fashions retailer in Russia. The investment was worth $225 million. Notably, from fiscal 2021, the investment in Familia is expected to slightly augment TJX Companies’ bottom line.

Fiscal 2020 Guidance

Management is encouraged about initiatives and constant efforts to boost customer traffic and sales. The company is particularly encouraged about the opportunities during the holiday season.

Management raised bottom-line guidance for fiscal 2020. TJX Companies now projects earnings per share of $2.61-$2.63 for the fiscal year, indicating year-over-year growth of 7-8% — including last year’s pension settlement charges) — and 7% — excluding last year’s pension settlement charges. The Zacks Consensus Estimate for earnings is currently pegged at $2.62. Earlier, management had projected earnings per share of $2.56-$2.61, indicating year-over-year growth of 5-7% — including last year’s pension settlement charges) — and 4-7% — excluding last year’s pension settlement charges.

Further, it expects consolidated comps growth of 3% and comps growth of 3-4% at Marmaxx

Q4 View

The company expects consolidated comps growth of 2-3% for the quarter. It anticipates comps at Marmaxx to grow in the same range. The company expects earnings of 74-76 cents per share, whereas it reported 68 cents in the year-ago quarter. The consensus mark for the same is pegged at 77 cents.

We note that this Zacks Rank #3 (Hold) stock has gained 16.1% in the past six months compared with the industry’s growth of 16.3%.

Don’t Miss These Solid Retail Bets

Dollar General DG, with a Zacks Rank #2, has long-term earnings per share growth rate of 10.2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Burlington Stores BURL, with a Zacks Rank #2, has long-term earnings per share growth rate of 15.9%.

Ross Stores ROST, with a Zacks Rank #2, has long-term earnings per share growth rate of 10.5%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance