Time to Buy the Dip in Target's (TGT) Stock After Q1 Earnings?

Despite rising +2% in today’s trading session, Target’s TGT stock is still down -7% since reporting mixed Q1 results on Wednesday.

With that being said, let’s see if it’s time to buy stock in the omnichannel retailer for a rebound from its current levels.

Q1 Financial Review

Target’s Q1 EPS came in at $2.03 which missed the Zacks Consensus of $2.05 per share by -1%. This is despite Q1 sales of $24.53 billion slightly beating estimates of $24.51 billion.

Year over year, Q1 earnings dipped -1% while sales fell -3% from $25.32 billion in the comparative quarter. The decline was attributed to continued softness in Home and Hardlines categories and softening trends in frequency categories with lower unit volumes and a smaller benefit from pricing power.

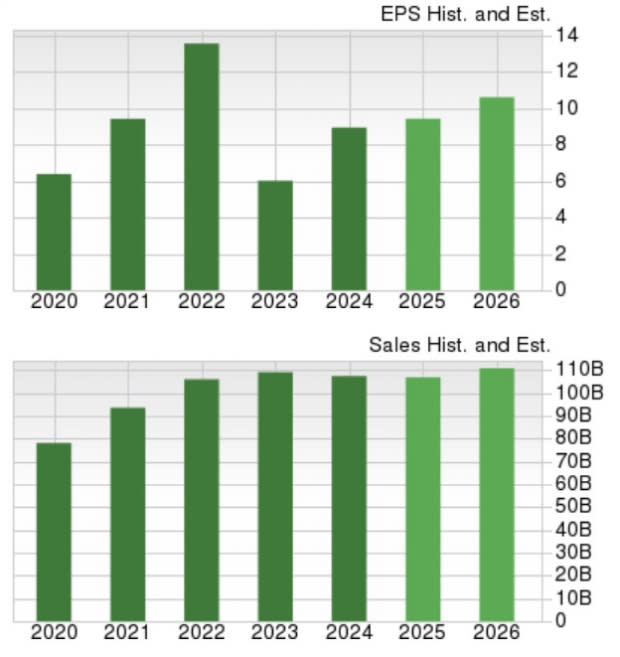

Image Source: Zacks Investment Research

Growth & Outlook

Based on Zacks estimates, Target’s annual earnings are now expected to rise 5% in its current fiscal 2025 and are projected to jump another 13% in FY26 to $10.60 per share. Total sales are expected to dip to $106.81 billion in FY25 compared to $107.41 billion last year. Still, FY26 sales are forecasted to rebound and rise 4% to $110.78 billion.

Image Source: Zacks Investment Research

Tracking Target's Historical Performance & Valuation

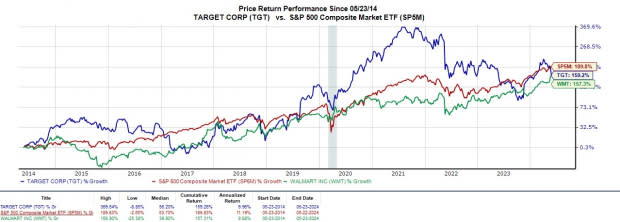

Year to date, Target’s stock is now down -1% which has lagged Walmart’s WMT +22% and the S&P 500’s +12%. In the last two years, Target’s -3% has largely trailed Walmart’s +57% and the S&P 500's +36%.

However, over the last decade, TGT is up +159% which has edged WMT at +157% althogh both have trailed the benchmark's +190%.

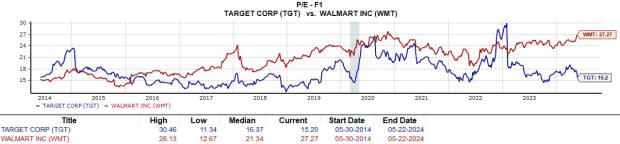

Image Source: Zacks Investment Research

Ttrading at 15.2X forward earnings, Target's P/E valuaiton is intriguingly beneath Walmart’s 27.2X and the S&P 500’s 22.2X. More intriguing is that TGT ‘trades well below its decade-long high of 30.4X and at a slight discount to the median of 16.3X.

Image Source: Zacks Investment Research

Bottom Line

The expected recovery in Target's bottom line along with a very reasonable P/E valuation makes its tempting to buy the post-earnings dip but for now TGT lands a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance