Time to Buy Salesforce (CRM) or C3.ai (AI) Stock After Earnings?

Two tech stocks receiving considerable attention from Wall Street going into their quarterly reports yesterday were Salesforce (CRM) and C3.ai (AI).

Salesforce’s quarterly results were closely monitored with the company being the leader in customer relationship management software and also making the push to generative AI. C3 has garnished Wall Streets’ attention as well with much optimism surrounding the enterprise AI software providers’ prospects.

Let’s take a look at Salesforce and C3’s quarterly results along with their outlooks to see if now is a good time to buy.

Salesforce Q1 Review

Salesforce CEO Marc Benioff stated the company significantly exceeded its non-GAAP margin targets for the quarter and plans to lead the next major revolution in CRM to infuse trusted, secure generative AI across its entire portfolio.

Salesforce’s Q1 earnings came in 5% above EPS expectations at $1.69 per share. First-quarter earnings also climbed 72% from the prior-year quarter. On the top line, sales surpassed estimates by roughly 1% at $8.24 billion and rose 11% year over year.

Image Source: Zacks Investment Research

C3 Q4 Review

C3’s stock has been a large beneficiary of the recent AI mania with the company announcing its accelerated digital transformation software will be sold on a marketplace run by Amazon (AMZN) Web Services.

Increased market demand for enterprise AI led to what the company stated was a substantial increase in opportunity and shorter sales cycles. Still, Wall Street and investors alike were a bit underwhelmed by C3's ability to capatilize on the AI frenzy.

C3’s fiscal fourth-quarter earnings came in at -$0.13 per share and above estimates of -$0.17 a share. This was also up from an adjusted loss of -$0.21 a share in the prior-year quarter. Sales came to $72.41 million which slightly topped estimates and was virtually flat from a year ago.

Image Source: Zacks Investment Research

Growth Prospects

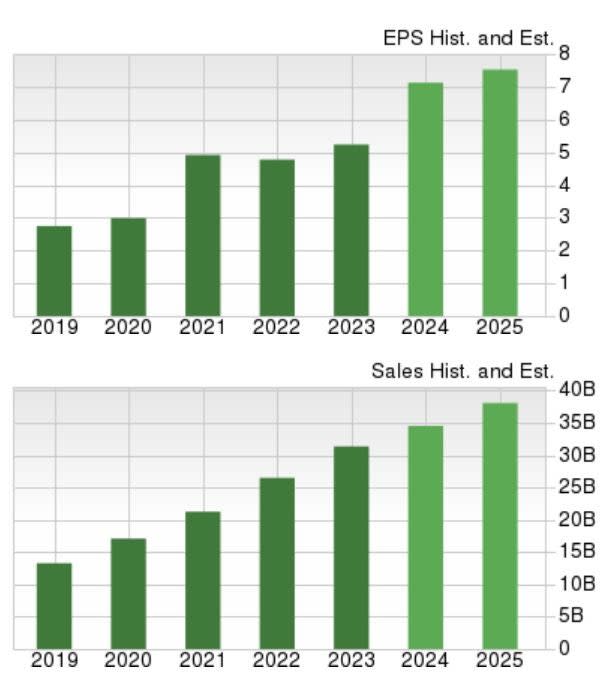

Based on Zacks estimates, Salesforce earnings are now projected to soar 35% in its current fiscal 2024 to $7.11 per share compared to EPS of $5.24 in FY23. Even better, fiscal 2025 earnings are projected to climb another 23% at $8.77 per share. Total sales are now forecasted to be up 10% in FY24 and rise another 11% in FY25 to $38.49 billion.

Image Source: Zacks Investment Research

Pivoting to C3, an adjusted loss of -$0.33 per share is projected in its current fiscal 2024 and up from -$0.42 a share in FY23. C3 is projected to move closer to probability in FY25 with an adjusted loss of -$0.19 a share expected. Sales are forecasted to jump 19% in FY24 and rise another 15% in FY25 to $366.76 million.

Image Source: Zacks Investment Research

Bottom Line

Salesforce and C3 stock both land a Zacks Rank #3 (Hold) following their quarterly results. There could be better buying opportunities ahead with C3 shares already soaring +207% YTD and Salesforce stock up +60%. With that being said, Salesforce's growth is very attractive and C3's outlook shows signs of promise as well.

Furthermore, the AI revolution appears to be upon us, and holding on to C3 and Salesforce stock could be rewarding going forward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance