Tile Shop Holdings Inc (TTSH) Reports Q1 2024 Earnings: Navigating Market Challenges

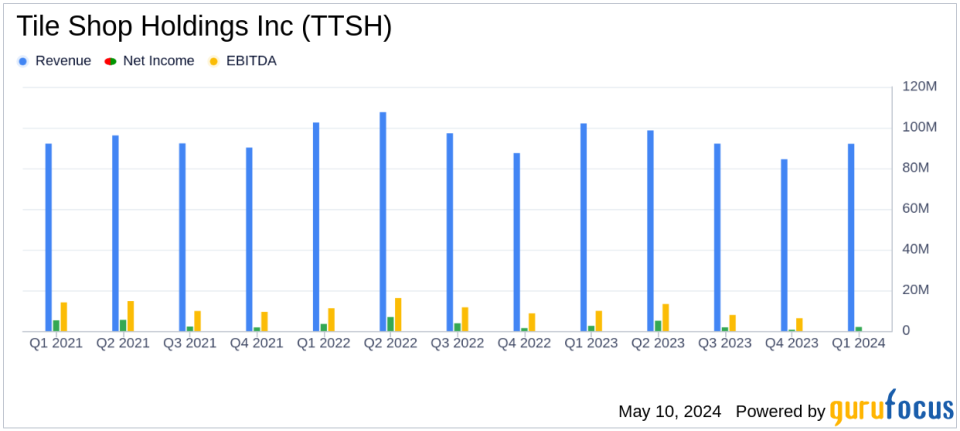

Net Sales: Decreased by 10.1% to $91.7 million in Q1 2024 from $102.0 million in Q1 2023.

Comparable Store Sales: Declined by 10.2% in Q1 2024.

Gross Margin: Increased to 65.8% in Q1 2024 from 64.2% in Q1 2023.

Net Income: Decreased to $1.7 million in Q1 2024 from $2.5 million in Q1 2023.

Diluted Earnings Per Share: Decreased to $0.04 in Q1 2024 from $0.06 in Q1 2023.

Cash Flow: Operating activities generated $18.6 million in Q1 2024.

Liquidity: Ended Q1 2024 with a cash balance of $24.0 million and no long-term debt.

On May 9, 2024, Tile Shop Holdings Inc (NASDAQ:TTSH), a prominent retailer of natural stone and man-made tiles, disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The report revealed a downturn in net sales by 10.1% year-over-year, aligning with a comparable store sales decrease of 10.2%. Despite these challenges, Tile Shop demonstrated a notable improvement in gross margin, reaching 65.8%, and maintained a strong cash flow.

Financial Performance Overview

The company's net sales fell to $91.7 million from $102 million in the prior year, primarily due to reduced traffic influenced by a slowdown in existing home sales. However, Tile Shop's strategic focus on cost control and operational efficiency was evident in its gross profit margin, which increased from 64.2% to 65.8%. This improvement was attributed to decreased international freight costs and lower product costs.

Net income for the quarter stood at $1.7 million, or $0.04 per diluted share, compared to $2.5 million, or $0.06 per diluted share, in the first quarter of 2023. Adjusted EBITDA was reported at $7.4 million, down from $10.3 million year-over-year, reflecting the tough market conditions yet showcasing effective management in a challenging environment.

Operational and Cost Management

Tile Shop's operational execution was highlighted by a reduction in Selling, General, and Administrative Expenses (SG&A), which decreased by 5.5% to $58 million, down from $61.4 million in the previous year. This reduction was primarily due to a decrease in variable costs and depreciation expenses, partially offset by a slight increase in rent expenses.

The company also reported a healthy liquidity position, ending the quarter with $24 million in cash and no long-term debt, supported by robust cash flow from operations which amounted to $18.6 million during the quarter.

Strategic Initiatives and Market Positioning

Despite the market-driven decline in sales, CEO Cabell Lolmaugh remarked on the company's resilience and adaptability.

Continued softness in existing home sales contributed to lower levels of traffic in our stores and had an adverse impact on our comparable store sales during the first quarter of 2024. Despite these challenges, we saw an improvement in our gross margin rate and were able to generate strong operating cash flow. Additionally, we were able to make significant inroads executing our key strategies and controlling costs,"

stated Lolmaugh.

The company's strategic efforts are focused on enhancing product offerings and optimizing customer experience, aiming to navigate through the cyclical downturns effectively. With a strong emphasis on maintaining a robust balance sheet and improving operational efficiencies, Tile Shop is positioning itself to capitalize on market opportunities as conditions improve.

Looking Forward

Tile Shop Holdings Inc continues to adapt its strategies to mitigate the impacts of the current market challenges. With a strong focus on cost management, margin improvement, and strategic capital allocation, the company is poised to navigate the uncertain market landscape effectively. Investors and stakeholders may anticipate how these strategies will unfold in upcoming quarters, potentially leading to a recovery in sales and sustained profitability improvements.

For more detailed information and updates, investors are encouraged to refer to the company's filings and forthcoming communications on its official website.

Explore the complete 8-K earnings release (here) from Tile Shop Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance