Is This the Right Time to Buy Bank of America (BAC) Stock?

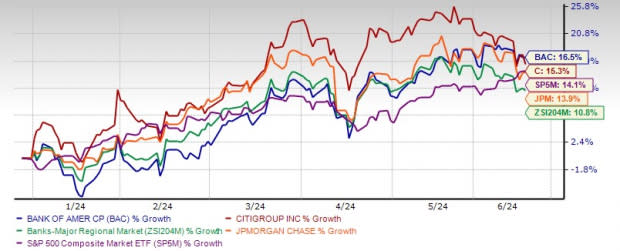

Bank of America BAC, one of the largest banks in the country, seems to have regained investors’ confidence. After just a 1.6% gain last year, the stock has jumped 16.5% in 2024. It has also outperformed the industry and the S&P 500 Index’s growth of 10.8% and 14.1%, respectively.

Last year, the banking industry was marred by high interest rates, a slowdown in loan demand, a rise in funding costs, prospects of recession and weakening asset quality. Further, the regional banking crisis in early March led to the collapse of three large banks and deposit outflows.

Though the situation has somewhat changed for the better, the overall operating environment continues to be challenging for the banks. The central bank officials have indicated higher rates are here to stay for a longer duration because of the ‘sticky’ inflation, while signaling one rate cut later this year.

This means that banks will continue to record higher deposit costs. The situation for Bank of America is more challenging. The company has billions of dollars worth of long-dated Treasuries and mortgage bonds, which it had piled up at low rates during the pandemic.

As the rates remain high, the interest that the company had to pay on deposits surged while the interest that it received from the above-mentioned long-term securities was relatively lesser. This resulted in hundreds of billions of dollars of unrealized losses being accumulated on Bank of America’s balance sheet.

Despite this major headwind, Bank of America has performed better than its major regional bank peers, including JPMorgan JPM and Citigroup C, in 2024. This can be seen from the price chart below:

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Before we dig into the fundamentals to understand what is driving the stock higher, first, let’s have a look at near-term management guidance.

Management Guidance

At an investor conference in May-end, Bank of America CEO Brian Moynihan noted that consumer spending is growing but at a slower pace. Also, he added loan demand continues to be weak because of higher borrowing costs. Thus, the company’s net interest income (NII) is expected to come in at 1% below the previously forecasted target of $14 billion for the second quarter of 2024. In the second half of the year, NII is expected to grow on a sequential basis. Notably, Citigroup anticipates NII (excluding Markets) to be modestly down this year.

On the other hand, Bank of America will likely get support from improvement in capital markets businesses this quarter. The company’s investment banking (IB) fees are projected to rise 10-15% year over year while trading revenues will increase at a low single-digit rate (driven by strong performance in equities, partially offset by broadly flat revenue in fixed income).

Likewise, JPM is also anticipating strong capital markets performance for the ongoing quarter. The company’s IB revenues are likely to increase 25-30% in the second quarter, up from the prior guidance of mid-teen percentage range. Also, the company’s markets revenues are expected to improve slightly more than the previously mentioned mid-single-digit growth.

On the expense front, Bank of America expects non-interest expenses to decline sequentially as nearly two-thirds of the first-quarter elevated payroll tax expenses come back out. For the remainder of the year, expenses are expected to trend further down.

Let’s now check the factors that show that the stock is worth betting on.

Robust Growth Drivers

Bank of America continues to align its banking center network according to customer needs. The bank is set to embark on an ambitious expansion plan to open financial centers in new and existing markets. In the last couple of years, it entered eight new markets and now plans to expand its financial center network into nine new markets by 2026.

The company also remains committed to providing modern and state-of-the-art financial centers through its ongoing renovation and modernization project. Over the past three years, Bank of America has been renovating and updating its existing financial centers across the country. By 2023-end, more than 2,500 centers were renovated, creating offices and meeting spaces for clients to engage with financial specialists and ensuring a consistent and modern experience across all centers.

These initiatives, along with the success of Zelle and Erica, will enable the company to improve digital offerings and cross-sell several products, including mortgages, auto loans and credit cards. Further, at Morgan Stanley US Financials, Payments & CRE Conference in early June, Dean Athanasia (president, Regional Banking) said, “Any time we open a financial center and we go to a new market, that increases our digital sales by over 50%. So, digital is a huge component to all of our businesses.”

Additionally, Bank of America remains focused on acquiring the industry's best deposit franchise and strengthening the loan portfolio. Despite a challenging operating environment, deposit balances and loans have remained solid over the past several years. As of Mar 31, 2023, the company’s net loans and leases grew marginally year over year to $1.04 trillion. While the tough macroeconomic scenario remains a headwind, the demand for loans is projected to be decent in the quarters ahead.

Impressive Capital Distributions

Following the clearance of the 2023 stress test, Bank of America announced a hike in the quarterly dividend by 9% to 24 cents per share. Prior to this, the company had announced a 4.8% hike to its quarterly dividend in July 2022.

In October 2021, the company's share repurchase plan of $25 billion was renewed. As of Mar 31, 2024, $10.2 billion worth of authorization remained available. Driven by a strong capital position and earnings strength, the company is expected to sustain improved capital distributions and enhance shareholder value.

Attractive Valuation

At $39.24 per share, Bank of America is currently trading at a price/tangible book value of 1.61X. This is way below the broader market average of 14.72X. Thus, the company’s attractive valuation is a good entry point for investors.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

Rising Earnings Estimates

Analysts seem to be bullish on Bank of America’s prospects. The company’s Zacks Consensus Estimate for 2024 and 2025 have been rising over the past 60 days.

Image Source: Zacks Investment Research

Given the current challenging operating environment, the company’s earnings are expected to decline 5.6% year over year this year. The earnings are then projected to rebound and grow 9.4% in 2025.

Further, Bank of America stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Conclusion

Considering Bank of America’s growth prospects and robust fundamentals, investors must invest in the stock for long-term gains. The company’s efforts to bolster revenues, strong balance sheet and liquidity positions and expansion into new markets will keep aiding its financials.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance