Time to Buy These Artificial Intelligence-Focused Stocks Before Earnings?

Looking ahead to next week’s earnings lineup, a few artificial intelligence (AI) focused companies are set to release their quarterly results.

With ChatGPT sparking investors and consumers intrerest in recent months, the AI boom continues to gain steam following the incredible spike in shares of Nvidia (NVDA) this week. After beating Q1 top and bottom line expectations on Wednesday, Nvidia stock has seen an extended rally with the company raising its Q2 revenue guidance due to strong demand for its AI chips.

This has many investors salivating for other stocks that offer exposure to the future of the AI realm. To that note, here are two such stocks that investors will want to watch as earnings approach.

Image Source: Zacks Investment Research

Dell Technologies (DELL)

Investors will certainly want to pay attention to Dell Technologies’ first-quarter report on Thursday, June 1. The iconic technology solutions company is swiftly making the push into artificial intelligence. In fact, Dell is partnered with Nvidia on its generative AI venture Project Helix.

Project Helix will assist businesses with using AI models to deliver better customer service, market intelligence, and enterprise research among other capabilities. In this regard, Dell has created a portfolio of Validated Designs for AI to simplify the IT infrastructure and provide faster and deeper insights. In addition to AI, Dell has recently launched new services and solutions to strengthen its cybersecurity portfolio.

Q1 Preview: Despite the intriguing AI developments, Dell is dealing with a tougher operating environment mostly attributed to weaker demand for PCs and servers.

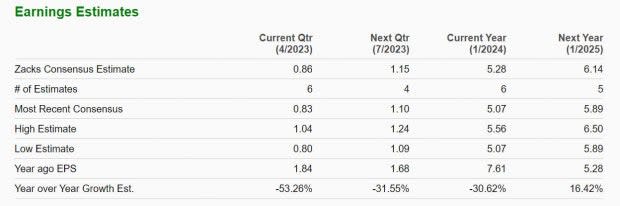

First-quarter earnings are projected at $0.86 per share, which would be a -53% decline from EPS of $1.84 in a tough to compete against prior-year quarter. On the top line, Q1 sales are expected to be $20.20 billion, down -22% from a year ago.

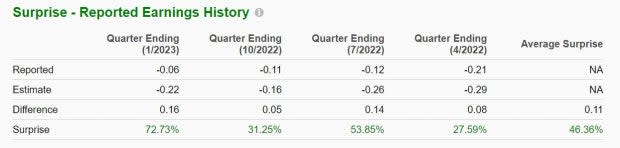

With that being said, Dell has exceeded earnings expectations in four consecutive quarters and topped sales estimates in its last two quarterly reports.

Image Source: Zacks Investment Research

Annual earnings are now forecasted to drop -30% in Dell’s current fiscal 2024 at $5.28 per share following a strong year that saw EPS at $7.61 in FY23. However, fiscal 2025 earnings are projected to rebound and jump 16% at $6.14 per share. Sales are expected to be down -16% in FY24 but rebound and rise 5% in FY25 to $90.53 billion.

Dell stock is up +20% this year to top the S&P 500’s +9% and the IT Services Martkets’ +7% while slightly trailing the Nasdaq’s +24%.

Image Source: Zacks Investment Research

C3.ai (AI)

As an enterprise artificial intelligence software company, Wall Street will be monitoring C3.ai's growth and outlook in its fiscal fourth-quarter report on Wednesday, May 31.

Founded in 2009, C3 is focused on accelerating digital transformation with the company developing and operating large-scale AI, predictive analysis, and IoT applications. C3 launched its IPO in 2020 and appears to be slowly but surely on its way to crossing the profitability line as the AI revolution gains momentum.

Q4 Preview: The Zacks Consensus for C3’s Q4 earnings is -$0.17 per share, up from an adjusted EPS loss of -$0.21 in Q4 2022. Fourth-quarter sales are expected to be virtually flat YoY at $72.32 million.

More intriguing, C3 has beaten earnings expectations for 8 consecutive quarters and topped sales estimates in its last two quarterly reports.

Image Source: Zacks Investment Research

C3’s annual earnings are now projected at -$0.46 per share, which would be a significant increase from an adjusted loss of -$0.73 a share in 2022. Fiscal 2024 earnings are expected to continue moving closer to the black at -$0.33 a share. Even better, sales are now forecasted to rise 5% this year and climb another 19% in FY24 to $317.18 million.

With much optimism in the market surrounding artificial intelligence, C3 stock has skyrocketed +192% YTD to even top Nvidia’s +166% along with Dell and the broader indexes.

Image Source: Zacks Investment Research

Bottom Line

Going into their quarterly reports next week, Dell and C3 stock both land a Zacks Rank #3 (Hold). Their quarterly estimates aren't overwhelming, but exceeding expectations and offering positive guidance could make DELL and C3 stock rally.

With market sentiment high on artificial intelligence, Dell and C3 stocks are worth holding for now as both companies have become very intriguing longer-term investments.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance