Titan International Inc (TWI) Q1 Earnings: Misses Analyst Revenue and EPS Forecasts Amid Market ...

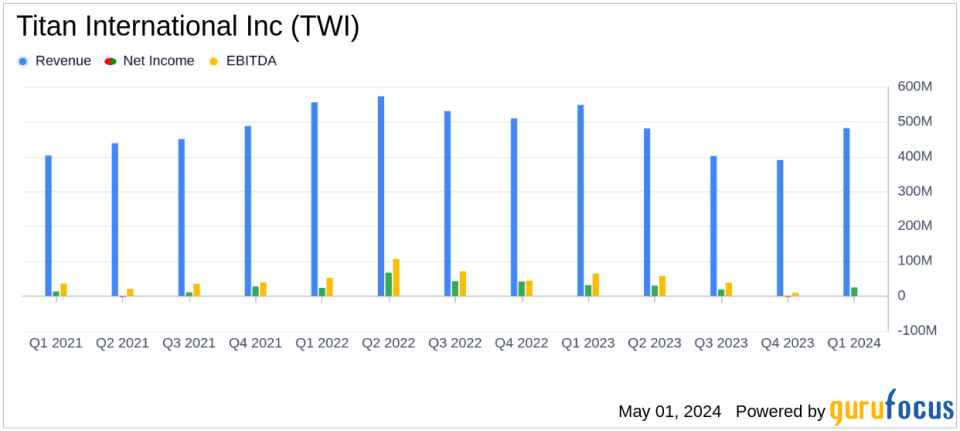

Revenue: Reported at $482.2 million, down from $548.6 million in the previous year, falling below estimates of $537.32 million.

Net Income: Achieved $9.97 million, significantly below the estimated $25.00 million.

Earnings Per Share (EPS): Recorded at $0.14, considerably below the estimated $0.45.

Gross Margin: Gross profit was $77.4 million, or 16.0% of net sales, down from 17.4% in the prior year.

Adjusted EBITDA: Reached $49.7 million, a decrease from $67.6 million in the comparable period last year.

Free Cash Flow: Reported a decrease, with net cash provided by operating activities at $2.0 million, down from $24.1 million in the prior year.

Debt Levels: Net debt stood at $369.5 million at the end of the quarter, up from $205.8 million at the end of the previous year.

On May 1, 2024, Titan International Inc (NYSE:TWI), a prominent manufacturer of off-highway wheels, tires, and undercarriage systems, disclosed its first-quarter earnings through its 8-K filing. The company reported a net income of $9.2 million and earnings per share (EPS) of $0.14, falling short of the analyst estimates which projected an EPS of $0.45 and net income of $25 million. Revenue for the quarter stood at $482.2 million, also below the expected $537.32 million.

Company Overview

Titan International Inc operates through three segments: Agricultural, Earthmoving/Construction, and Consumer. The majority of its revenue is generated from the Agricultural segment, which manufactures equipment such as tractors and combines. The company serves both original equipment manufacturers (OEMs) and aftermarket customers across various regions including the United States, Europe, Latin America, and other international markets.

Operational Highlights and Market Challenges

The first quarter saw Titan integrating the newly acquired Carlstar Group, enhancing its 'one stop shop' strategy in the Agricultural and Consumer segments. Despite the strategic advancements, Titan faced significant market headwinds. Paul Reitz, President and CEO, emphasized the impact of macroeconomic uncertainties affecting all sectors, leading to reduced OEM demand globally. Notably, the Agricultural segment saw a 21.6% drop in net sales, primarily due to decreased demand in North and South America and economic challenges in Brazil.

Financial Performance Analysis

The company's gross margin slightly decreased to 16.0% from 17.4% in the previous year. This decline in profitability can be attributed to lower sales volumes which affected the fixed cost leverage. The Earthmoving/Construction segment particularly felt the pressure with a 38.3% decrease in gross profit and a significant reduction in income from operations by 62.5%. However, the Consumer segment experienced a 76.3% increase in net sales, benefiting from the Carlstar acquisition, albeit with a slight decrease in profit margin due to inventory valuation adjustments.

Strategic Outlook and Future Projections

Looking ahead to Q2 2024, Titan anticipates revenues between $525 million to $575 million and adjusted EBITDA of $45 million to $55 million. The company remains cautious, refraining from providing full-year guidance due to the prevailing market uncertainties. CFO David Martin highlighted the focus on integrating Carlstar's operations and achieving synergy savings, which are expected to bolster the bottom line in the long term.

Conclusion

While Titan International Inc faces short-term challenges, its strategic acquisitions and focus on operational efficiencies position it to navigate through cyclical market conditions. Investors and stakeholders will be watching closely how the company leverages its 'one stop shop' strategy to enhance its market share and profitability in the coming quarters.

For a deeper dive into Titan International Inc's detailed financial figures and strategic initiatives, you can access the full earnings report and management commentary on their official 8-K filing.

Explore the complete 8-K earnings release (here) from Titan International Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance