Three Swedish Dividend Stocks Offering Yields From 4% To 5.9%

As global markets experience mixed signals with varying performances across major indices, Sweden's market continues to offer intriguing opportunities for dividend-seeking investors. Amidst this landscape, selecting stocks that not only provide attractive yields but also demonstrate stability and growth potential becomes crucial for those looking to enhance their investment portfolios.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.04% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.97% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.25% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.13% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.03% | ★★★★★☆ |

Duni (OM:DUNI) | 4.49% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.71% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.10% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.53% | ★★★★☆☆ |

AB Traction (OM:TRAC B) | 4.02% | ★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

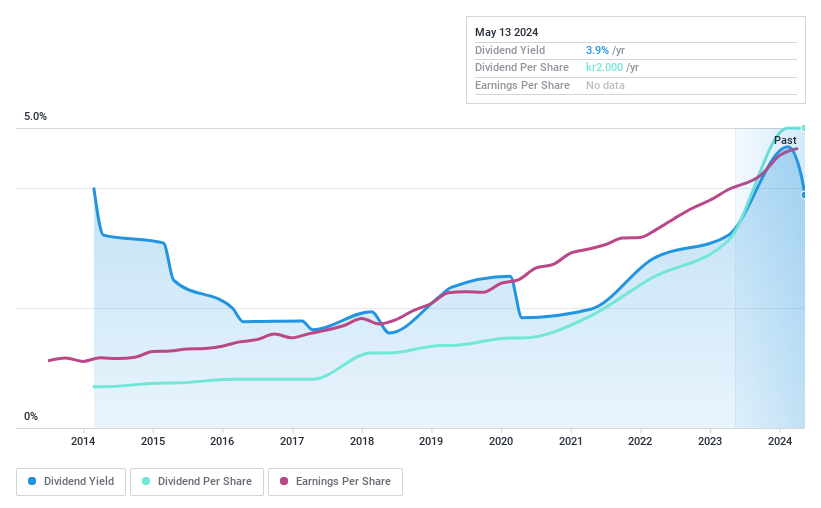

Bahnhof

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB operates in the Internet and telecommunications sector primarily in Sweden and across Europe, with a market capitalization of approximately SEK 5.32 billion.

Operations: Bahnhof AB generates revenue through its Retail Market and Corporate Market segments, earning SEK 1.30 billion and SEK 606.24 million respectively.

Dividend Yield: 4%

Bahnhof AB has demonstrated a consistent dividend history over the past decade, with stable and increasing payouts. However, despite recent growth in earnings and sales as reported on May 7, 2024, its dividend sustainability is questionable. The dividends are not well covered by earnings, with a high payout ratio of 97.5%, indicating potential pressure on future payments. Additionally, though Bahnhof's stock trades below our fair value estimate by 27.2%, its dividend yield at 4.04% remains slightly below the top quartile in Sweden's market.

Click here to discover the nuances of Bahnhof with our detailed analytical dividend report.

The valuation report we've compiled suggests that Bahnhof's current price could be inflated.

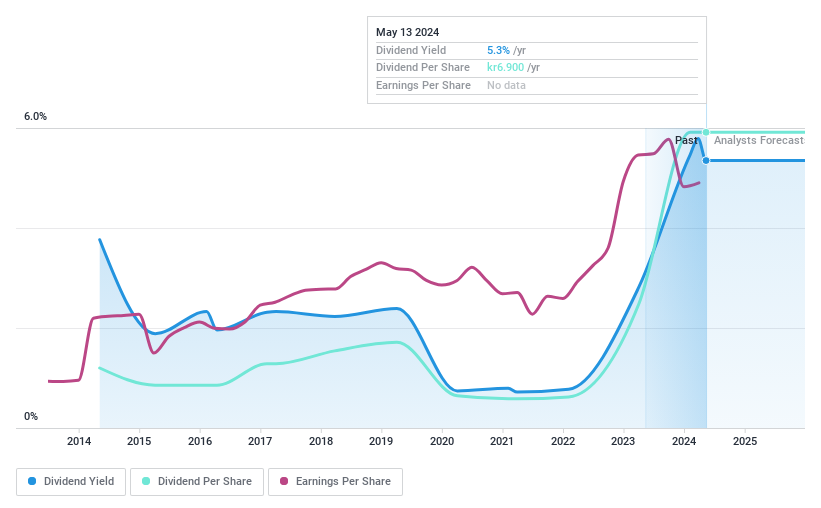

BioGaia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB, a healthcare company based in Sweden, specializes in the development and distribution of probiotic products globally, with a market capitalization of approximately SEK 12.81 billion.

Operations: BioGaia AB generates revenue primarily through two segments: Pediatrics at SEK 999.84 million and Adult Health at SEK 293.44 million.

Dividend Yield: 5.4%

BioGaia's dividend yield of 5.44% ranks well in Sweden, surpassing the market's 4.18% average, reflecting a decade of growth in payouts. However, its dividends face coverage issues with a high cash payout ratio of 215.5%, suggesting potential stress from free cash flow despite a reasonable earnings-based payout ratio of 51.7%. Recent financials show modest growth with Q1 net income rising to SEK 121.85 million from SEK 115.95 million year-over-year, but volatility and reliability concerns persist due to inconsistent dividend patterns over the past ten years.

Get an in-depth perspective on BioGaia's performance by reading our dividend report here.

Upon reviewing our latest valuation report, BioGaia's share price might be too optimistic.

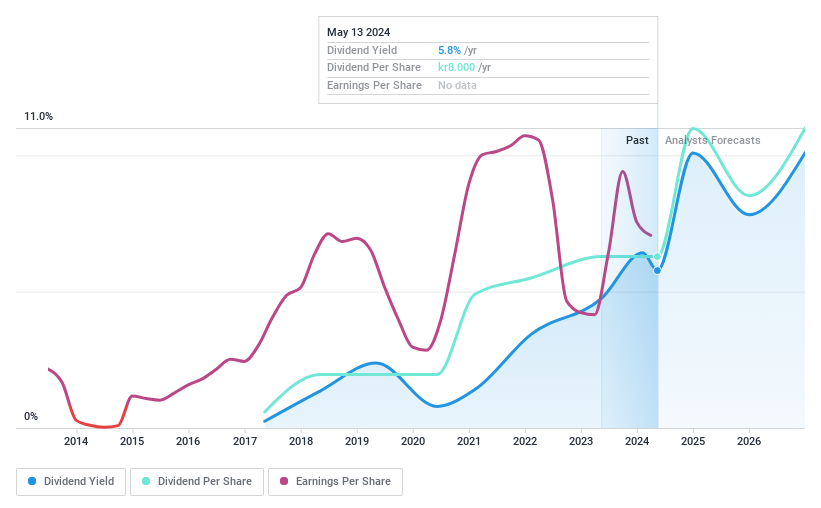

G5 Entertainment

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G5 Entertainment AB, based in Sweden, specializes in developing and publishing free-to-play games for smartphones, tablets, and personal computers with a market capitalization of SEK 1.06 billion.

Operations: G5 Entertainment AB generates its revenue primarily from the development and sales of casual games, totaling SEK 1,271.96 million.

Dividend Yield: 6%

G5 Entertainment, with a dividend yield of 5.96%, stands above the Swedish market average. Despite a recent dip in Q1 sales to SEK 297.41 million and net income to SEK 37.48 million, the company maintains a healthy payout ratio of 54.4%, ensuring dividends are well-covered by earnings and cash flows (cash payout ratio at 36.1%). However, its dividend history is relatively short at seven years, posing questions about long-term sustainability amidst forecasts of modest earnings growth at 4.1% per year.

Make It Happen

Unlock our comprehensive list of 24 Top Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BAHN B OM:BIOG B and OM:G5EN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance