Time to Buy Stock in These Highly Ranked Multi-Sector Conglomerates

Investors are always looking for stocks with diverse business operations and at the moment the Zacks Diversified Operations Industry is in the top 8% of over 250 Zacks industries.

With these stocks considered multi-sector conglomerates their improved outlooks are very appealing and here are a few to consider.

Carlisle Companies CSL: We’ll start with Carlisle Companies which operates a global portfolio of niche brands and businesses that manufacture a wide range of roofing and waterproofing products, engineered products, and fishing equipment.

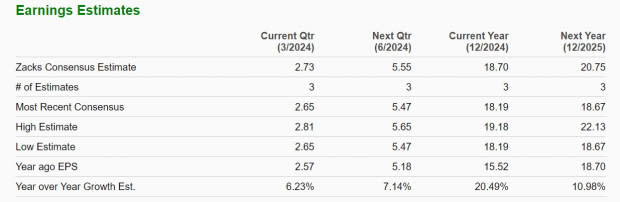

With its operations spanning five continents, Carlisle Companies' EPS outlook is very impressive as annual earnings are forecasted to soar 20% in fiscal 2024 to $18.70 per share versus $15.52 a share last year. Better still, FY25 EPS is projected to rise another 11%.

Image Source: Zacks Investment Research

Furthermore, earnings estimate revisions are nicely up over the last 30 days for FY24 and FY25 which suggests the strong price performance of Carlisle Companies' stock could continue. To that point, CSL has climbed +28% year to date and is now up +94% in the last year.

Image Source: Zacks Investment Research

Mitsubishi MSBHF: As Japan’s largest general trading company, Mitsubishi has a global presence that extends to many markets including energy, metals, machinery, chemicals, food, and general merchandise.

Most impressive is Mitsubishi’s blazing price performance with its stock soaring +45% YTD and skyrocketing +97% over the last year.

Image Source: Zacks Investment Research

The extended rally comes as Mitsubishi’s stock was vastly undervalued in terms of P/E valuation among other financial metrics despite annual earnings expected to dip to $1.59 a share this year versus $2.00 per share in 2023.

However, FY25 EPS is projected to rebound and rise 3% with Mitsubishi’s stock still trading at a reasonable 14.4X forward earnings multiple which is below the industry average of 20.9X. Plus, over the last 60 days, FY24 and FY25 EPS estimates are up 4% and 11% respectively.

Image Source: Zacks Investment Research

Vector Group VGR: Rounding out the list is Vector Group, which manufactures cigarette products through its subsidiaries and holds minority investments in various real estate projects in the United States.

Vector Group’s stock has dipped -9% in 2024 and is down -16% over the last year but looks poised for a sharp rebound. To that point, Vector Group’s stock trades at $10 and just 8.3X forward earnings with EPS expected to be up roughly 1% in FY24 and projected to rise another 7% in FY25 to $1.33 per share. Reassuringly, FY24 earnings estimates are up 7% over the last 60 days while FY25 EPS estimates have remained unchanged.

Image Source: Zacks Investment Research

More enticing is that Vector Group offers a 7.77% annual dividend yield to support patient investors. Notably, this towers over the S&P 500’s 1.31% average and the industry average of 1.61% although many of its diversified operations peers don’t offer a payout setting Vector Group apart.

Image Source: Zacks Investment Research

Takeaway

Attributed to their positive earnings estimate revisions these multi-sector conglomerates currently sport a Zacks Rank #1 (Strong Buy). More importantly, Carlisle Companies, Mitsubishi, and Vector Group’s stock should be viable long-term investments as well considering their diversified operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Vector Group Ltd. (VGR) : Free Stock Analysis Report

Mitsubishi Corp. (MSBHF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance