Time to Buy These Travel-Related Stocks

Spring and Summer are peak travel seasons for vacationers and tourists alike with several companies poised to benefit.

Here are three top-rated Zacks stocks that should be beneficiaries as we approach the warmer months of the year.

Airbnb (ABNB)

An increasingly popular name among travel-related stocks is Airbnb which has a Zacks Rank #2 (Buy) at the moment. Airbnb’s Internet-Content Industry is also in the top 21% of over 250 Zacks industries.

With its online platform providing more intimate or unique stays and experiences outside of traditional hotels Airbnb is a viable investment to get in on the evolution of the broader travel industry.

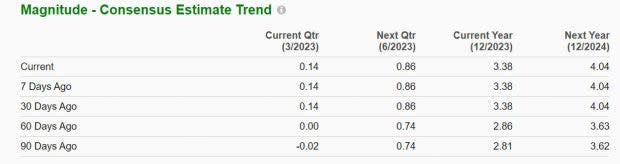

Airbnb is still in the beginning stages of its growth and corporate life after being founded in 2008 and going public in 2020. Monitoring the company’s growth, Airbnb earnings are now forecasted to jump 21% this year and pop another 19% in FY24 at $4.04 per share.

Image Source: Zacks Investment Research

Plus, earnings estimate revisions have remained much higher over the last quarter. Trading at $114 per share Airbnb stock is up +33% year to date to easily top the S&P 500’s +7%, the Nasdaq’s +15%, and the Internet Content Markets +19%.

Even better, investors are not paying a very high premium for shares of Airbnb at the moment compared to other growth stocks. To that point, Airbnb's 33.3X forward earnings isn't drastically above the industry average of 21.6X.

Booking Holdings (BKNG)

As indicated in its robust stock price, Booking Holdings has been a staple and gem among travel-related stocks since the late 1990s. This looks set to continue as Booking stock currently sports a Zacks Rank #1 (Strong Buy) and is also part of the top-rated Internet Commerce Industry.

Serving as a one-stop shop for travel-related offerings, Booking stock trades at $2,566 per share and has already spiked 27% year to date to outperform the broader indexes and the Internet Commerce Market.

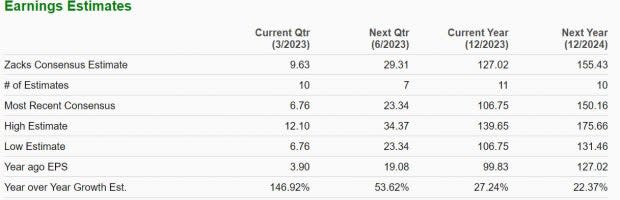

Earnings estimates have also trended higher for the online travel behemoth. Bookings earnings are expected at $127.02 per share this year, up 27% from EPS of $99.83 in 2022. Plus, fiscal 2024 earnings are anticipated to climb another 22%.

Furthermore, Booking stock trades at 20.2X forward earnings which is slightly beneath the industry average of 21.1X. This is also well below its decade-long high of 471.4X and a slight discount to the median of 23.1X.

Image Source: Zacks Investment Research

Hilton Worldwide (HLT)

Also worthy of consideration is Hilton Worldwide which is sporting a Zacks Rank #2 (Buy) and its Hotels and Motels Industry is in the top 14% of all Zacks industries.

Hilton has a loyal customer base and has maintained its industry dominance. To that point earnings estimate revisions are slightly higher for Hilton with solid top and bottom line growth expected for the hotel chain operator that has been around since the early 1900s.

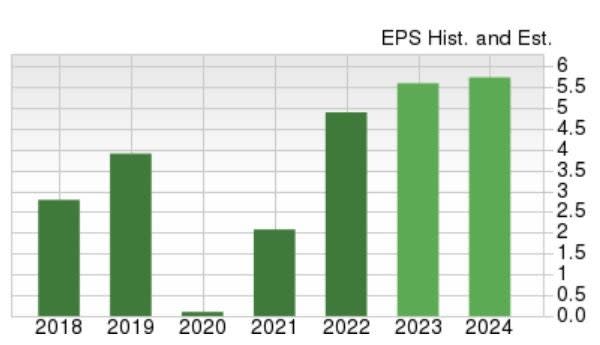

Image Source: Zacks Investment Research

Impressively, Hilton’s earnings are forecasted to climb 16% this year and jump another 11% in FY24 at $6.32 per share. Hilton stock trades at 24.8X forward earnings which is slightly above its industry average of 20.2X but the comapny is a clear leader in its space.

On top of this, Hilton trades far below its decade-long high of 539.5X and at a 22% discount to the median of 32X. Hilton stock is up +12% YTD to beat the benchmark and the Hotels & Motels Markets +10%.

Bottom Line

These stocks could continue rising as we approach the summer months and now appears to be a great time for investors to get in. The rising earnings estimate revisions are an indication of such and are supportive of more upside along with their reasonable price-to-earnings valuations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance