Thryv Holdings Inc Reports Mixed Q1 2024 Results: SaaS Growth Strong Despite Overall Revenue Decline

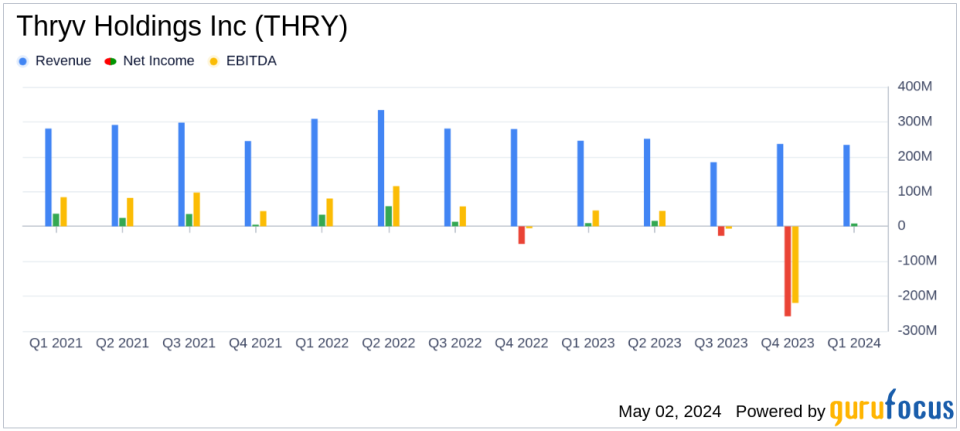

Total SaaS Revenue: Reached $74.3 million, marking a 24% increase year-over-year, aligning with strategic growth in the SaaS sector.

Marketing Services Revenue: Declined to $159.3 million, a decrease of 14% from the previous year, reflecting shifting market dynamics.

Consolidated Revenue: Totaled $233.6 million, down 5% year-over-year, exceeding the estimated $226.55 million.

Net Income: Reported at $8.4 million, or $0.22 per diluted share, below the estimated earnings per share of $0.49 and net income of $17.64 million.

Adjusted EBITDA: Consolidated Adjusted EBITDA stood at $54.1 million, with a margin of 23.2%, indicating strong profitability metrics.

SaaS Clients Growth: Increased by 30% year-over-year to 70,000, showcasing significant customer acquisition and retention.

Guidance: Raised full-year SaaS revenue projections to between $326 million and $329 million, reflecting positive outlook and business momentum.

On May 2, 2024, Thryv Holdings Inc (NASDAQ:THRY), a leading provider of small business software solutions, disclosed its first quarter earnings through an 8-K filing. The company reported a significant 24% increase in SaaS revenue, reaching $74.3 million, driven by a 30% increase in SaaS subscribers. However, total revenue experienced a 5% decline year-over-year, totaling $233.6 million, which fell short of the estimated $226.55 million projected by analysts.

Thryv Holdings Inc operates primarily through its software as a service (SaaS) management tools and digital and print marketing tools, catering to small and mid-sized businesses. The company has streamlined its operations into two segments: Thryv U.S. Marketing Services and Thryv International Marketing Services, now combined into a single segment, and Thryv U.S. SaaS and Thryv International SaaS, also merged into one segment.

Financial Highlights and Challenges

The company's net income for the quarter was $8.4 million, or $0.22 per diluted share, a decrease from $9.3 million, or $0.25 per diluted share, in the first quarter of 2023. This decline in profitability highlights the challenges Thryv faces in its Marketing Services segment, which saw a 14% decrease in revenue. Despite these challenges, the SaaS segment's robust growth and strategic initiatives, including a new $40 million share repurchase program and a refinancing of its credit facilities, underscore Thryv's commitment to capitalizing on its core growth areas and enhancing shareholder value.

Operational and Strategic Developments

Thryv's operational strategy in the first quarter was marked by significant developments, including the appointment of Rees Johnson as Chief Product Officer. Johnson's role will focus on advancing Thryv's product strategy to better serve small business owners. The company's efforts to optimize its capital structure were also evident in its successful refinancing of its Term Loan and ABL, which is expected to provide incremental cost savings and financial flexibility.

Looking Forward

For the upcoming quarters of 2024, Thryv has raised its full-year guidance for SaaS revenue, projecting it to be between $326 million and $329 million. The company's leadership expresses confidence in the continued growth and profitability of the SaaS segment, which remains a primary focus. However, the ongoing decline in the Marketing Services segment poses a risk to overall revenue growth and could impact future profitability.

Conclusion

Thryv Holdings Inc's first quarter of 2024 illustrates a company at a pivotal point. While its SaaS business shows significant promise with substantial revenue growth and expanding client base, the broader challenges in the Marketing Services segment and a slight decline in overall profitability underscore the hurdles Thryv faces in achieving balanced growth across all its operations. Investors and stakeholders will likely watch closely how the company navigates these challenges while capitalizing on the opportunities within its SaaS offerings.

Explore the complete 8-K earnings release (here) from Thryv Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance