Three US Stocks Estimated To Be Up To 39.8% Below Intrinsic Value

As the Nasdaq Composite and S&P 500 continue to set records, reflecting a robust appetite for equities amid fluctuating economic indicators, investors are keenly watching the market for opportunities. In this context, understanding what constitutes an undervalued stock is crucial, especially when high-performing indices may overshadow stocks priced below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

SouthState (NYSE:SSB) | $76.02 | $151.58 | 49.8% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.20 | $31.78 | 49% |

Duckhorn Portfolio (NYSE:NAPA) | $7.03 | $14.25 | 50.7% |

USCB Financial Holdings (NasdaqGM:USCB) | $12.12 | $23.46 | 48.3% |

AppLovin (NasdaqGS:APP) | $86.96 | $166.54 | 47.8% |

Fluence Energy (NasdaqGS:FLNC) | $17.09 | $31.44 | 45.6% |

Vasta Platform (NasdaqGS:VSTA) | $3.08 | $5.95 | 48.2% |

HealthEquity (NasdaqGS:HQY) | $83.56 | $165.65 | 49.6% |

APi Group (NYSE:APG) | $36.89 | $70.72 | 47.8% |

Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $248.68 | $495.29 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen

Super Micro Computer

Overview: Super Micro Computer, Inc. specializes in developing and manufacturing high-performance server and storage solutions with a modular and open architecture, operating across the United States, Europe, Asia, and internationally, with a market capitalization of $49.60 billion.

Operations: The company generates $11.82 billion in revenue from its high-performance server solutions segment.

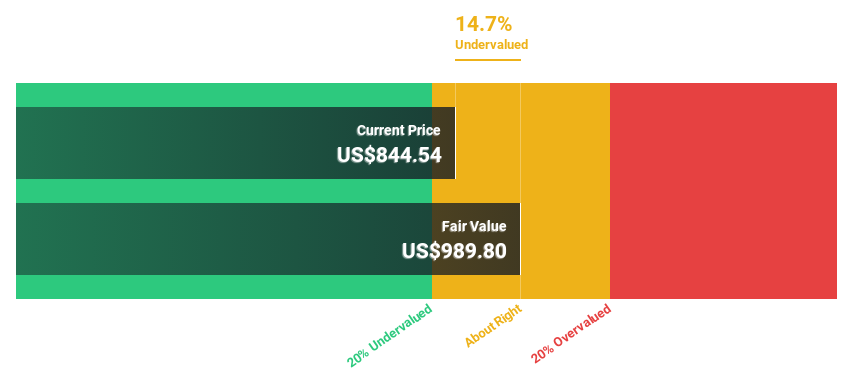

Estimated Discount To Fair Value: 23.4%

Super Micro Computer, priced at US$837.17, is currently valued below its estimated fair value of US$1105.86, indicating potential undervaluation based on cash flows. The company's robust forecast includes a 36% return on equity and significant earnings growth of 40.2% annually over the next three years, outpacing the US market's 14.7%. However, it faces high share price volatility and recent shareholder dilution. Notably, Super Micro has been dropped from several Russell indexes but added to others like the Russell 1000 and Midcap Growth Indexes as of July 2024, reflecting a mixed market perception amidst its strategic expansions in liquid-cooled data centers aimed at enhancing AI compute performance.

KE Holdings

Overview: KE Holdings Inc. operates an integrated online and offline platform for housing transactions and services in China, with a market capitalization of approximately $19.20 billion.

Operations: The company generates revenue primarily from three segments: New Home Transaction Services (CN¥27.09 billion), Existing Home Transaction Services (CN¥24.50 billion), and Home Renovation and Furnishing (CN¥11.85 billion).

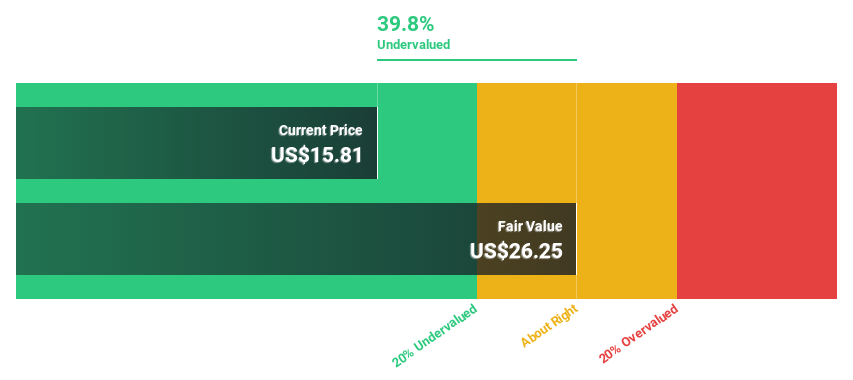

Estimated Discount To Fair Value: 39.8%

KE Holdings, priced at US$15.05, trades below its calculated fair value of US$26.16, suggesting possible undervaluation based on discounted cash flows. Despite a significant drop in net income and earnings per share as reported in Q1 2024, the company is expected to see substantial earnings growth of 21.6% annually over the next three years. However, a dividend sustainability issue exists due to inadequate cash flow coverage. Additionally, recent large-scale share buybacks reflect active capital return efforts but raise concerns about long-term financial strategy amidst fluctuating performance metrics.

Vertiv Holdings Co

Overview: Vertiv Holdings Co (NYSE: VRT) specializes in designing, manufacturing, and servicing critical digital infrastructure technologies for data centers, communication networks, and commercial and industrial environments globally, with a market capitalization of approximately $34.97 billion.

Operations: Vertiv Holdings Co generates revenue through its operations in the Americas ($3.95 billion), Asia Pacific ($1.64 billion), and Europe, the Middle East, and Africa ($1.83 billion).

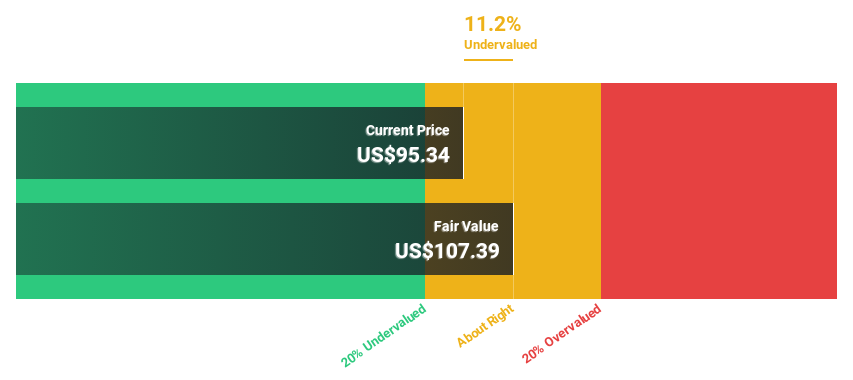

Estimated Discount To Fair Value: 19%

Vertiv Holdings Co, currently priced at US$88, is trading 23.6% below its estimated fair value of US$115.16, highlighting potential undervaluation based on cash flows. The company's earnings have surged by 241.2% over the past year and are projected to grow at an annual rate of 30.4%, outpacing the US market forecast of 14.7%. Despite these strengths, Vertiv faces challenges including a high debt level and significant insider selling in recent months, which could raise concerns about its financial stability and governance practices.

Get an in-depth perspective on Vertiv Holdings Co's balance sheet by reading our health report here.

Summing It All Up

Reveal the 185 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:SMCI NYSE:BEKE and NYSE:VRT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance