Three US Growth Companies With Insider Ownership Exceeding 12%

The United States stock market has shown robust growth, climbing 1.0% over the past week and achieving a 27% increase over the past year, with earnings expected to grow by 15% annually. In this thriving environment, companies with substantial insider ownership can be particularly compelling, as high insider stakes often align management’s interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 27.5% | 20.9% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

Li Auto (NasdaqGS:LI) | 29.3% | 21.8% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.8% | 90% |

EHang Holdings (NasdaqGM:EH) | 33% | 97.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 91.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 75.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Kanzhun

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kanzhun Limited operates an online recruitment platform in the People's Republic of China, with a market capitalization of approximately $9.26 billion.

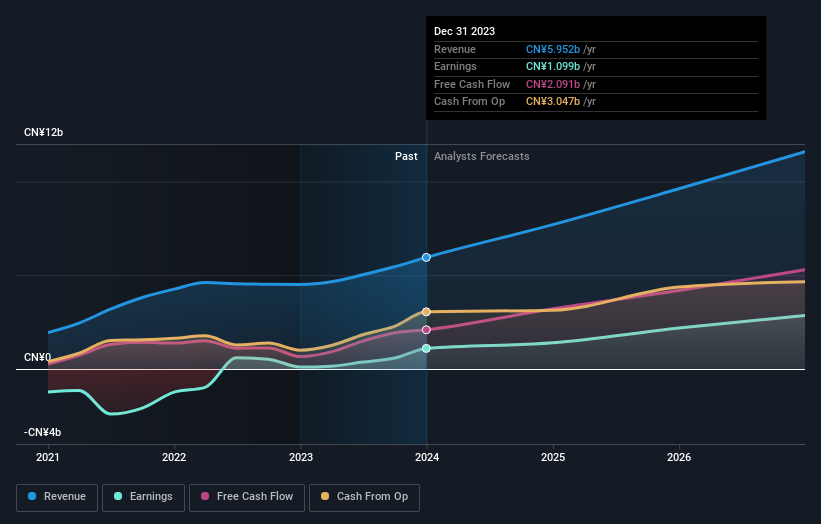

Operations: The company generates its revenue primarily from internet information services, totaling CN¥5.95 billion.

Insider Ownership: 16.3%

Kanzhun Limited has demonstrated robust financial growth, with its revenue increasing significantly to CNY 1.58 billion in Q4 2023, up from CNY 1.08 billion the previous year, and net income shifting from a loss to a profit of CNY 331.24 million. The company forecasts further revenue growth between RMB 1.64 billion and RMB 1.67 billion for Q1 2024, indicating continued upward momentum. Despite shareholder dilution over the past year, Kanzhun trades at a substantial discount to estimated fair value and has committed to an aggressive share buyback program worth up to US$200 million over the next year, underscoring strong insider confidence in its prospects despite relatively low forecasted Return on Equity (16.6%).

Delve into the full analysis future growth report here for a deeper understanding of Kanzhun.

The valuation report we've compiled suggests that Kanzhun's current price could be quite moderate.

MP Materials

Simply Wall St Growth Rating: ★★★★★☆

Overview: MP Materials Corp. operates in the production of rare earth materials and has a market capitalization of approximately $2.70 billion.

Operations: The company generates revenue primarily from its miscellaneous metals and mining segment, totaling approximately $206.43 million.

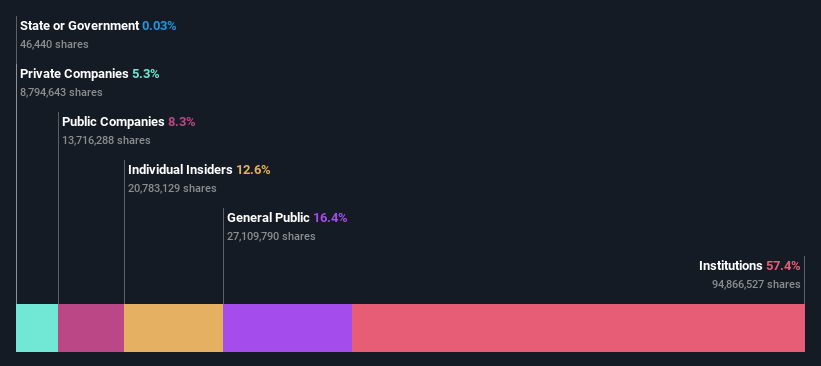

Insider Ownership: 12.6%

MP Materials, a key player in the rare earth sector, has experienced fluctuating financial performance with recent quarterly revenues and net income showing declines from the previous year. Despite this, the company is poised for potential growth with its significant investment in America's first fully-integrated rare earth magnet manufacturing facility, supported by a US$58.5 million government award. This strategic move aligns with increasing global demand for NdFeB magnets essential in various advanced technologies. However, current profit margins remain low and insider trading activity has been neutral over the past three months.

On Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: On Holding AG is a global company specializing in the development and distribution of sports products, with a market capitalization of approximately $9.78 billion.

Operations: The company generates CHF 1.79 billion in revenue primarily from its athletic footwear segment.

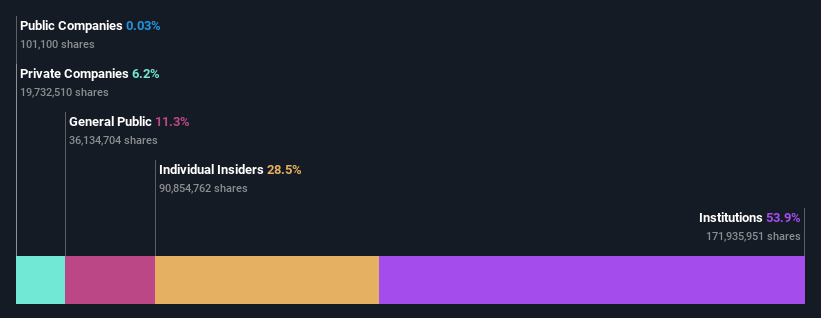

Insider Ownership: 28.5%

On Holding AG has demonstrated robust financial growth, with a recent quarterly increase in sales and net income. The company forecasts an ambitious revenue target of at least CHF 2.29 billion for 2024, reflecting a commitment to significant growth in a challenging economic climate. This performance is underpinned by strong earnings projections, with expected annual profit growth outpacing the US market significantly. Despite these positives, the stock trades below its estimated fair value, suggesting potential undervaluation.

Make It Happen

Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 189 companies by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:BZ NYSE:MP and NYSE:ONON.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance